- Canada

- /

- Metals and Mining

- /

- TSX:EQX

Will Commercial Production at Valentine Mine Change Equinox Gold's (TSX:EQX) Narrative?

Reviewed by Sasha Jovanovic

- Equinox Gold Corp. recently announced the commencement of commercial production at its 100% owned Valentine Gold Mine in Newfoundland & Labrador, Canada.

- This transition to commercial production marks a substantial operational achievement, reflecting progress in advancing one of the company's key development projects.

- We'll examine how advancing Valentine to commercial production shapes Equinox Gold’s investment narrative and impacts its future outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Equinox Gold Investment Narrative Recap

To be a shareholder in Equinox Gold, you need confidence in the company's ability to consistently ramp up production at new and existing sites, delivering scale, efficiency, and operational resilience. The shift to commercial production at Valentine is a meaningful milestone that supports near-term output growth, solidifying a crucial catalyst for the business. However, the main risk remains ongoing operational headwinds at assets like Greenstone, where lower-than-expected ore grades could still weigh on margins regardless of recent Valentine news.

Among the company’s latest announcements, the September first gold pour at Valentine Gold Mine stands out as particularly relevant. That moment laid the operational groundwork for this month’s commercial production declaration, underlining Equinox’s progress toward achieving its updated annual production guidance and providing incremental support for near-term revenue growth targets.

Yet, investors should also be mindful that despite Valentine’s successful start, persistent grade challenges at Greenstone could still…

Read the full narrative on Equinox Gold (it's free!)

Equinox Gold's narrative projects $4.3 billion in revenue and $1.4 billion in earnings by 2028. This requires 31.2% yearly revenue growth and a $1.423 billion earnings increase from current earnings of $-23.1 million.

Uncover how Equinox Gold's forecasts yield a CA$21.75 fair value, a 20% upside to its current price.

Exploring Other Perspectives

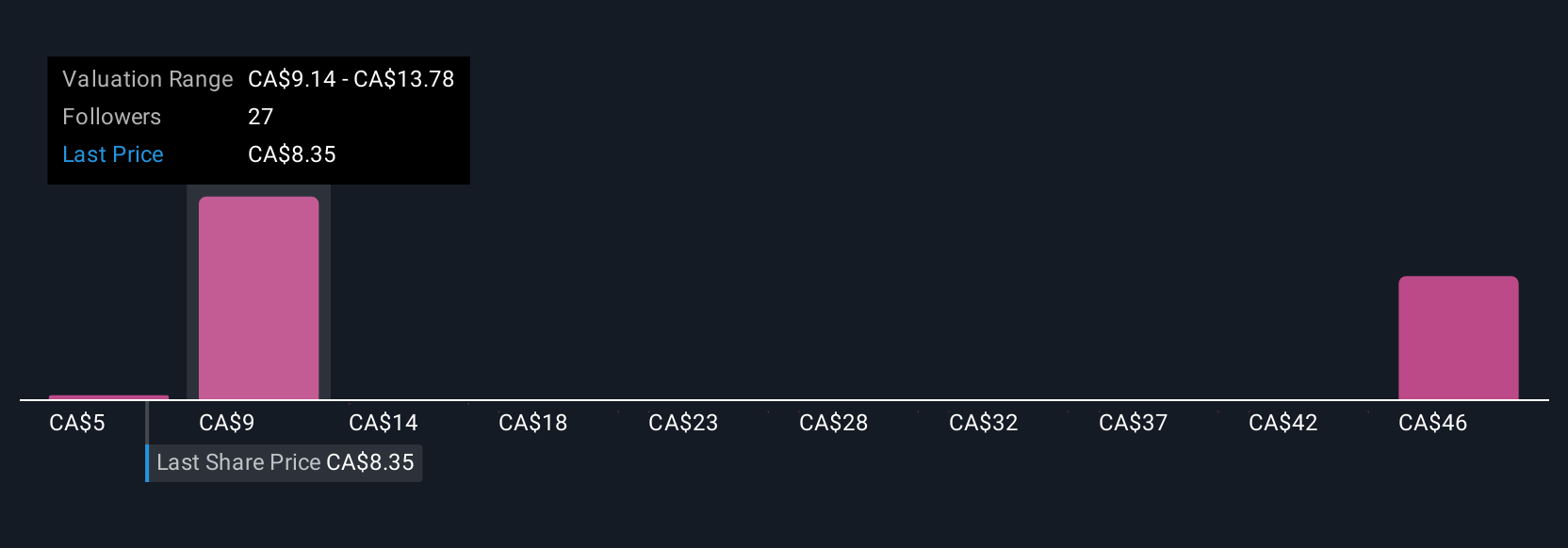

Ten fair value estimates from the Simply Wall St Community stretch from CA$8.21 to CA$54.23 per share. Several contributors focus on upcoming production increases, but others still express concerns about ore grade risks and their broader effect on future returns.

Explore 10 other fair value estimates on Equinox Gold - why the stock might be worth less than half the current price!

Build Your Own Equinox Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinox Gold research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Equinox Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinox Gold's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026