- Canada

- /

- Metals and Mining

- /

- TSX:EDR

Did Terronera’s Launch and Q3 Results Just Shift Endeavour Silver’s (TSX:EDR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Endeavour Silver Corp. recently reported third quarter 2025 results, including a rise in sales to US$142.83 million and a net loss of US$41.96 million, alongside commercial production at the Terronera mine.

- This strong increase in output and revenues was driven by Terronera’s launch, highlighting management’s focus on expanding operational scale despite ongoing cost pressures.

- We'll examine how Terronera's successful production start influences Endeavour Silver’s updated investment narrative and future outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Endeavour Silver Investment Narrative Recap

To be a shareholder in Endeavour Silver, you need to believe that recent production gains, especially following Terronera’s commercial launch, will translate into sustainable cash flow and eventually profitability, despite current net losses and cost concerns. This quarter’s surge in sales confirms Terronera’s importance as a short-term catalyst, but with losses also rising, it has not eliminated questions over ongoing cost pressures and near-term liquidity, the most important risks facing Endeavour today.

The October announcement of Terronera achieving commercial production is central to this quarter's results, underscoring the mine’s role as a key contributor to the company’s scale-up plans. With average throughput rates matching targeted capacity during ramp-up, the successful transition at Terronera is a significant step toward supporting future revenue and cash flow targets, but it also magnifies the spotlight on execution and cost control as revenue rises.

By contrast, investors should be aware of ongoing cost pressures and how quickly they could impact...

Read the full narrative on Endeavour Silver (it's free!)

Endeavour Silver's outlook anticipates $705.2 million in revenue and $155.6 million in earnings by 2028. This reflects a 41.7% annual revenue growth rate and a $225.2 million increase in earnings from the current -$69.6 million.

Uncover how Endeavour Silver's forecasts yield a CA$15.12 fair value, a 37% upside to its current price.

Exploring Other Perspectives

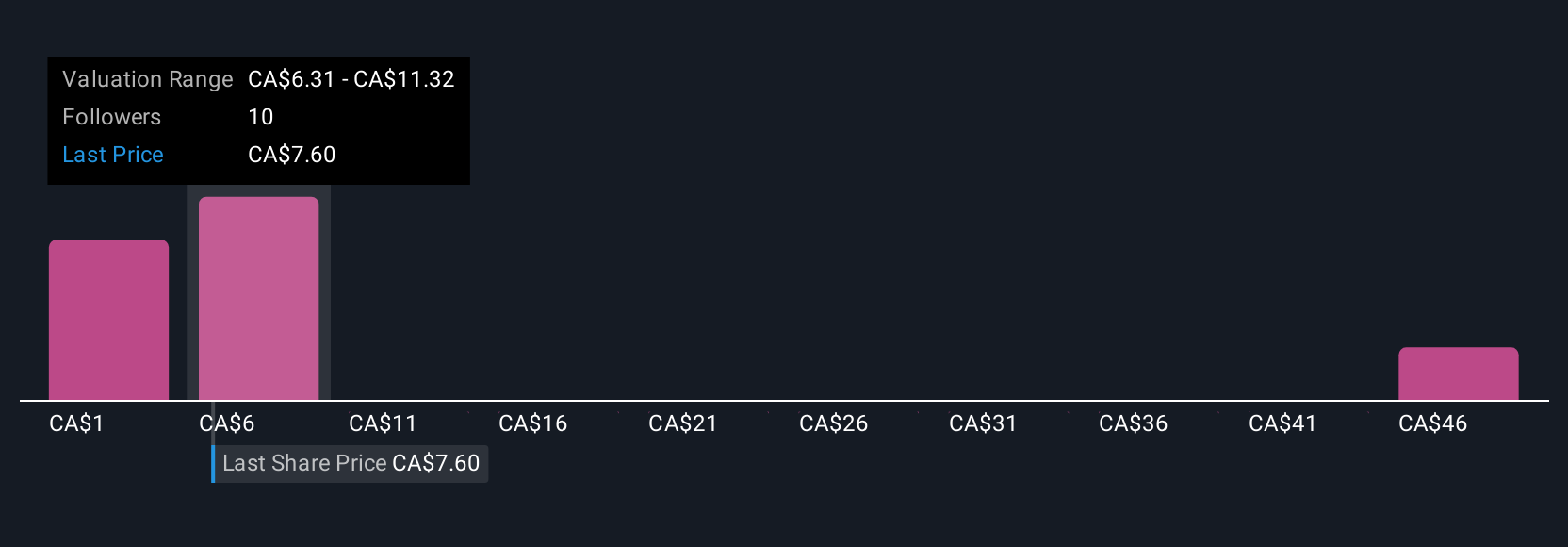

Simply Wall St Community members provided nine separate fair value estimates for Endeavour Silver, with targets ranging from US$2.55 to US$67.50 per share. As the company works to ramp up Terronera’s contribution in the face of rising costs, you can compare your view with those of other investors and form your own assessment of the company’s potential.

Explore 9 other fair value estimates on Endeavour Silver - why the stock might be worth over 6x more than the current price!

Build Your Own Endeavour Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Endeavour Silver research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Endeavour Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Endeavour Silver's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives