- Canada

- /

- Metals and Mining

- /

- TSX:DSV

How Investors May Respond To Discovery Silver (TSX:DSV) Appointing Alison White as CFO and Reshuffling Finance Team

Reviewed by Simply Wall St

- On July 31, 2025, Discovery Silver Corp. appointed Alison White as Chief Financial Officer, bringing her extensive financial leadership experience from SSR Mining and Newmont, while transitioning Andreas L’Abbé to Senior Vice President, Finance to oversee initiatives including the integration of Porcupine assets.

- This executive reshuffling places proven mining sector knowledge at the helm of the company’s finance team, signaling potential changes in financial management and operational priorities.

- We’ll explore how Alison White’s appointment, with her background in transforming key finance functions at major miners, may impact Discovery Silver’s investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Discovery Silver's Investment Narrative?

For shareholders, the case for Discovery Silver often comes down to belief in the successful development of its Cordero silver project and the company’s ability to transition toward eventual profitability. In the short term, investors have closely tracked catalysts like drilling updates, ongoing negotiations over the Hemlo mine, and the impact of recent capital raises, as well as key risks such as the unprofitable status and limited cash runway. The arrival of Alison White as CFO, following her experience at SSR Mining and Newmont, adds new depth to a relatively new management team, which could be reassuring for those focused on financial discipline and large-scale project execution. However, based on the recent share price reaction, a modest uptick on the appointment, there’s little to suggest that immediate catalysts or primary risks have fundamentally shifted as a result of this leadership change. Attention is likely to remain on operational milestones, funding, and the path to meaningful revenue.

Yet some potential funding challenges may still loom for those watching closely.

Exploring Other Perspectives

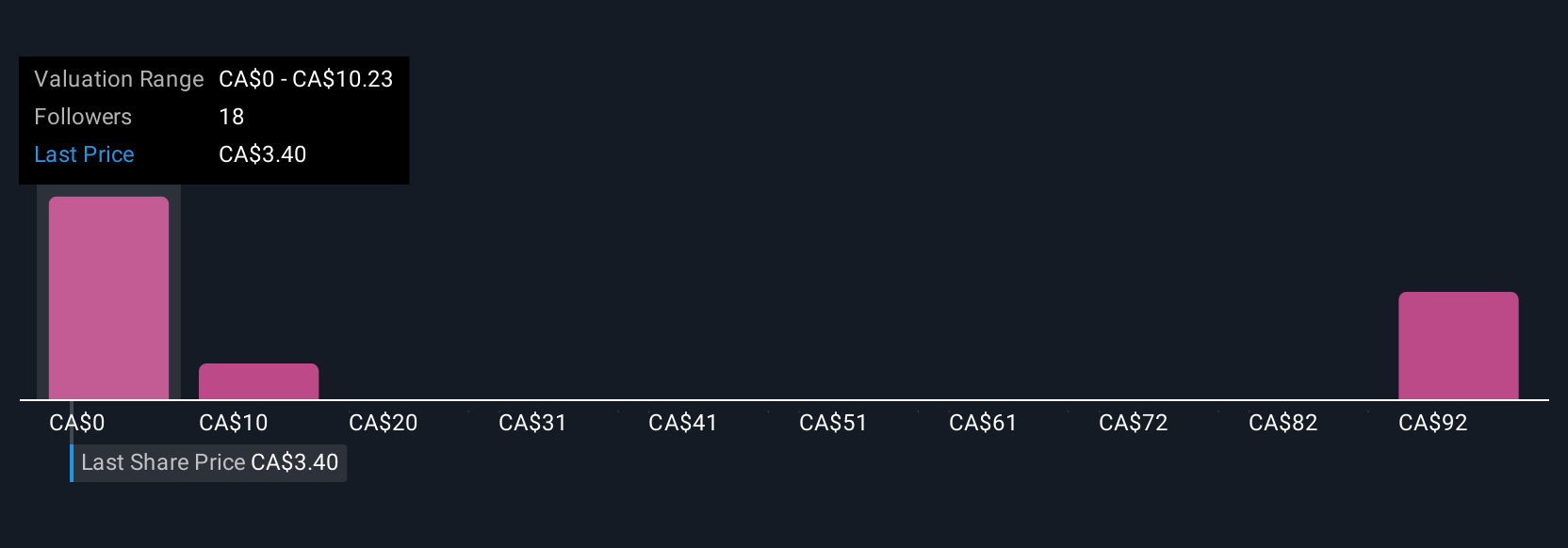

Explore 10 other fair value estimates on Discovery Silver - why the stock might be a potential multi-bagger!

Build Your Own Discovery Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Discovery Silver research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Discovery Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Discovery Silver's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives