- Canada

- /

- Metals and Mining

- /

- TSX:EQX

How Investors Are Reacting To Equinox Gold (TSX:EQX) Ahead of Anticipated Earnings Surge and Options Spike

Reviewed by Sasha Jovanovic

- Equinox Gold recently generated headlines with expectations of strong year-over-year gains in both earnings and revenue for its upcoming quarter, supported by analyst forecasts and increased options market activity.

- An unusual surge in options trading highlights shifting investor sentiment, driven by the company’s focus on operational improvements and cost optimization across its gold mining assets in the Americas.

- We’ll examine how rising optimism around upcoming earnings and efficiency gains could reshape Equinox Gold’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Equinox Gold Investment Narrative Recap

To be an Equinox Gold shareholder today, you need to trust in the company’s ability to ramp up gold production, execute ongoing efficiency improvements, and convert growth projects like Valentine into consistent cash flow. While the recent spike in options activity and strong earnings forecasts have brought short-term optimism, the major catalyst remains operational performance at flagship sites, where ore grade consistency and timely project ramp-ups are still the biggest risks. At this stage, the headlines do not fundamentally shift that short-term equation, as structural execution risks linger.

Among Equinox’s recent announcements, its updated Q3 2025 production results stand out. The company reported consolidated gold production of 233,216 ounces for the quarter and noted year-to-date output of 634,428 ounces, supporting its drive for higher volumes and potentially reinforcing near-term earnings strength tied to production ramp-ups, particularly at Greenstone and Valentine.

In contrast, investors should be mindful that ongoing operational risks at key sites...

Read the full narrative on Equinox Gold (it's free!)

Equinox Gold's outlook anticipates $4.3 billion in revenue and $1.4 billion in earnings by 2028. Achieving this requires a 31.2% annual revenue growth rate and a $1.42 billion increase in earnings from the current -$23.1 million.

Uncover how Equinox Gold's forecasts yield a CA$19.78 fair value, a 30% upside to its current price.

Exploring Other Perspectives

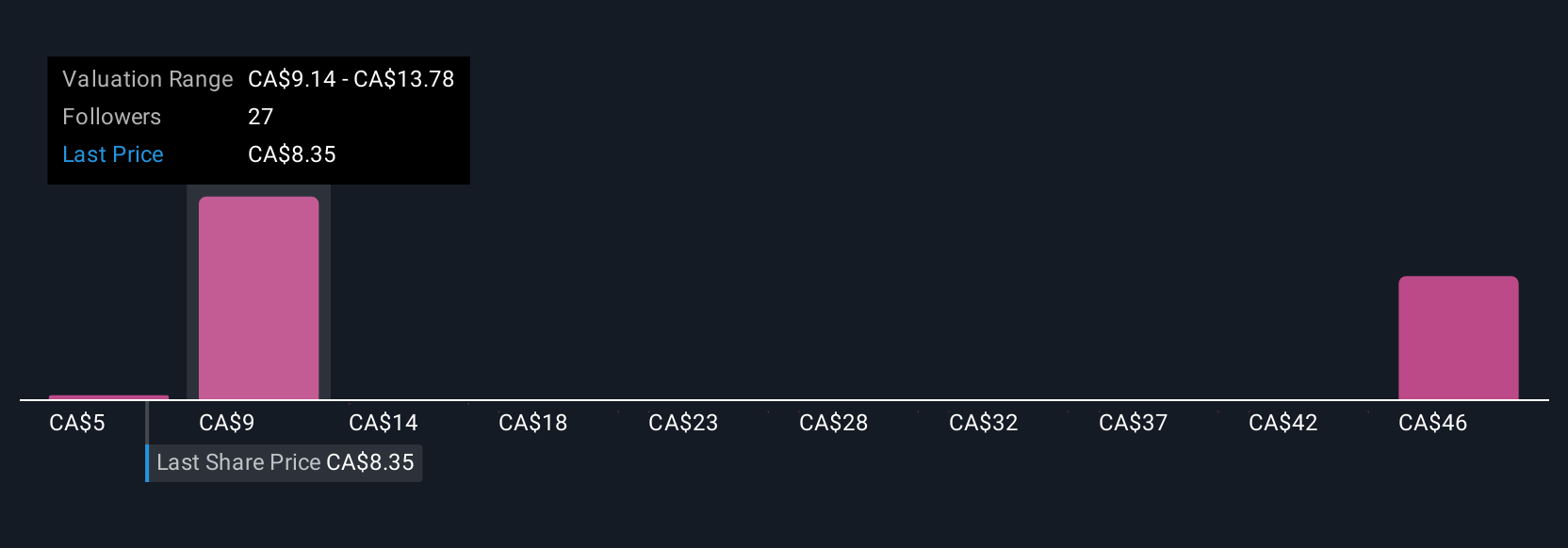

Simply Wall St Community members’ fair value ranges for Equinox Gold span from CA$8.21 to CA$59.85, with 11 unique estimates. With operational consistency still the central business catalyst, you can see how widely perspectives differ when weighing production risk against future earnings growth potential.

Explore 11 other fair value estimates on Equinox Gold - why the stock might be worth 46% less than the current price!

Build Your Own Equinox Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinox Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Equinox Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinox Gold's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives