- Canada

- /

- Metals and Mining

- /

- TSX:EDV

What Does a Senior Insider’s Share Sale Reveal About Endeavour Mining’s (TSX:EDV) Management Confidence?

Reviewed by Sasha Jovanovic

- On December 16, 2025, Endeavour Mining senior officer Martin John White sold 15,565 common shares, cutting his directly held stake by 58.6%.

- This sizeable insider sale by a key executive is likely to interest investors who monitor management share dealings for signals about internal confidence.

- We’ll now examine how this large insider sale by a senior officer may influence Endeavour Mining’s existing investment narrative and risk profile.

The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

Endeavour Mining Investment Narrative Recap

To own Endeavour Mining, you need to believe in its ability to convert a West Africa focused gold portfolio into sustained cash generation, while managing geopolitical and cost pressures. The recent insider sale by senior officer Martin John White is sizeable but, on its own, does not appear to alter the key near term catalyst of execution on growth projects or the central risk around regional and regulatory stability.

The most relevant recent update is Endeavour’s November 13, 2025 guidance confirmation, targeting the top half of 1,110 to 1,260 koz output in 2025 with AISC of US$1,150 to US$1,350 per ounce and higher royalty costs tied to strong gold prices. This reinforces that, despite insider selling, the operational story and production guidance remain the main reference points for assessing whether current profitability and cost control can offset the company’s concentrated West African risk profile.

Yet while production and earnings are tracking well, the persistent geopolitical and fiscal risks in West Africa are something investors should be aware of...

Read the full narrative on Endeavour Mining (it's free!)

Endeavour Mining's narrative projects $3.3 billion revenue and $595.3 million earnings by 2028.

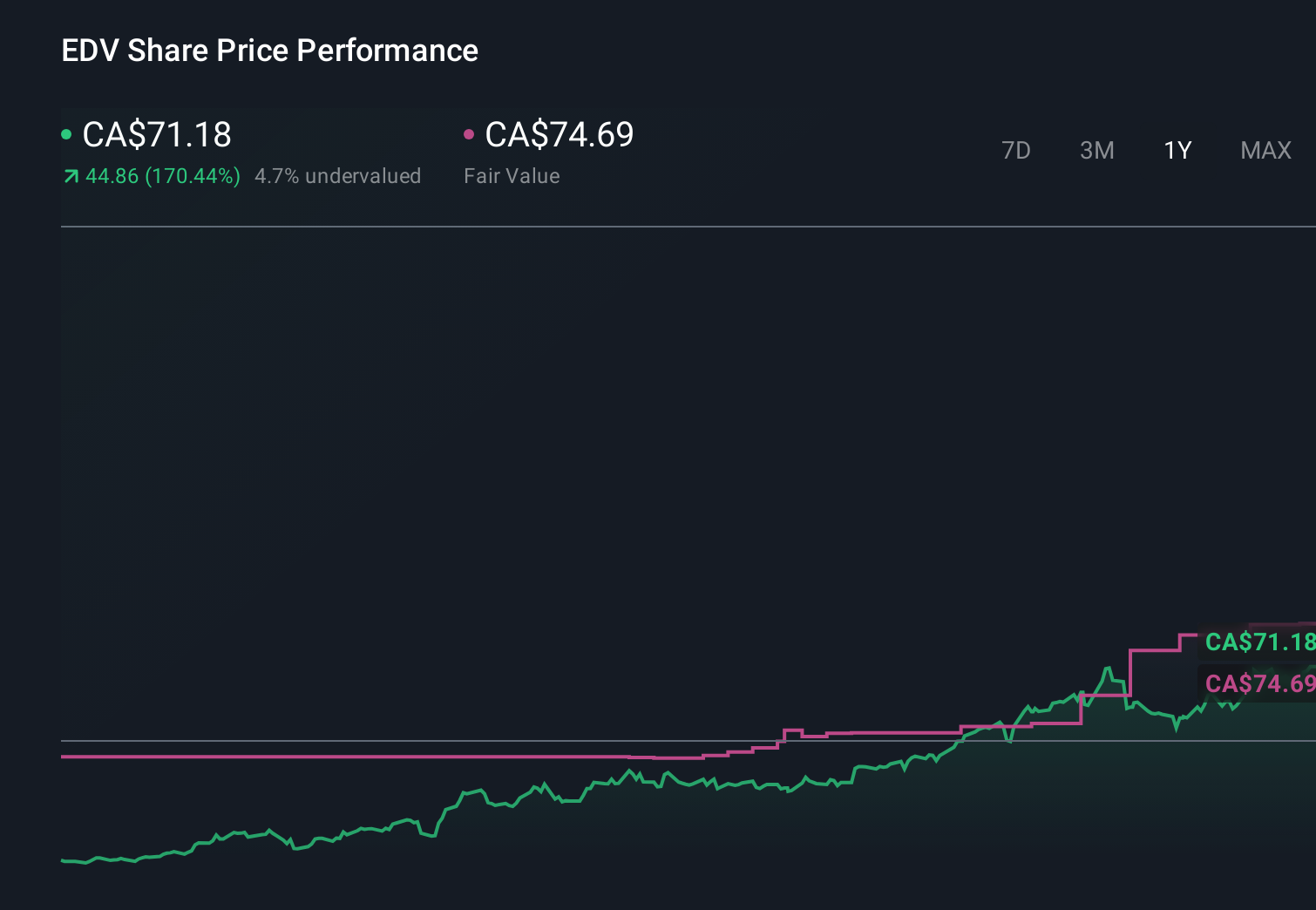

Uncover how Endeavour Mining's forecasts yield a CA$74.69 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates cluster between CA$74.69 and CA$124.62 per share, showing how far apart individual views can be. When you set those side by side with the company’s reliance on West African assets, it underlines why many readers may want to compare several different opinions before deciding how comfortable they are with Endeavour’s risk return trade off.

Explore 2 other fair value estimates on Endeavour Mining - why the stock might be worth as much as 75% more than the current price!

Build Your Own Endeavour Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Endeavour Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Endeavour Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Endeavour Mining's overall financial health at a glance.

No Opportunity In Endeavour Mining?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Endeavour Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDV

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion