- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Is Avino Silver & Gold Mines Worth a Look After Soaring Over 370% in 2025?

Reviewed by Bailey Pemberton

- Wondering if Avino Silver & Gold Mines is a hidden gem or overhyped? Let’s dig into whether its soaring share price is backed by cold, hard value.

- While the stock posted an eye-watering 379.9% year-to-date return and 251.1% gains over the past year, it has pulled back nearly 10% in the last month. This reminds investors that volatility comes with the territory.

- Some of these dramatic swings have come amid a flurry of coverage on sector-wide moves in precious metals, along with operational updates by Avino and mining peers regarding project advancements and exploration results. These stories have set the tone for renewed attention and speculation around the company’s longer-term prospects.

- Our initial valuation check gives Avino Silver & Gold Mines a 2 out of 6 on key value metrics, so there is clearly more to unpack. We will walk through traditional valuation approaches next, and offer a deeper perspective on what the numbers really mean for investors.

Avino Silver & Gold Mines scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Avino Silver & Gold Mines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future free cash flows and then discounting those amounts back to the present. This helps investors judge what the business could really be worth, based on its ability to generate cash over time.

For Avino Silver & Gold Mines, the latest reported Free Cash Flow (FCF) stands at $16.8 million. The DCF model used here outlines an ambitious growth trajectory. By 2026, the FCF is estimated to rise to $31.3 million, and it is expected to exceed $191.6 million by 2035. While analyst forecasts only officially extend about five years, further projections are mathematically extrapolated to map out Avino’s long-term potential. All figures are given in $.

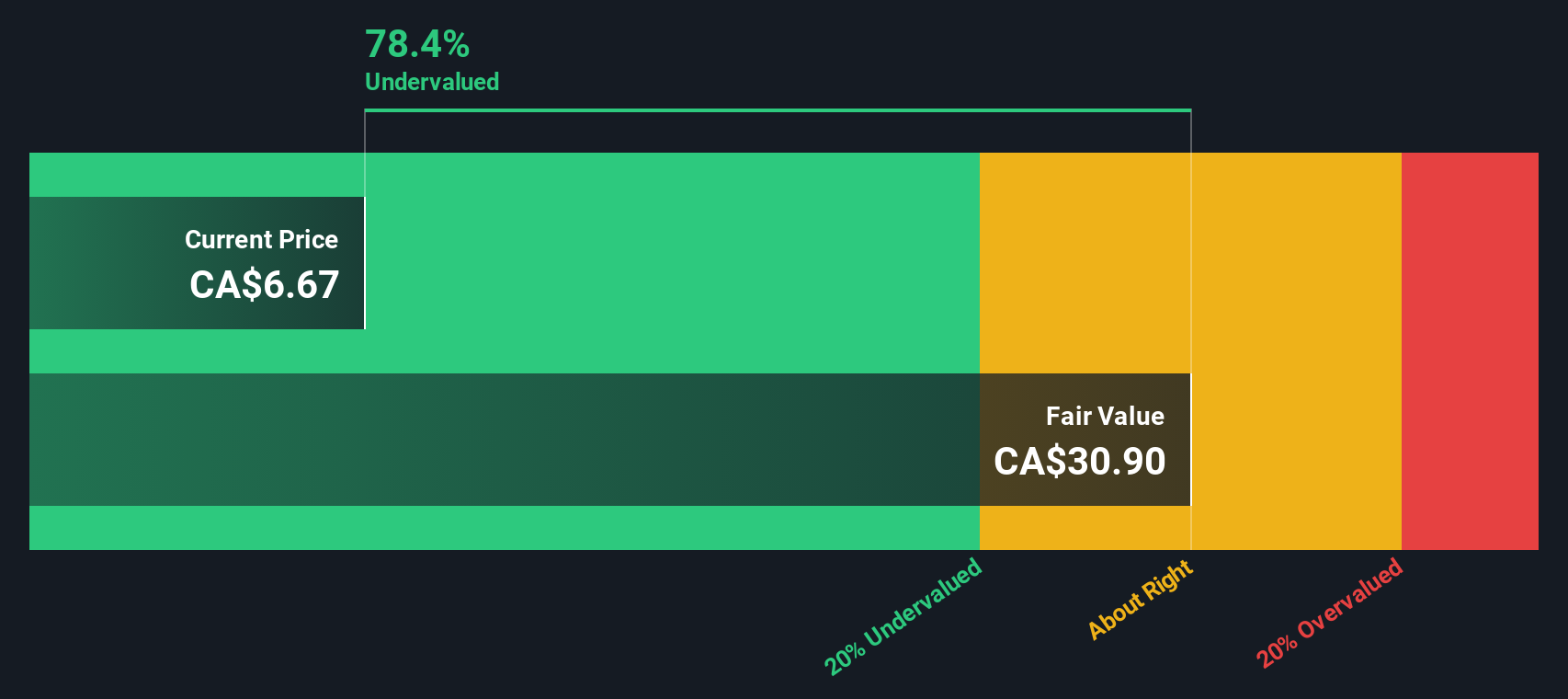

After crunching the numbers using this 2 Stage Free Cash Flow to Equity approach, the intrinsic value of Avino Silver & Gold Mines is calculated at $30.90 per share. That represents a substantial 78.4% discount versus the current trading price, suggesting the market is significantly undervaluing the business based on these cash flow forecasts.

In summary, the DCF view presents Avino as a serious bargain for value-focused investors. At least on paper, the fundamentals look robust compared to its share price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Avino Silver & Gold Mines is undervalued by 78.4%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Avino Silver & Gold Mines Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Avino Silver & Gold Mines, as it compares a company's share price to its earnings per share. It gives investors a quick sense of how much they are paying for each dollar of profit the company generates.

What constitutes a "normal" or "fair" PE ratio depends on factors such as a company’s expected earnings growth and risk profile. Generally, higher growth expectations or lower perceived risks can justify higher PE ratios. In contrast, riskier or slower-growing companies should trade at a lower multiple.

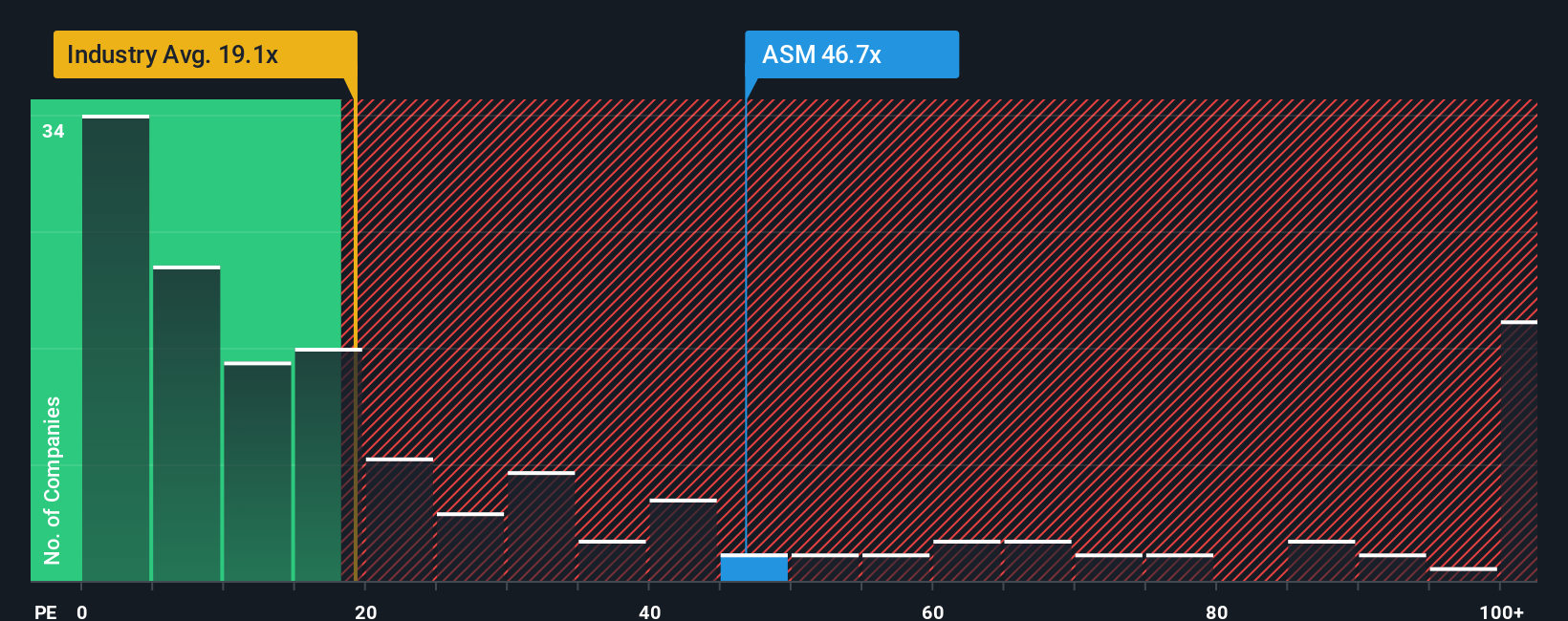

Avino currently trades at a PE ratio of 48.6x. This is well above the Metals and Mining industry average of 21.2x, and far exceeds its peer group’s average of -0.14x. On the surface, this suggests Avino is priced at a significant premium to both its sector and direct competitors.

This is where Simply Wall St's proprietary Fair Ratio comes into play. The Fair Ratio for Avino is 34.99x, reflecting what would be considered an appropriate PE given the company’s unique combination of factors such as earnings growth potential, industry profile, profit margins, market cap, and risks. The Fair Ratio methodology improves on basic peer or industry comparisons by providing a more nuanced benchmark tailored to the company’s specific situation.

Since Avino’s actual PE of 48.6x is higher than its Fair Ratio of 35x, this suggests the stock is trading above its fundamental value on this metric and may be overvalued based on current earnings power and risk considerations.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Avino Silver & Gold Mines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, dynamic tool that lets you tell the story behind your view of Avino Silver & Gold Mines, combining your personal take on its future prospects, such as estimates for revenue, profits, and margins, with a fair value that moves as the facts change. Narratives connect the dots between the company's story, your financial expectations, and market price. If your fair value is well below today’s price, it may be time to hold or sell; but if it is well above, you might consider buying.

This approach is accessible on Simply Wall St’s Community page, where millions of investors use Narratives to weigh in. Each one is unique, updated dynamically as news and earnings are released, and visible alongside current valuations and forecasts. For example, one investor, focused on explosive metal price scenarios, projects a $20 per share target for Avino in five years based on $3,500 gold and $100 silver. Another, more cautious on margin pressure and regulatory risk, posts a fair value near $5.30 per share. Narratives make investing smarter by helping you connect real business stories with real-time valuations and actionable decisions, no matter your perspective.

For Avino Silver & Gold Mines, we will make it simple for you with previews of two leading Avino Silver & Gold Mines Narratives:

- 🐂 Avino Silver & Gold Mines Bull Case

Fair Value: $26.79

Undervalued by 75.10%

Revenue Growth Assumption: 78.01%

- Bull case projects Avino as significantly undervalued, expecting strong production growth and free cash flow from La Preciosa ramp-up along with bullish silver and gold price assumptions ($100/oz silver and $3,500/oz gold).

- The company is highlighted as debt-free, demonstrating operational efficiency, a significant resource base, and a robust year-end cash position, with an aim to achieve intermediate producer status by 2029.

- Key upside levers include the successful La Preciosa startup, sustained high metal prices, and sector-wide investor optimism. However, this scenario also carries risks from commodity price swings, cost inflation, and macro or political shocks.

- 🐻 Avino Silver & Gold Mines Bear Case

Fair Value: $5.30

Overvalued by 25.94%

Revenue Growth Assumption: 21.92%

- The bear case warns that market optimism may overstate future demand and profitability, as rising costs, regulatory risks, and reliance on project expansions could challenge forecasted earnings and margins.

- Forecasts depend on expansion at La Preciosa and analyst assumptions that may not materialize, while operational concentration in Mexico introduces geographic and political risks.

- The analyst fair value target is 21% below the current share price, suggesting the market is already anticipating more growth than fundamentals or risk justify, inviting investors to check their own assumptions.

Do you think there's more to the story for Avino Silver & Gold Mines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives