- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Eldorado Gold (TSX:ELD) Is Up 8.3% After Reporting Record Gold Reserves at Lamaque Complex Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In November 2025, Eldorado Gold released updated Mineral Reserve and Resource estimates, reporting a 5% increase in Proven and Probable gold reserves to 12.5 million ounces as of September 30, 2025, marking the highest reserve estimate since the company's acquisition in 2017.

- This increase, driven primarily by successful exploration and resource conversion at the Lamaque Complex, enhances the company’s long-term operational outlook through extended mine life and new discovery opportunities.

- We’ll examine how Eldorado Gold’s record reserve growth, fueled by exploration at Lamaque, influences its long-term investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Eldorado Gold Investment Narrative Recap

To be a shareholder in Eldorado Gold, you need confidence in the company’s focus on increasing gold reserves, extending mine life, and unlocking value through ongoing exploration, seen recently with record reserves at Lamaque. While the 5% reserve increase marks a positive development for the company’s operational outlook, it does not directly address the most pressing short-term catalyst, which remains the successful commissioning and ramp-up of the Skouries project. Risks from cost pressures and project execution remain material in the near term.

The Skouries construction update in February 2025 is particularly relevant; it confirmed that first production is expected in Q1 2026, while total capital cost estimates remain at US$1.06 billion. This milestone is the anticipated turning point for Eldorado, with the project slated to diversify revenue and lift production volumes, even as rising operating costs and complex ramp-up conditions continue to weigh on near-term performance.

In contrast, investors should be alert to the potential impact of ongoing all-in sustaining cost (AISC) increases on future margins and profitability as ...

Read the full narrative on Eldorado Gold (it's free!)

Eldorado Gold's narrative projects $3.2 billion in revenue and $1.0 billion in earnings by 2028. This requires a 26.5% annual revenue growth rate and a $579.7 million increase in earnings from the current $420.3 million.

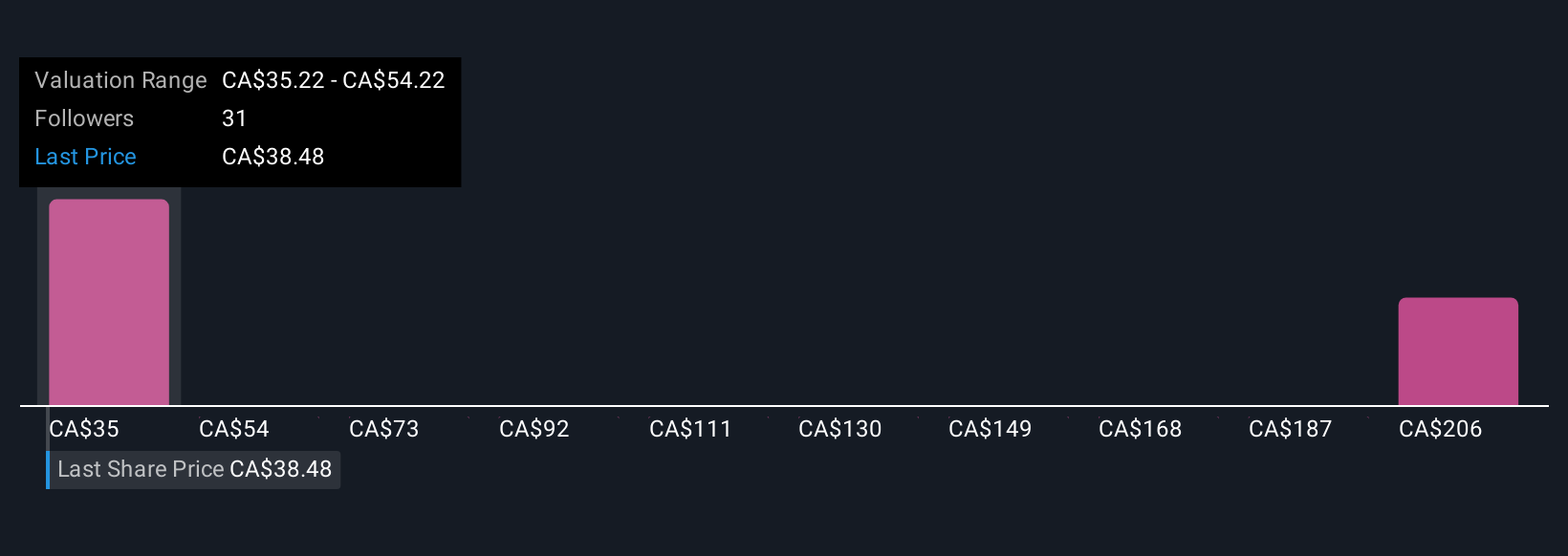

Uncover how Eldorado Gold's forecasts yield a CA$50.23 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community stretch from CA$28.97 to CA$312.26 per share, showing sharply different views. With Skouries ramp-up still in focus, consider how project timing and cost performance could reshape those outlooks.

Explore 7 other fair value estimates on Eldorado Gold - why the stock might be worth 34% less than the current price!

Build Your Own Eldorado Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eldorado Gold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Eldorado Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eldorado Gold's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026