- Canada

- /

- Metals and Mining

- /

- TSX:DSV

Why Discovery Silver (TSX:DSV) Is Up 20.0% After Surging Into Profit With Strong Exploration Results

Reviewed by Sasha Jovanovic

- Discovery Silver Corp. recently reported third-quarter 2025 earnings, recording sales of US$236.96 million and a net income of US$42.44 million, marking a turnaround from a net loss in the same period last year.

- Alongside financial improvement, the company unveiled positive exploration results across multiple projects at its Porcupine Complex, emphasizing both potential resource growth and ongoing drilling activity in key mine areas.

- We'll explore how Discovery Silver's transition to profitability, backed by ongoing exploration success, shapes its investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Discovery Silver's Investment Narrative?

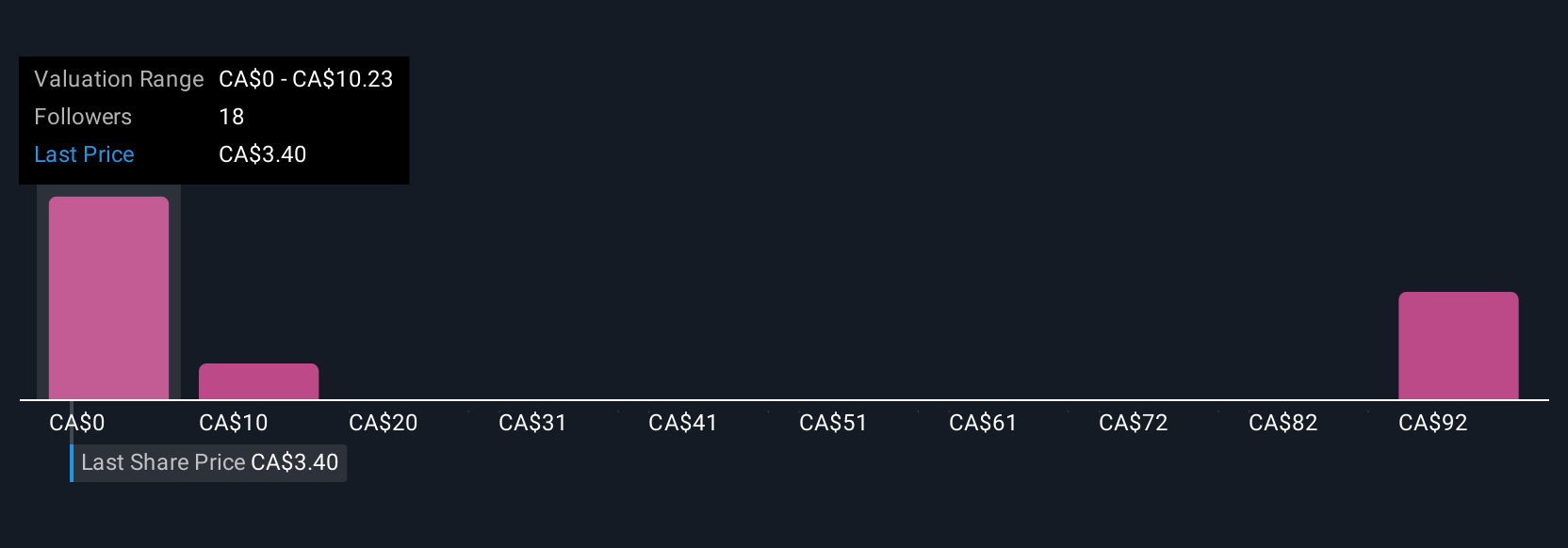

For shareholders, the Discovery Silver story increasingly centers on its ability to translate strong financial execution and exploration momentum into lasting value. The recent Q3 results marked a sharp swing to profit, reversing previous losses and signaling the first clear evidence of operational turnaround. The timing is notable: as the Porcupine Complex drill program broadens, resource growth could shift the near-term focus to expansion and production capacity. This run of success may reset the most immediate catalysts, specifically, progress with resource extensions and updates to official estimates now carry more weight following sustained profitability. However, risks remain. The stock’s price surge has created a lofty valuation relative to industry peers, and continued insider selling signals caution. The transition from early-stage growth to operational stability still demands management discipline and careful capital allocation. On the flip side, recent insider selling is information investors should be paying close attention to.

Discovery Silver's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 12 other fair value estimates on Discovery Silver - why the stock might be a potential multi-bagger!

Build Your Own Discovery Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Discovery Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Discovery Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Discovery Silver's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives