- Canada

- /

- Metals and Mining

- /

- TSX:EDR

Investors Appear Satisfied With Endeavour Silver Corp.'s (TSE:EDR) Prospects As Shares Rocket 27%

Despite an already strong run, Endeavour Silver Corp. (TSE:EDR) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

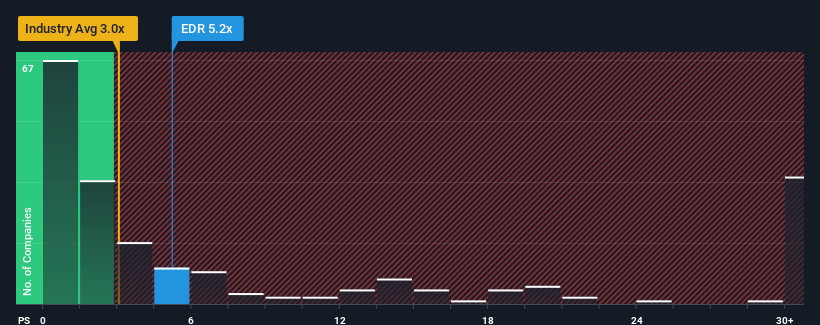

Since its price has surged higher, Endeavour Silver may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 5.2x, when you consider almost half of the companies in the Metals and Mining industry in Canada have P/S ratios under 3x and even P/S lower than 1x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Endeavour Silver

What Does Endeavour Silver's P/S Mean For Shareholders?

Endeavour Silver could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Endeavour Silver's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Endeavour Silver's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. The latest three year period has also seen an excellent 42% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 19%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Endeavour Silver's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Endeavour Silver's P/S Mean For Investors?

The strong share price surge has lead to Endeavour Silver's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Endeavour Silver shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Endeavour Silver is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Endeavour Silver's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success