- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Evaluating Avino Silver & Gold Mines (TSX:ASM): What the Silver Supply Deficit and Operational Gains Mean for Valuation

Reviewed by Simply Wall St

If you have been watching Avino Silver & Gold Mines (TSX:ASM), you are not alone. Recent industry coverage has put the spotlight back on silver miners, with news that the silver market is headed for its fifth straight year of supply deficit. For companies like Avino, which have been focusing on operational improvements and disciplined cost management, this sets an intriguing backdrop that goes beyond day-to-day market moves.

Looking at how Avino has performed lately, momentum seems to be building. The stock is up 13% over the past month and nearly 23% in the past three months, easily outpacing its 4% total return over the past year. Forward-looking sentiment has picked up, which makes sense given the combination of strengthening silver prices and the company's solid revenue and net income growth this year. Both are signs investors could be reassessing future opportunity versus risk.

With the silver market’s supply gap and Avino’s operational progress in mind, is there still value left to capture in ASM shares or are markets already baking in a brighter future?

Most Popular Narrative: 77.9% Undervalued

According to the most widely followed narrative, Avino Silver & Gold Mines is considered deeply undervalued relative to its projected fundamentals and growth strategy.

Its strategy emphasizes sustainable growth, leveraging existing infrastructure to expand production while minimizing environmental impact. Financial Performance (2024 Highlights): Avino reported record financial performance in 2024, driven by higher metal prices and increased production.

Want a glimpse behind Avino’s explosive valuation upside? There is a bold cash flow forecast embedded in this narrative, built atop operational milestones and a market scenario that few expect. Curious about just how high those future earnings projections go, and what key levers turbocharge that aggressive fair value? The full narrative breaks it all down, and you might be surprised by what is fueling that valuation estimate.

Result: Fair Value of $26.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, operational setbacks at La Preciosa or a sharp downturn in metal prices could quickly test even the most bullish case for Avino’s valuation.

Find out about the key risks to this Avino Silver & Gold Mines narrative.Another View: What Do Market Ratios Say?

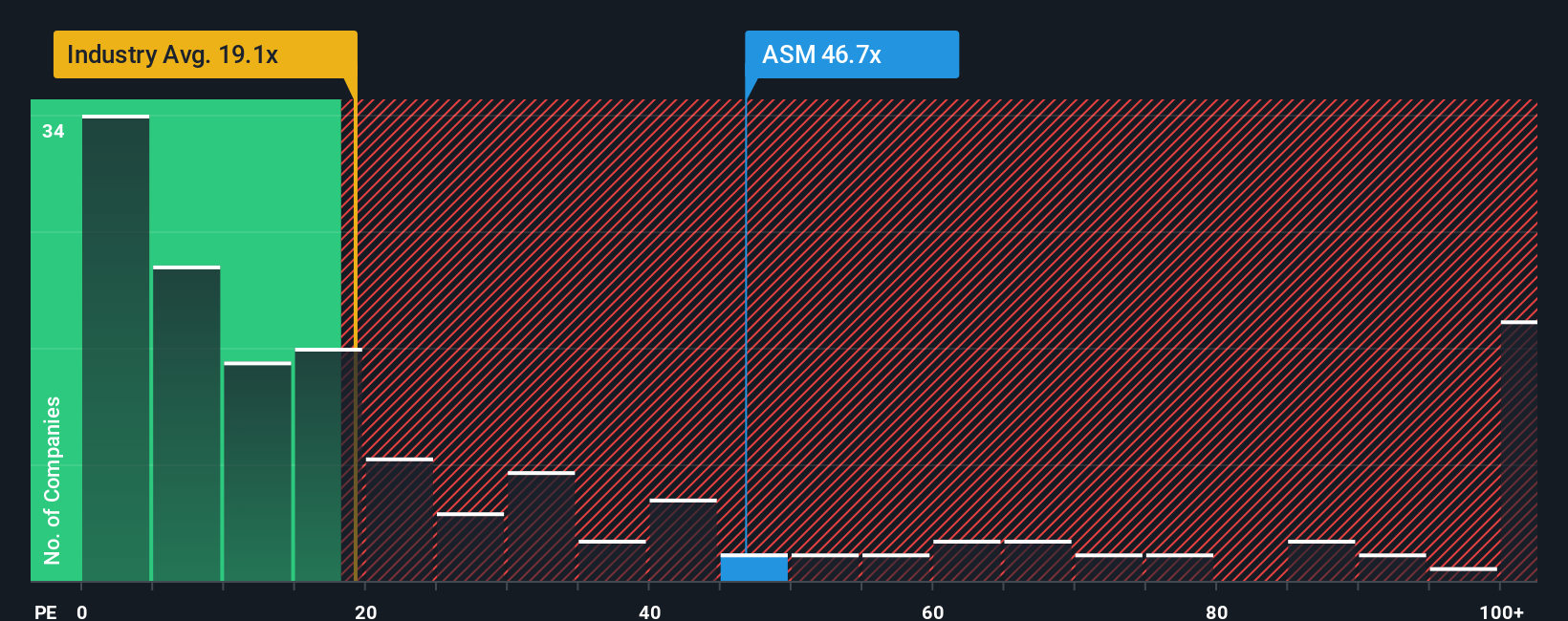

Not everyone agrees ASM is such a bargain. When we stack its valuation ratio up against the wider industry, Avino actually looks expensive compared to peers. Could the market know something the models do not?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Avino Silver & Gold Mines to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Avino Silver & Gold Mines Narrative

If you see the numbers differently or want to dive deeper with your own analysis, crafting a unique perspective only takes a few minutes. Do it your way.

A great starting point for your Avino Silver & Gold Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t leave your strategy half-finished. Thousands of investors have already uncovered unique opportunities using tailored insights from our screeners. Give your portfolio the edge it deserves by matching your goals with on-trend stock picks.

- Tap into future-defining breakthroughs by scanning the quantum computing stocks for companies driving innovation in quantum computing and next-generation technology.

- Unlock steady income streams with the dividend stocks with yields > 3% featuring reliable dividend stocks yielding above 3% in today’s competitive market.

- Catch early growth stories through the AI penny stocks and spot up-and-coming players shaping advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives