- Canada

- /

- Metals and Mining

- /

- TSX:CMMC

The Copper Mountain Mining (TSE:CMMC) Share Price Is Down 70% So Some Shareholders Are Wishing They Sold

Over the last month the Copper Mountain Mining Corporation (TSE:CMMC) has been much stronger than before, rebounding by 38%. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 70% after a long stretch. So is the recent increase sufficient to restore confidence in the stock? Not yet. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

Check out our latest analysis for Copper Mountain Mining

Because Copper Mountain Mining made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Copper Mountain Mining grew its revenue at 3.4% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 21% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

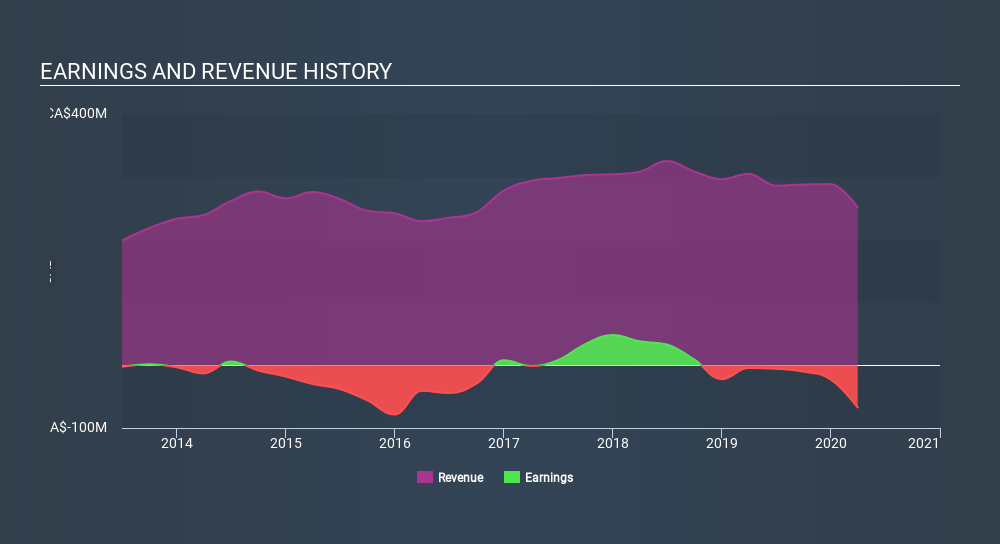

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Copper Mountain Mining will earn in the future (free profit forecasts).

A Different Perspective

While the broader market lost about 9.3% in the twelve months, Copper Mountain Mining shareholders did even worse, losing 52%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 21% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Copper Mountain Mining that you should be aware of.

Copper Mountain Mining is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CMMC

Copper Mountain Mining

Copper Mountain Mining Corporation engages in the mining, exploration, and development of mineral properties in Canada.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives