- Canada

- /

- Metals and Mining

- /

- TSX:CMMC

Some Copper Mountain Mining (TSE:CMMC) Shareholders Have Copped A Big 69% Share Price Drop

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the Copper Mountain Mining Corporation (TSE:CMMC) share price dropped 69% over five years. That's not a lot of fun for true believers. And it's not just long term holders hurting, because the stock is down 42% in the last year. The falls have accelerated recently, with the share price down 15% in the last three months.

Check out our latest analysis for Copper Mountain Mining

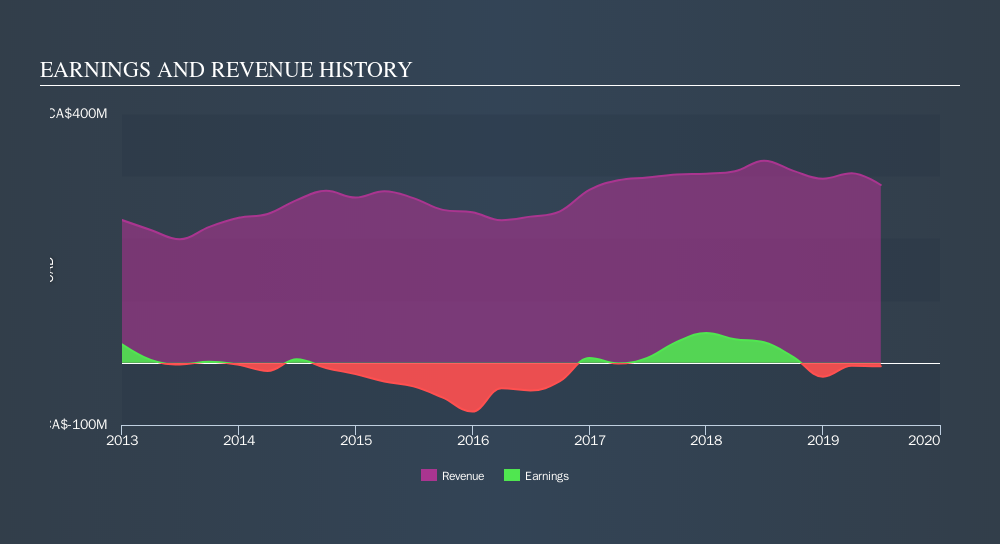

Because Copper Mountain Mining is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Copper Mountain Mining grew its revenue at 4.3% per year. That's far from impressive given all the money it is losing. It's likely this weak growth has contributed to an annualised return of 21% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Copper Mountain Mining. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

You can see how revenue has changed over time in the image below.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Copper Mountain Mining

A Different Perspective

Copper Mountain Mining shareholders are down 42% for the year, but the market itself is up 2.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 21% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:CMMC

Copper Mountain Mining

Copper Mountain Mining Corporation engages in the mining, exploration, and development of mineral properties in Canada.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives