Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Top TSX Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

The Canadian market has shown robust growth, rising 4.0% in the past week and 12% over the last year, with earnings projected to increase by 15% annually. In such an optimistic climate, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 55.0% |

| goeasy (TSX:GSY) | 21.5% | 15.5% |

| Payfare (TSX:PAY) | 14.8% | 38.6% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.4% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 67.3% |

| Alpha Cognition (CNSX:ACOG) | 18% | 66.5% |

| Artemis Gold (TSXV:ARTG) | 31.4% | 45.6% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

| Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

| Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's review some notable picks from our screened stocks.

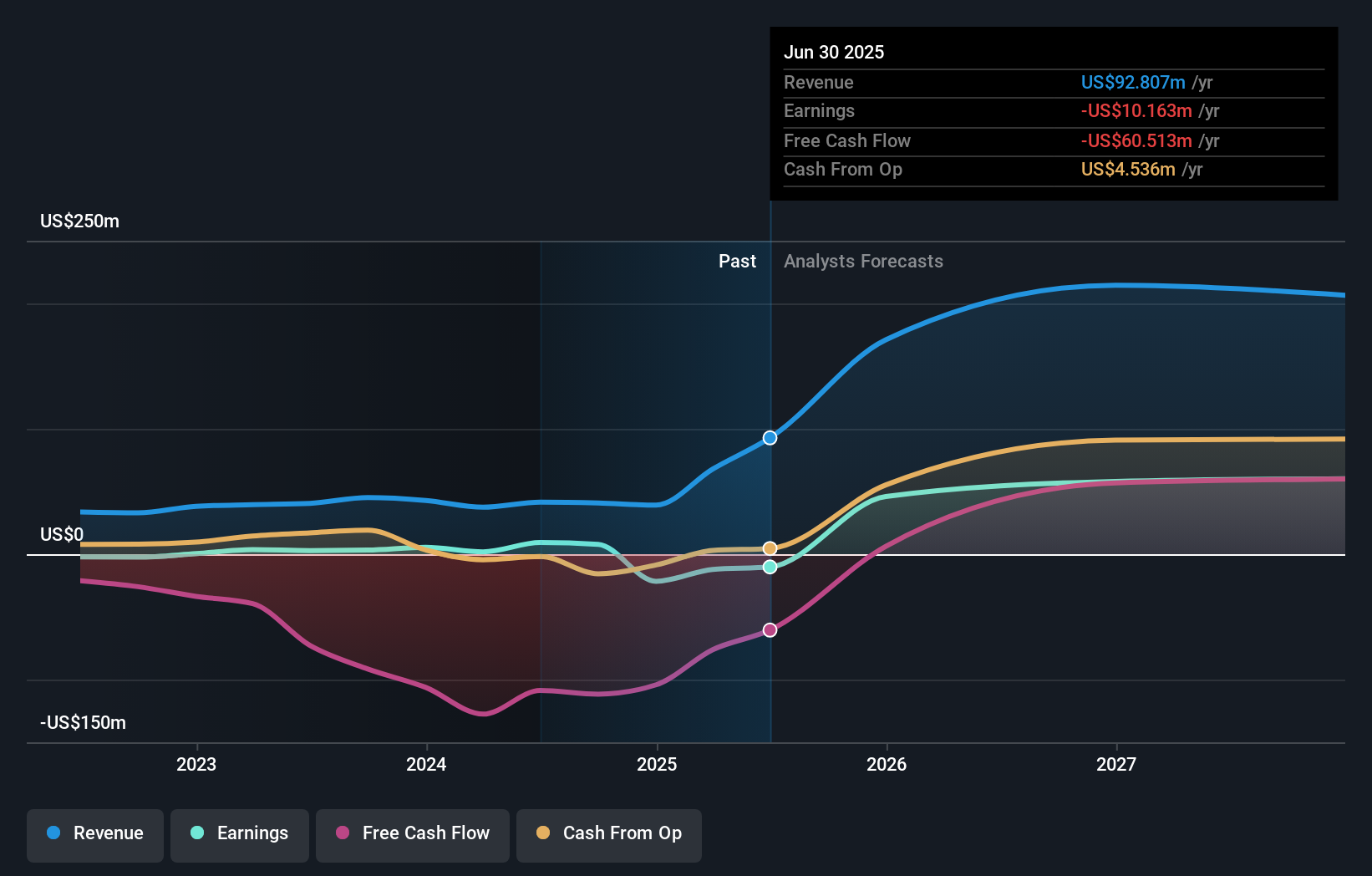

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. operates in the exploration, evaluation, and development of precious metals projects in Morocco with a market capitalization of approximately CA$2.09 billion.

Operations: The company generates revenue primarily from its production activities at the Zgounder Silver Mine in Morocco, totaling CA$37.48 million.

Insider Ownership: 10.3%

Aya Gold & Silver has shown promising growth with earnings forecasted to increase by 51.64% annually and revenue expected to rise at 43.5% per year, outpacing the Canadian market significantly. Recent insider activities reveal more buying than selling, indicating confidence from those closest to the company. However, shareholder dilution occurred over the past year, and profit margins have decreased from 9.3% to 5%. The inaugural silver pour at its expanded Zgounder mine marks a critical step towards reaching commercial production by Q4-2024, alongside high-grade drill results enhancing its mining prospects.

- Navigate through the intricacies of Aya Gold & Silver with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Aya Gold & Silver shares in the market.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$8.58 billion.

Operations: The company generates revenue through its commercial real estate and investment management services across the Americas (CA$2.53 billion), Asia Pacific (CA$616.58 million), Europe, Middle East & Africa (CA$730.10 million), and its Investment Management segment (CA$489.23 million).

Insider Ownership: 14.2%

Colliers International Group is poised for robust growth with its earnings expected to surge by 38.34% annually, outperforming the Canadian market forecast of 15% yearly growth. Recent strategic moves, including a partnership with SPGI Zurich AG to enhance its European footprint and a contract to market Diamondhead Casino's property, underscore its aggressive expansion strategy. However, concerns linger as debt isn't well covered by operating cash flow and there has been significant insider selling in the past three months.

- Dive into the specifics of Colliers International Group here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Colliers International Group is trading behind its estimated value.

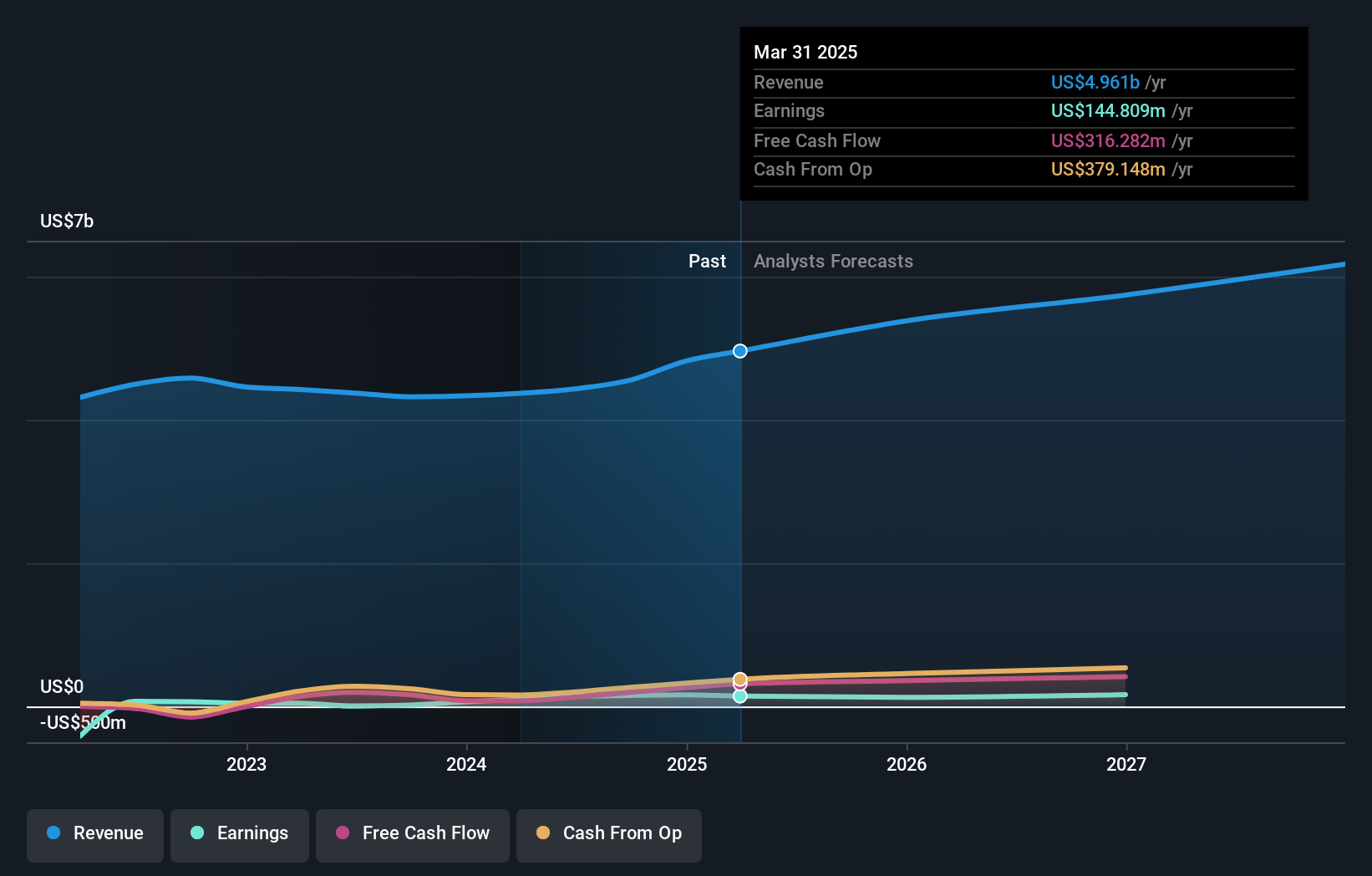

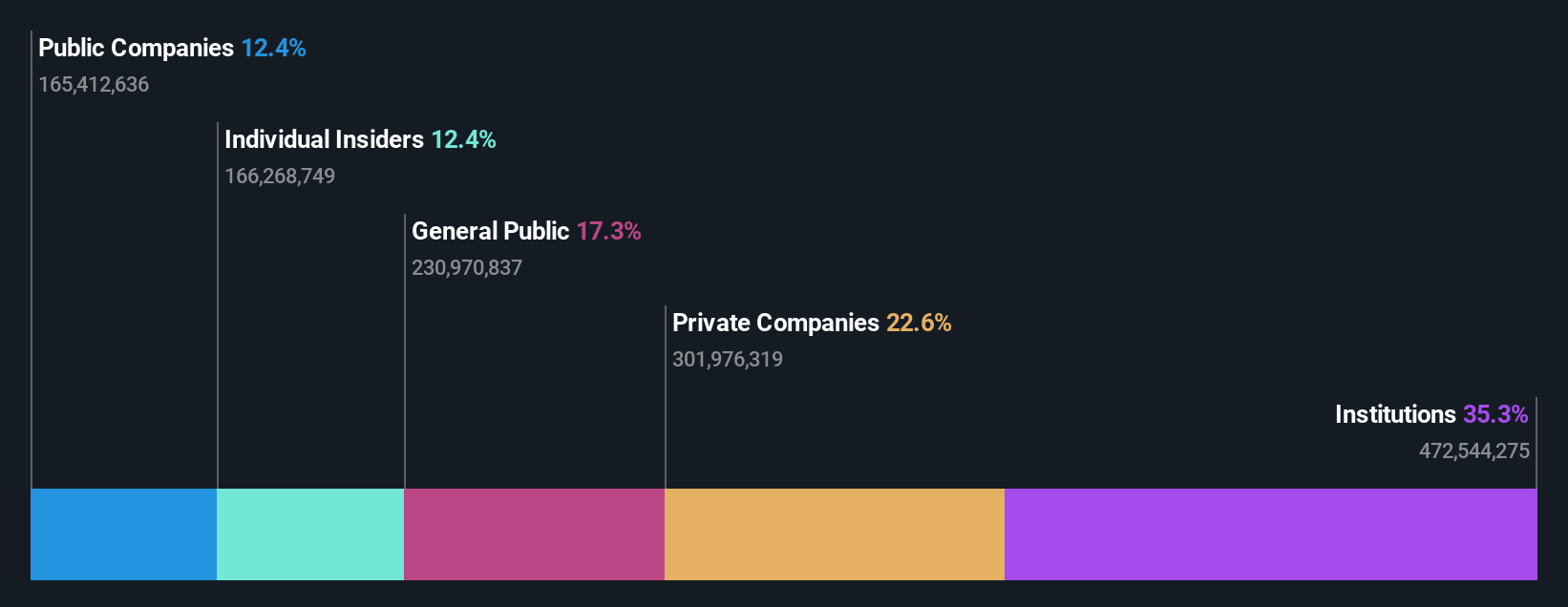

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. specializes in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$26.25 billion.

Operations: The company primarily focuses on the extraction and processing of minerals and precious metals across various locations in Africa.

Insider Ownership: 12.4%

Ivanhoe Mines, a growth-oriented company with significant insider ownership, has recently completed its Phase 3 concentrator at the Kamoa-Kakula Copper Complex ahead of schedule, boosting potential annual copper production to over 600,000 tonnes. This development could position it as the world's fourth-largest copper mining complex. Despite no substantial insider buying in the past three months and a recent net loss of US$65.55 million in Q1 2024, analysts predict a strong revenue growth rate of 82.4% per year and earnings growth of 67.28% annually, outpacing the Canadian market significantly.

- Get an in-depth perspective on Ivanhoe Mines' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Ivanhoe Mines' share price might be on the expensive side.

Taking Advantage

- Navigate through the entire inventory of 29 Fast Growing TSX Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Ivanhoe Mines is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential low.