- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Aya Gold & Silver (TSX:AYA) Surges Output in Q2—What Does This Mean for its Competitive Edge?

Reviewed by Simply Wall St

- Aya Gold & Silver Inc. reported its second quarter 2025 operating results, revealing silver production of 1,042,317 ounces and ore processed of 273,471 tonnes, both substantially higher compared to the same period last year.

- This sharp increase in output indicates operational improvements at its mines and positions the company for potentially stronger future results.

- We'll explore how the significant rise in second quarter silver production shapes Aya Gold & Silver's current investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Aya Gold & Silver Investment Narrative Recap

For Aya Gold & Silver, believing in the value of expanding production and operational efficiency is central to the shareholder thesis. The recent sharp jump in silver output meaningfully addresses the company’s biggest short-term catalyst, realizing the benefits of the Zgounder expansion, but concerns remain over rising production costs, which could offset gains if not managed alongside higher output.

The July 2025 operating update closely follows recent high-grade exploration results at Boumadine, further supporting Aya’s strategy to boost resources and future revenue streams. While production improvements are promising, success will ultimately depend on maintaining strong profit margins as the company scales up operations.

In contrast, investors should not lose sight of the risk that higher production volumes sometimes come with rising cash costs per silver ounce, which may impact long-term profitability if...

Read the full narrative on Aya Gold & Silver (it's free!)

Aya Gold & Silver's narrative projects $264.4 million revenue and $91.9 million earnings by 2028. This requires 57.3% yearly revenue growth and a $104 million increase in earnings from the current $-12.1 million.

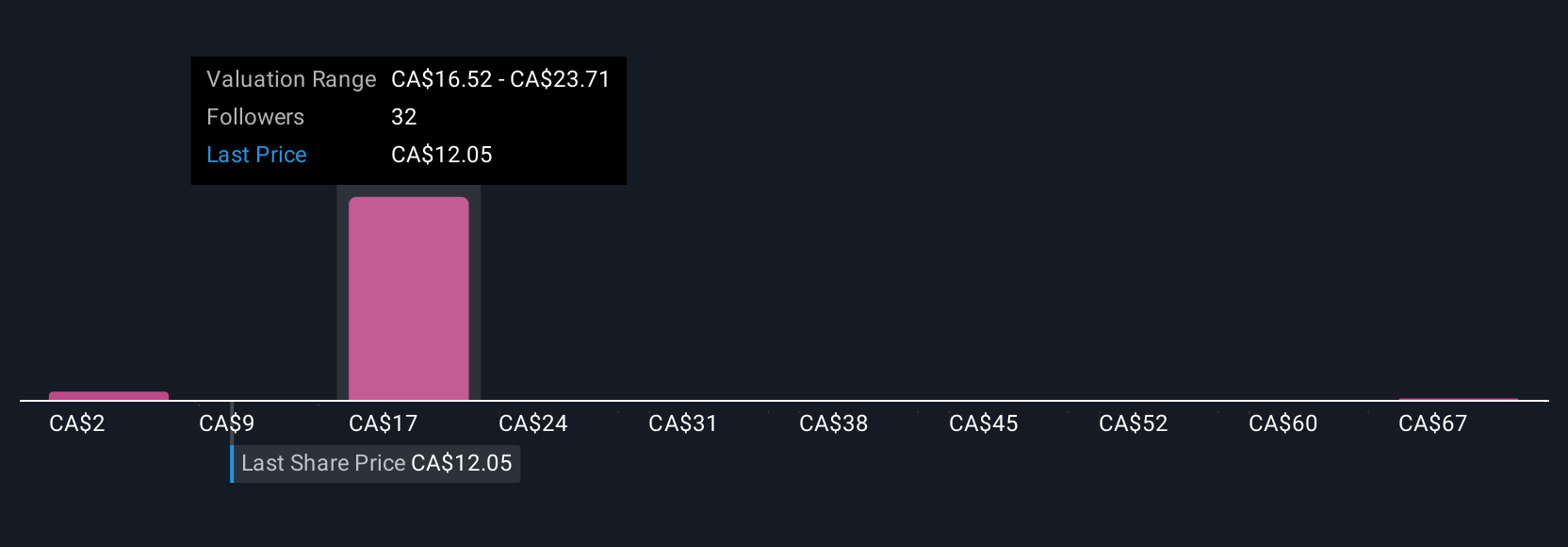

Uncover how Aya Gold & Silver's forecasts yield a CA$19.67 fair value, a 63% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have issued eight fair value estimates for Aya, ranging from CA$2.15 to CA$74. The recent surge in silver output highlights how sharply earnings potential can shift, underscoring why opinions on the company’s future performance are so varied, check out several viewpoints before forming your own.

Explore 8 other fair value estimates on Aya Gold & Silver - why the stock might be worth over 6x more than the current price!

Build Your Own Aya Gold & Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aya Gold & Silver research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Aya Gold & Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aya Gold & Silver's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives