- Canada

- /

- Oil and Gas

- /

- TSX:WCP

Top TSX Dividend Stocks For March 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a period of sideways consolidation, investors are increasingly focused on fortifying their portfolios against potential volatility with strategies like diversification and rebalancing. In such an environment, dividend stocks can be appealing for their ability to provide steady income and potential stability, making them a valuable component in a balanced investment approach.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.91% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 4.21% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.15% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.63% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.78% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 5.39% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.76% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.49% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.39% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.70% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

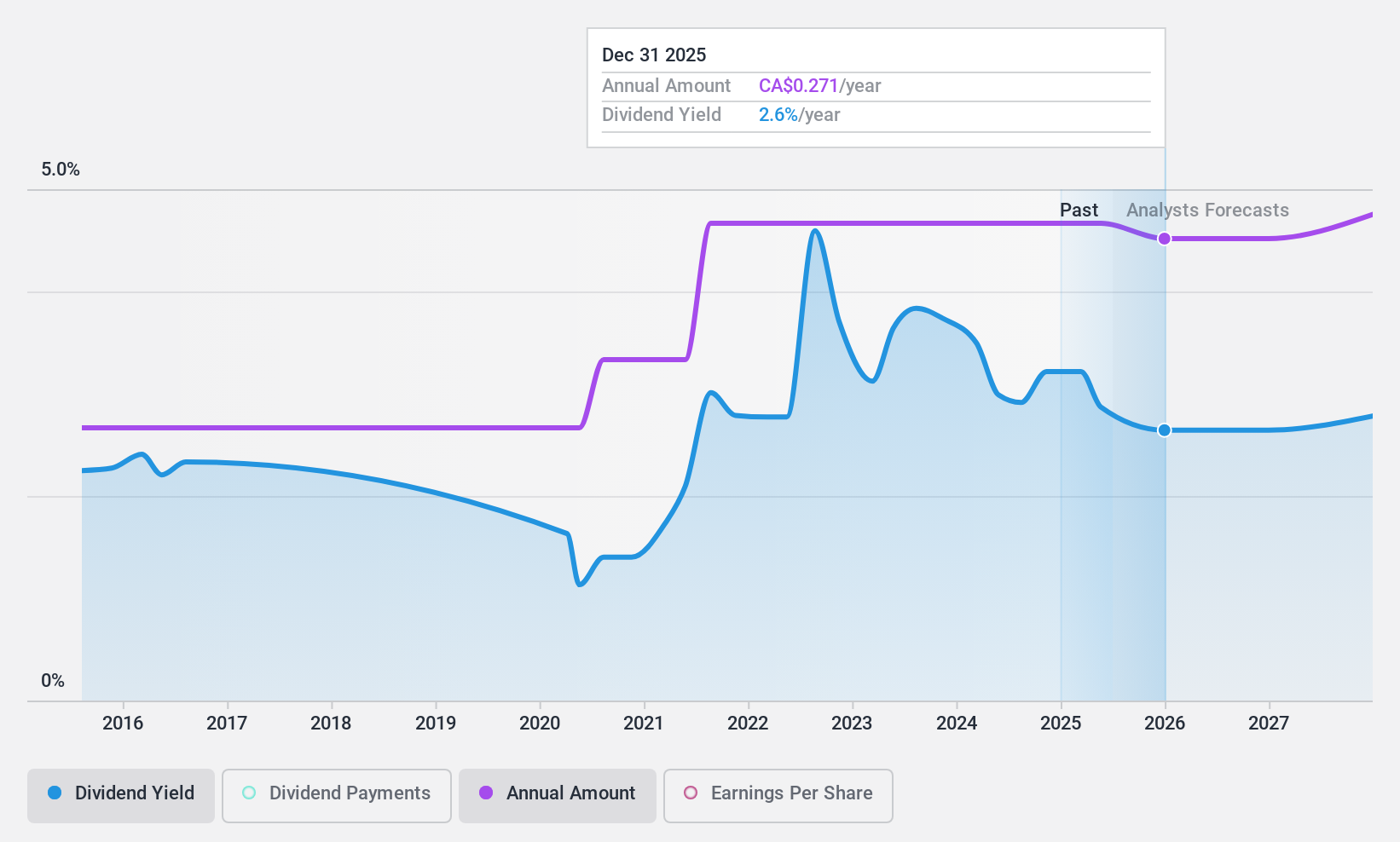

Centerra Gold (TSX:CG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Centerra Gold Inc. is involved in the acquisition, exploration, development, and operation of gold and copper properties across North America, Turkey, and internationally with a market cap of CA$1.74 billion.

Operations: Centerra Gold Inc.'s revenue is primarily derived from its Öksüt operations ($559.44 million), Mount Milligan ($460.21 million), and Molybdenum segment ($232.42 million).

Dividend Yield: 3.4%

Centerra Gold's dividend payments, though covered by earnings and cash flows with payout ratios of 43.7% and 20% respectively, have been volatile over the past decade. The recent approval of a CAD 0.07 per share quarterly dividend reflects its ongoing commitment to returning capital to shareholders despite fluctuations in production levels and executive changes. While trading below estimated fair value, its dividend yield remains modest compared to top Canadian payers, highlighting potential for cautious income investors.

- Dive into the specifics of Centerra Gold here with our thorough dividend report.

- The valuation report we've compiled suggests that Centerra Gold's current price could be quite moderate.

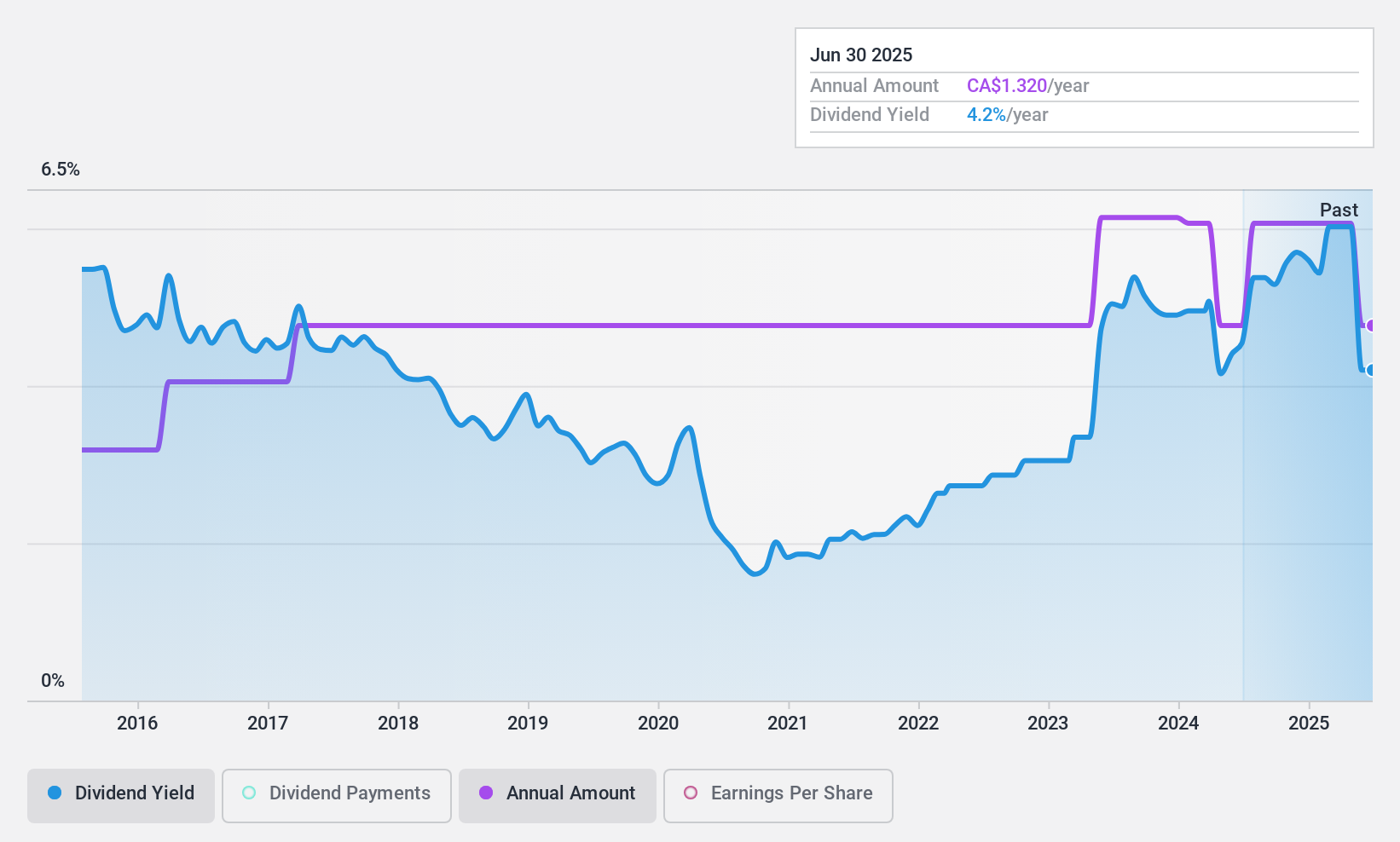

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, along with its subsidiaries, is involved in the design, manufacturing, and distribution of packaging containers and healthcare supplies across North America, with a market cap of CA$321.31 million.

Operations: Richards Packaging Income Fund generates revenue from its wholesale miscellaneous segment, amounting to CA$411.82 million.

Dividend Yield: 5.8%

Richards Packaging Income Fund's dividends are well-covered by earnings and cash flows, with payout ratios of 38.7% and 32.6%, respectively, ensuring sustainability. The fund has consistently paid CAD 0.11 per unit monthly, reflecting stability over the past decade while also showing growth in payments during this period. Although its dividend yield of 5.76% is lower than Canada's top payers, it offers reliability for income-focused investors while trading at a discount to estimated fair value.

- Click to explore a detailed breakdown of our findings in Richards Packaging Income Fund's dividend report.

- Our comprehensive valuation report raises the possibility that Richards Packaging Income Fund is priced lower than what may be justified by its financials.

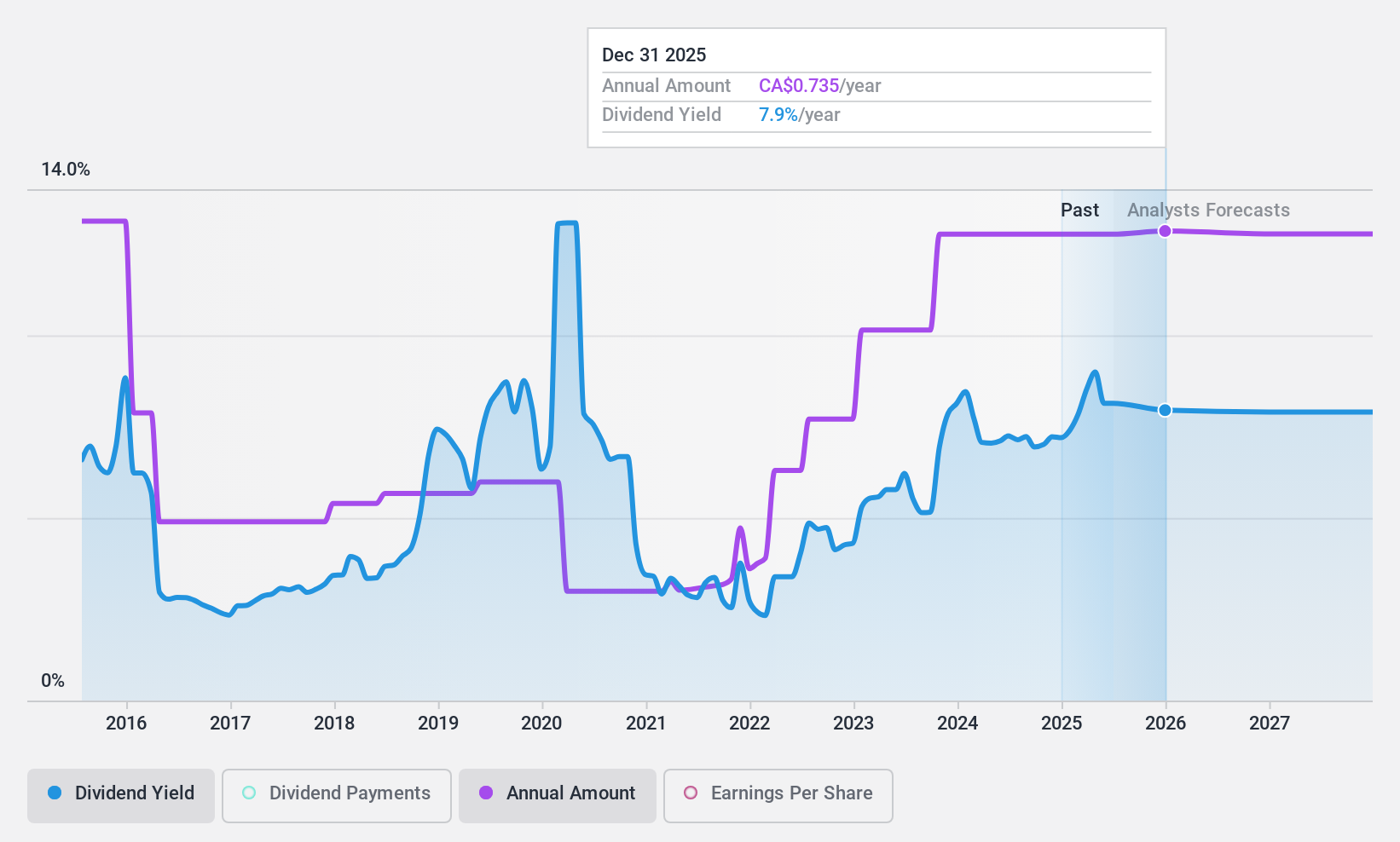

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is involved in acquiring, developing, and producing petroleum and natural gas properties in Western Canada, with a market cap of approximately CA$5.50 billion.

Operations: Whitecap Resources Inc. generates revenue primarily from its oil and gas exploration and production activities, amounting to CA$3.34 billion.

Dividend Yield: 7.9%

Whitecap Resources offers a high dividend yield of 7.91%, ranking in the top 25% of Canadian payers, with dividends well-covered by earnings and cash flows (payout ratios: 53.4% and 61%). Despite recent earnings decline, revenue is projected to grow annually by 5.62%. The company trades at a significant discount to estimated fair value and seeks growth through strategic acquisitions, enhancing its potential for sustained dividend payments amidst stable past performance.

- Take a closer look at Whitecap Resources' potential here in our dividend report.

- Our expertly prepared valuation report Whitecap Resources implies its share price may be lower than expected.

Taking Advantage

- Gain an insight into the universe of 29 Top TSX Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whitecap Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WCP

Whitecap Resources

Engages in the acquisition, development, and production of petroleum and natural gas properties and assets in Western Canada.

Very undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives