- Canada

- /

- Metals and Mining

- /

- TSX:EQX

Equinox Gold (TSX:EQX) Reports Q1 2025 Earnings With US$424M Sales

Reviewed by Simply Wall St

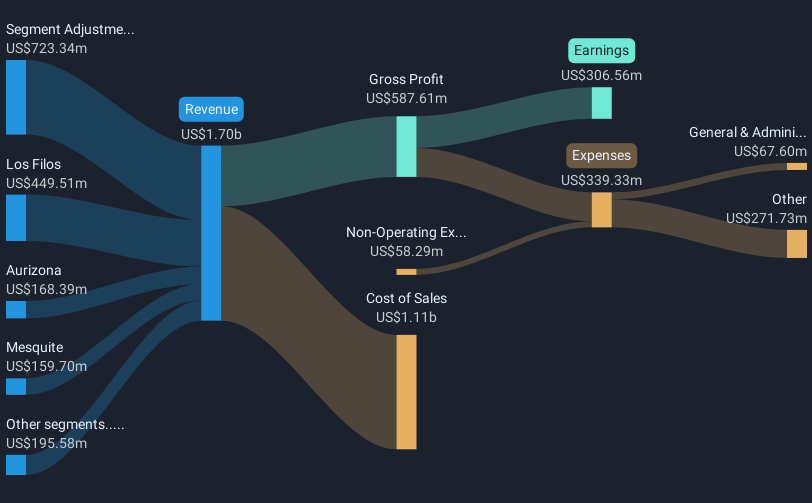

Equinox Gold (TSX:EQX) reported its first-quarter 2025 earnings and operating results on May 8, revealing a substantial rise in sales to $424 million, although the net loss increased to $76 million. This occurred against the backdrop of a broader market that declined 1% over the week. Despite higher production levels of 145,290 ounces of gold, the company's share price rose 11%. The broader market movements, like mounting concerns about the federal deficit and fluctuating bond yields, likely provided mixed influences on the company's stock dynamics, while its operational and sales growth offered positive insights for investors.

We've identified 2 weaknesses for Equinox Gold that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent surge in Equinox Gold's sales and production figures reported for Q1 2025 may positively impact its future outlook. Specifically, the successful ramp-up at Greenstone and potential expansions at Piaba and Castle Mountain are poised to boost revenue streams and earnings. Despite facing a net loss of US$76 million, the operational improvements hinted at in the announcement offer promising revenue growth that could support analyst expectations of an annual revenue increase of 22.2% over the next three years. However, the increased net loss also underscores the need for careful management of costs and ongoing risks associated with community agreements and environmental challenges.

Over a three-year timespan, Equinox Gold's total return reached 21.50%, illustrating solid longer-term growth. This serves as a backdrop to the company's recent positive share price movement of 11%, contrasted against a broader market decline of 1% in the past week. Notably, the company's 12-month performance surpassed the Canadian Market's 10.9% return while matching a 20.9% return in the Canadian Metals and Mining industry. This highlights Equinox's competitive positioning within its sector.

The current share price of CA$9.16 remains below the consensus price target of CA$11.96, which implies a potential upside of 23.4%. This gap underscores the market's cautious optimism regarding Equinox's ability to meet or exceed future earnings and revenue projections. As the company navigates these developments, market participants may continue to assess the sustainability of its growth trajectory in light of present challenges and opportunities.

Gain insights into Equinox Gold's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives