- Canada

- /

- Metals and Mining

- /

- TSXV:SVE

3 TSX Penny Stocks Under CA$400M Market Cap

Reviewed by Simply Wall St

November kicked off with a wobble in equity markets, triggered by renewed scrutiny of artificial intelligence (AI) valuations. While enthusiasm around AI continues to fuel innovation and investor interest, it also has the potential to amplify volatility, especially when a handful of mega-cap technology stocks dominate U.S. index performance. In this context, penny stocks—though an outdated term—remain relevant as they often represent smaller or newer companies that can offer both affordability and growth potential. By focusing on those with robust financials and clear growth paths, investors might find opportunities in these lesser-known equities amidst current market dynamics.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$53.85M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.90 | CA$207.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.46 | CA$4.01M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.16 | CA$798.36M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.13 | CA$22.79M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.24 | CA$996.77M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.80 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.11 | CA$203.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bragg Gaming Group (TSX:BRAG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bragg Gaming Group Inc. is an iGaming content and technology solutions provider catering to online and land-based gaming operators with proprietary and exclusive content, with a market cap of CA$73.55 million.

Operations: The company's revenue is primarily generated from its B2B Online Gaming segment, which accounts for €104.91 million.

Market Cap: CA$73.55M

Bragg Gaming Group showcases potential within the penny stock landscape through its strategic expansion into the U.S. iGaming market, highlighted by a recent partnership with Caesars Entertainment in West Virginia. Despite being unprofitable, Bragg maintains a positive cash flow and sufficient cash runway for over three years, supported by its growing B2B Online Gaming revenue of €104.91 million. The company has secured a USD 6 million credit facility from BMO to bolster growth efforts while managing debt effectively. However, significant insider selling and ongoing losses may pose challenges as it seeks profitability in an expanding market space.

- Click here to discover the nuances of Bragg Gaming Group with our detailed analytical financial health report.

- Understand Bragg Gaming Group's earnings outlook by examining our growth report.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$300.48 million.

Operations: The company generates revenue primarily from its Corporate and Others segment, which accounts for CA$2.98 million, followed by Mining Services with CA$1.46 million.

Market Cap: CA$300.48M

Dundee Corporation's position in the penny stock arena is marked by its stable financial footing, with short-term assets of CA$92.4 million comfortably covering both short and long-term liabilities. Despite having a low Return on Equity at 12.9%, Dundee has shown consistent earnings growth, albeit impacted by a one-off gain of CA$49.8 million in its recent results. The company recently succeeded in appealing tax reassessments from the CRA for 2014, potentially leading to a refund including interest, which could enhance its financial flexibility despite current negative operating cash flow and limited revenue streams totaling CA$4 million.

- Click to explore a detailed breakdown of our findings in Dundee's financial health report.

- Learn about Dundee's historical performance here.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver One Resources Inc. focuses on the acquisition, exploration, and development of mineral properties in the United States, with a market cap of CA$106.08 million.

Operations: Silver One Resources Inc. does not report any revenue segments as it is focused on acquiring, exploring, and developing mineral properties in the United States.

Market Cap: CA$106.08M

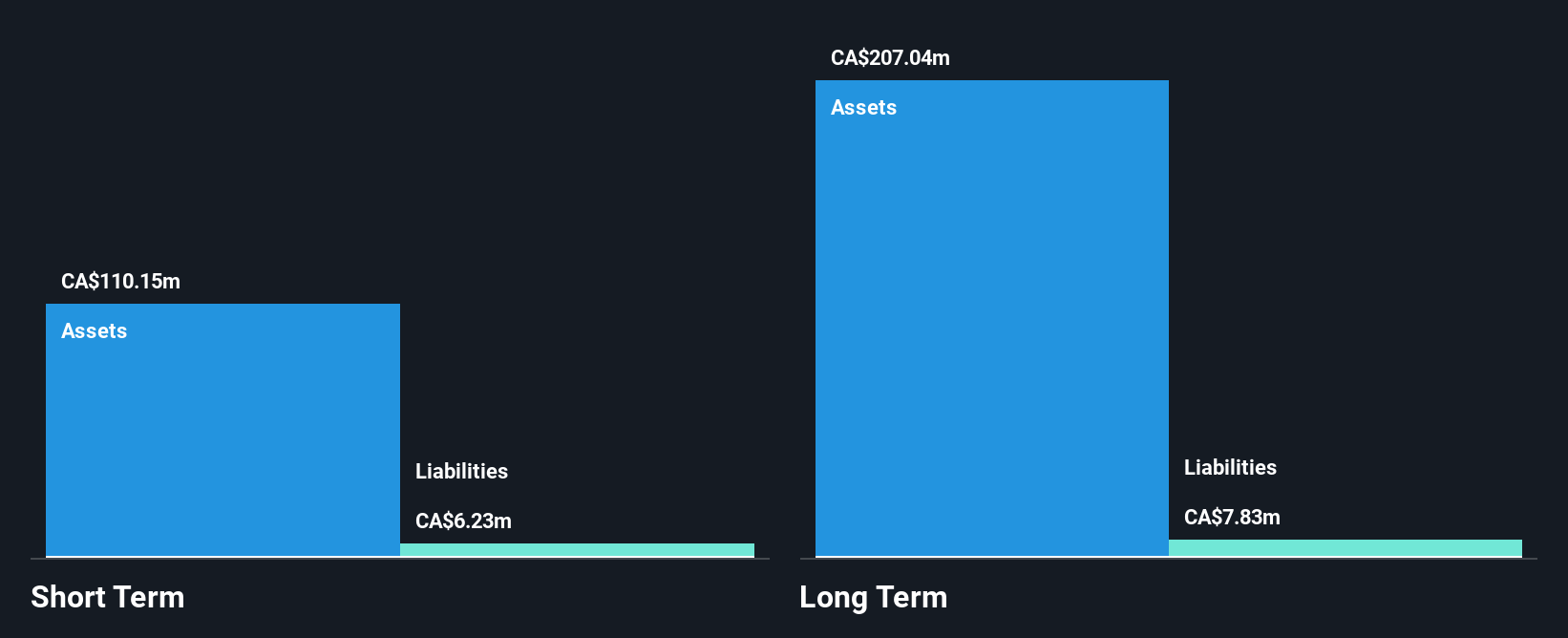

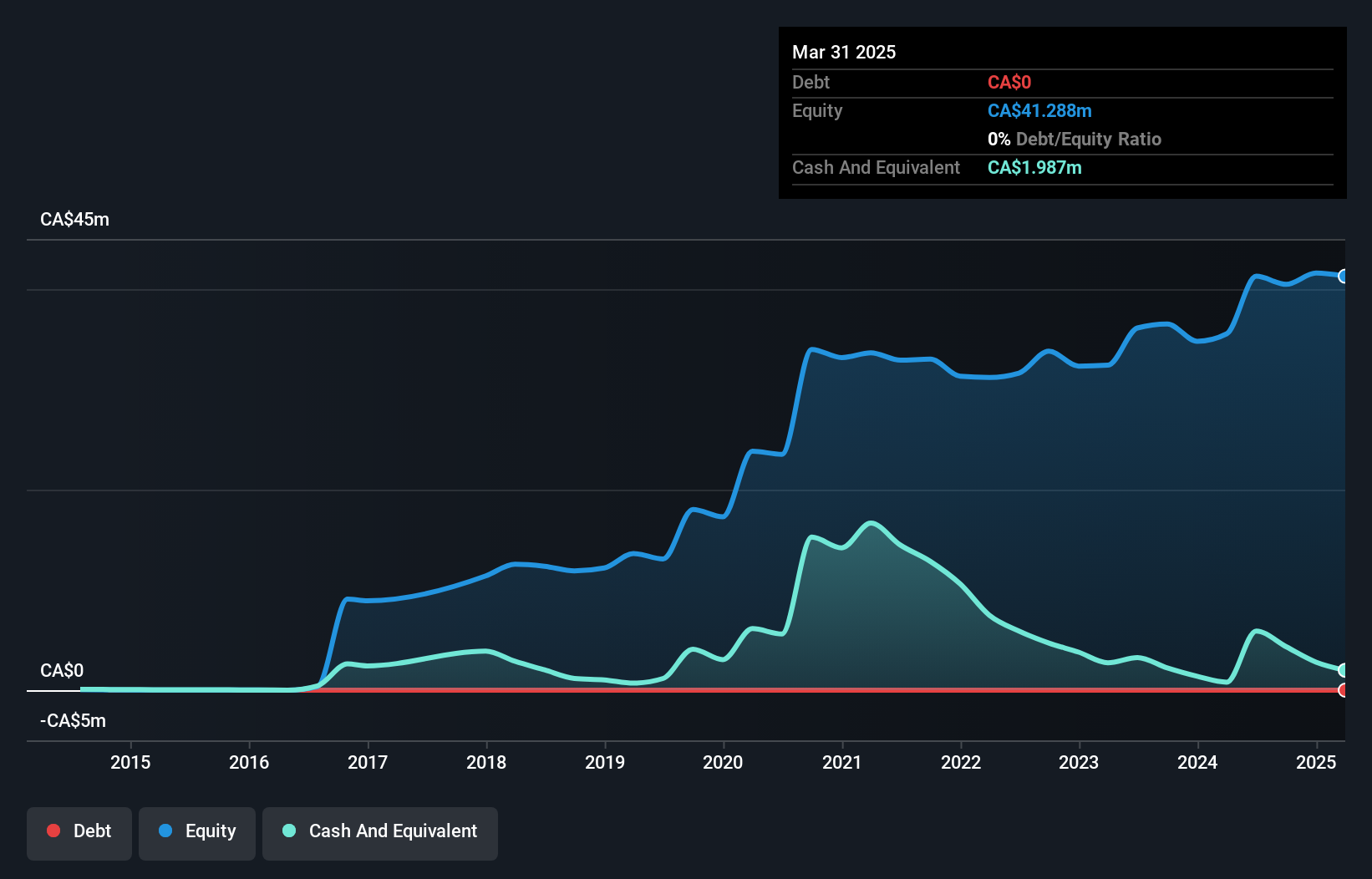

Silver One Resources Inc., with a market cap of CA$106.08 million, remains pre-revenue as it focuses on mineral property development in the U.S. The company has improved its financial position by reducing net losses, reporting a loss of CA$0.35 million for Q3 2025 compared to CA$0.55 million the previous year. Despite having no debt and short-term assets exceeding liabilities, its cash runway is limited to four months based on past free cash flow but was bolstered by recent capital raises totaling over CA$6 million through private placements, indicating ongoing investor interest despite operational challenges.

- Dive into the specifics of Silver One Resources here with our thorough balance sheet health report.

- Assess Silver One Resources' previous results with our detailed historical performance reports.

Next Steps

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 409 more companies for you to explore.Click here to unveil our expertly curated list of 412 TSX Penny Stocks.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SVE

Silver One Resources

Engages in the acquisition, exploration, and development of mineral properties in the United States.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives