- Canada

- /

- Metals and Mining

- /

- TSX:EDV

Announcing: Endeavour Mining (TSE:EDV) Stock Increased An Energizing 175% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the Endeavour Mining Corporation (TSE:EDV) share price has soared 175% in the last half decade. Most would be very happy with that. Also pleasing for shareholders was the 31% gain in the last three months.

Check out our latest analysis for Endeavour Mining

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

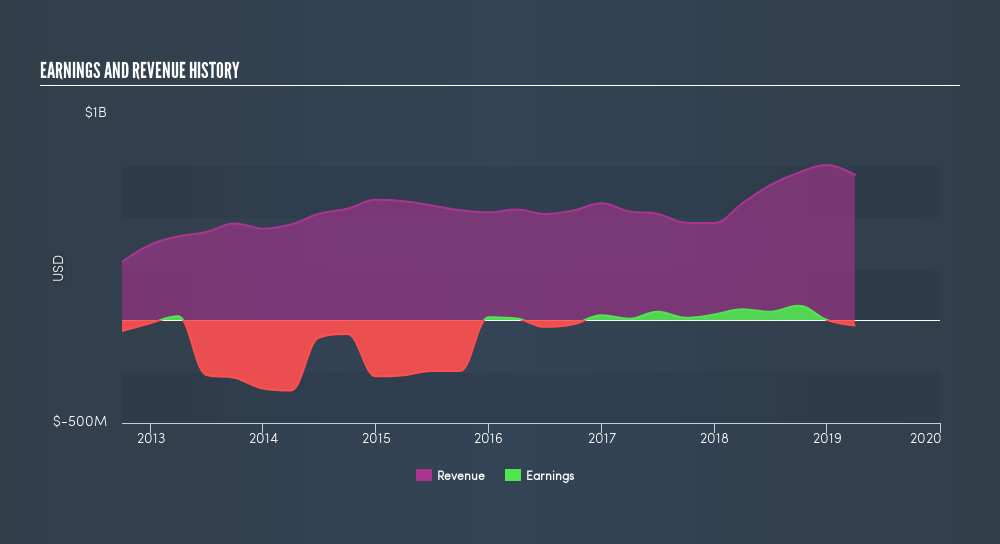

We know that Endeavour Mining has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. So we might find other metrics can better explain the share price movements.

On the other hand, Endeavour Mining's revenue is growing nicely, at a compound rate of 5.3% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Endeavour Mining has rewarded shareholders with a total shareholder return of 8.9% in the last twelve months. However, that falls short of the 22% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:EDV

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives