We Think EcoSynthetix Inc.'s (TSE:ECO) CEO Compensation Looks Fair

It would be hard to discount the role that CEO Jeff MacDonald has played in delivering the impressive results at EcoSynthetix Inc. (TSE:ECO) recently. Shareholders will have this at the front of their minds in the upcoming AGM on 17 May 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for EcoSynthetix

Comparing EcoSynthetix Inc.'s CEO Compensation With the industry

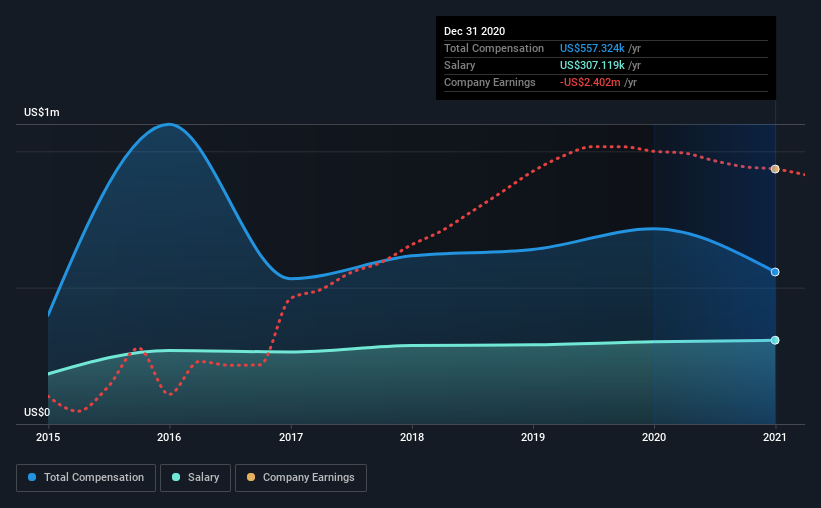

At the time of writing, our data shows that EcoSynthetix Inc. has a market capitalization of CA$291m, and reported total annual CEO compensation of US$557k for the year to December 2020. That's a notable decrease of 22% on last year. We note that the salary of US$307.1k makes up a sizeable portion of the total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between CA$121m and CA$483m, we discovered that the median CEO total compensation of that group was US$754k. So it looks like EcoSynthetix compensates Jeff MacDonald in line with the median for the industry. Furthermore, Jeff MacDonald directly owns CA$1.0m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$307k | US$302k | 55% |

| Other | US$250k | US$414k | 45% |

| Total Compensation | US$557k | US$716k | 100% |

Talking in terms of the industry, salary represented approximately 74% of total compensation out of all the companies we analyzed, while other remuneration made up 26% of the pie. In EcoSynthetix's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at EcoSynthetix Inc.'s Growth Numbers

Over the past three years, EcoSynthetix Inc. has seen its earnings per share (EPS) grow by 30% per year. Its revenue is down 28% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has EcoSynthetix Inc. Been A Good Investment?

We think that the total shareholder return of 199%, over three years, would leave most EcoSynthetix Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

Shareholders may want to check for free if EcoSynthetix insiders are buying or selling shares.

Switching gears from EcoSynthetix, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based chemicals, and other related products in the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success