- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Avino Silver & Gold Mines (TSX:ASM) Sees 44% Price Rise Over Last Quarter

Reviewed by Simply Wall St

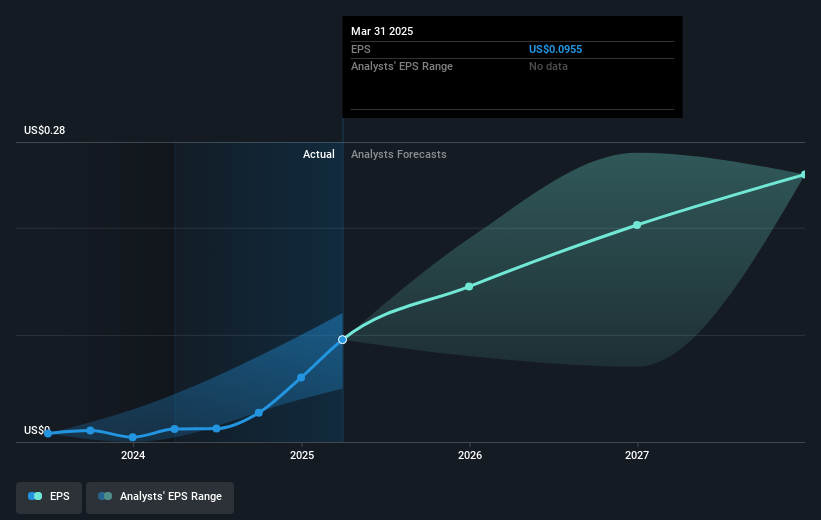

Avino Silver & Gold Mines (TSX:ASM) experienced a notable quarter, marked by a 44% rise in share price. Key events influencing this movement include the announcement of increased production in copper and gold during Q2, despite a dip in silver output. The company's addition to the S&P/TSX Global Mining Index and recent executive changes may have bolstered investor confidence. Moreover, the broader market's upward trend, driven by positive earnings reports, likely provided additional support for Avino's price performance, highlighting its alignment with sector and market gains over the last quarter.

The recent developments at Avino Silver & Gold Mines have the potential to significantly influence the company's future trajectory, aligning with the narrative of enhanced production capabilities through the La Preciosa development. The increased output of copper and gold, combined with the company's inclusion in the S&P/TSX Global Mining Index, could further support its revenue and earnings forecasts. This aligns positively with analysts' expectations of revenue growth and margin improvements, although the volatile nature of metal prices poses a risk.

Over a longer three-year period, Avino's shares yielded a total return of 495.12%, a very large increase. In contrast, its one-year performance also exceeded the Canadian Metals and Mining industry benchmark, which returned 51.8% during the same timeframe.

Despite the recent 44% quarterly share price increase, Avino's current trading price of CA$4.88 stands below analysts' consensus price target of CA$4.13. This discrepancy suggests varying expectations among analysts regarding the company's ability to achieve projected earnings and revenue growth. As the company continues to expand at La Preciosa, any unforeseen escalation in operational costs could impact earnings and challenge the path to reaching the aspirational price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives