- Canada

- /

- Metals and Mining

- /

- TSX:EQX

A Look at Equinox Gold's (TSX:EQX) Valuation After Commercial Production Begins at Valentine Gold Mine

Reviewed by Simply Wall St

Equinox Gold (TSX:EQX) just reached a significant milestone with the start of commercial production at its wholly owned Valentine Gold Mine in Newfoundland & Labrador. This transition represents a new operational phase for the company.

See our latest analysis for Equinox Gold.

Momentum has been picking up for Equinox Gold, with the announcement of commercial production at the Valentine Gold Mine coinciding with a rapid stretch of share price gains. The company has reported a 28% 1-month return and a 147.78% year-to-date return. Looking at the bigger picture, long-term shareholders have also seen total returns up over 140% in the past year and more than 300% over three years.

If the market’s appetite for fast-moving producers has piqued your curiosity, now’s the perfect time to discover fast growing stocks with high insider ownership

With such an impressive rally, investors may be wondering if Equinox Gold’s recent surge is simply catching up to its potential value, or if future optimism is already reflected in the stock price. Is there still room for growth, or has the market already priced in the good news?

Most Popular Narrative: 12.7% Undervalued

With the narrative fair value estimate at CA$21.75 and shares last closing at CA$18.98, the gap has captured investor attention amid renewed analyst optimism.

Successful ramp-up of Greenstone and Valentine mines, combined with the recent merger, positions Equinox Gold for significantly higher output and scale. This is expected to support meaningful revenue and cash flow growth in the coming quarters as new production fully contributes.

Wondering what is driving this bullish fair value? Uncover the narrative's bold expectations for explosive earnings growth and margin expansion. There are some eye-opening financial forecasts at its core. See which assumptions are causing this price target to surge.

Result: Fair Value of $21.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from new mine ramp-ups and uncertainty around broader sector trends could still challenge Equinox Gold’s upbeat outlook.

Find out about the key risks to this Equinox Gold narrative.

Another View: What Do the Multiples Say?

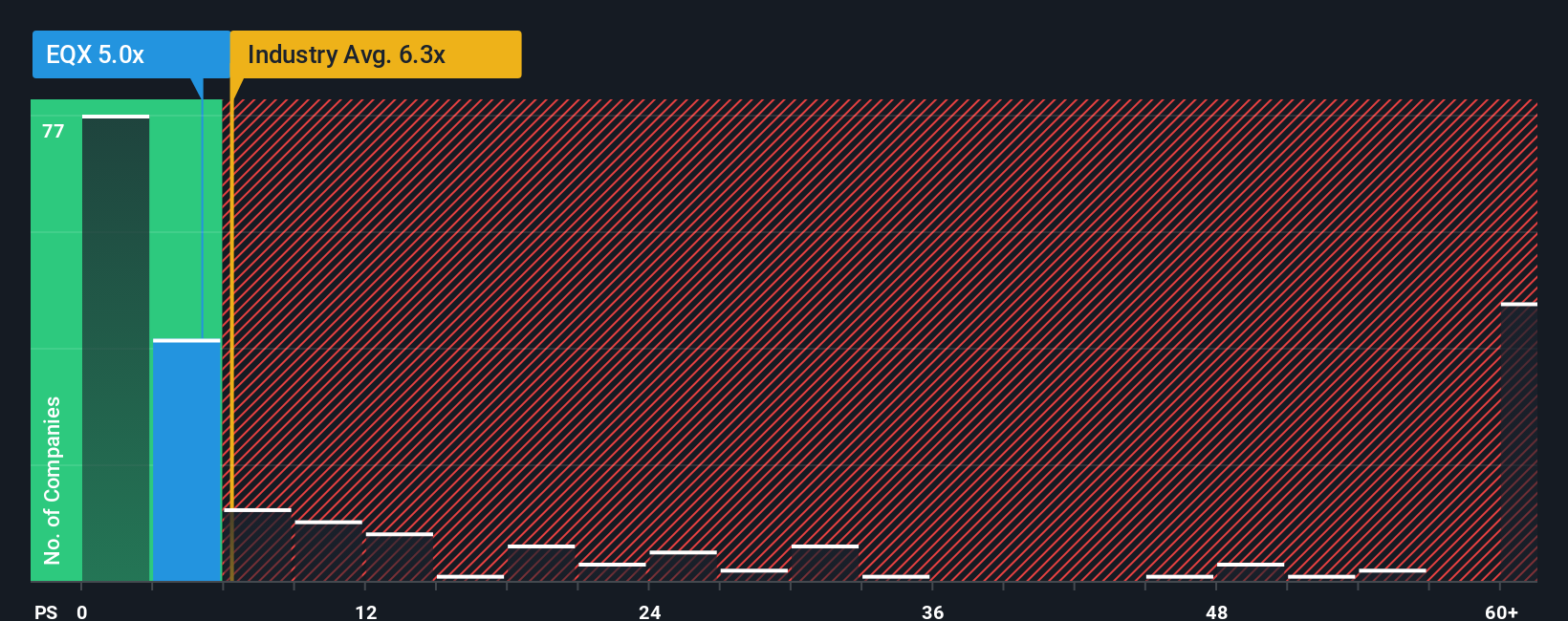

While the narrative points to undervaluation, market multiples offer a different perspective. Equinox Gold currently trades at a price-to-sales ratio of 4.6x. This is lower than the industry average of 5.6x and also below the peer average of 9x, yet it stands above the fair ratio of 4.1x that the market could converge towards. This gap suggests a mix of opportunity and risk. Will sentiment keep pushing the shares higher, or should investors be wary if the market starts moving closer to that fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinox Gold Narrative

If you think differently or want to dig deeper into the numbers, you can easily craft your own take and see the results for yourself in just minutes with Do it your way.

A great starting point for your Equinox Gold research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to a single stock. Boost your portfolio by finding standout opportunities with the tools top investors rely on at Simply Wall St.

- Tap into hidden growth potential by browsing these 926 undervalued stocks based on cash flows currently trading below their fair value, offering you attractive entry points not to be missed.

- Secure steady income for your future by considering these 15 dividend stocks with yields > 3% with yields above 3% for stronger returns and peace of mind.

- Ride the wave of innovation and get ahead of the crowd with these 27 quantum computing stocks shaping advancements in computing and technology’s next frontier.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success