- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Why Aris Mining (TSX:ARIS) Is Up 6.0% After Strong Q3 Results and Positive Toroparu Assessment

Reviewed by Sasha Jovanovic

- Aris Mining recently reported strong third quarter results, with sales rising to US$258.12 million and net income reaching US$42.01 million, alongside a positive preliminary economic assessment for its Toroparu Gold Project confirming a 21.3-year mine life and robust project economics.

- The appointment of Brigitte Baptiste, a highly respected Colombian environmental leader, to the board enhances Aris Mining's ESG focus and expertise in sustainable development, aligning with the company's ongoing projects and expansion plans.

- We'll look at how Toroparu's long-life and robust economics may influence Aris Mining's investment narrative going forward.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Aris Mining Investment Narrative Recap

To be a shareholder in Aris Mining, you’d need to believe in the company's ability to execute its multi-asset growth strategy, manage ESG demands, and deliver on ambitious production targets, despite operational and jurisdictional risks. Recent news, including strong Q3 results and the appointment of an esteemed environmental leader to the board, supports Aris Mining’s ESG credentials but does not materially affect the near-term production ramp-up at Segovia or alleviate core risks from Colombia’s regulatory landscape.

Among the latest announcements, the preliminary economic assessment for the Toroparu Gold Project stands out: it confirms a long mine life, robust project economics, and consistent production outlook. The detailed production plan, supported by OEM lease financing and an integrated copper recovery circuit, directly supports Aris Mining’s narrative of growth through diversified assets and operational resilience.

But, despite these positive developments, investors should be aware of one key factor: if Colombia introduces new regulatory or tax hurdles, the company’s expansion plans could face...

Read the full narrative on Aris Mining (it's free!)

Aris Mining's narrative projects $1.5 billion revenue and $695.3 million earnings by 2028. This requires 32.4% yearly revenue growth and a $690.2 million earnings increase from $5.1 million currently.

Uncover how Aris Mining's forecasts yield a CA$23.57 fair value, a 71% upside to its current price.

Exploring Other Perspectives

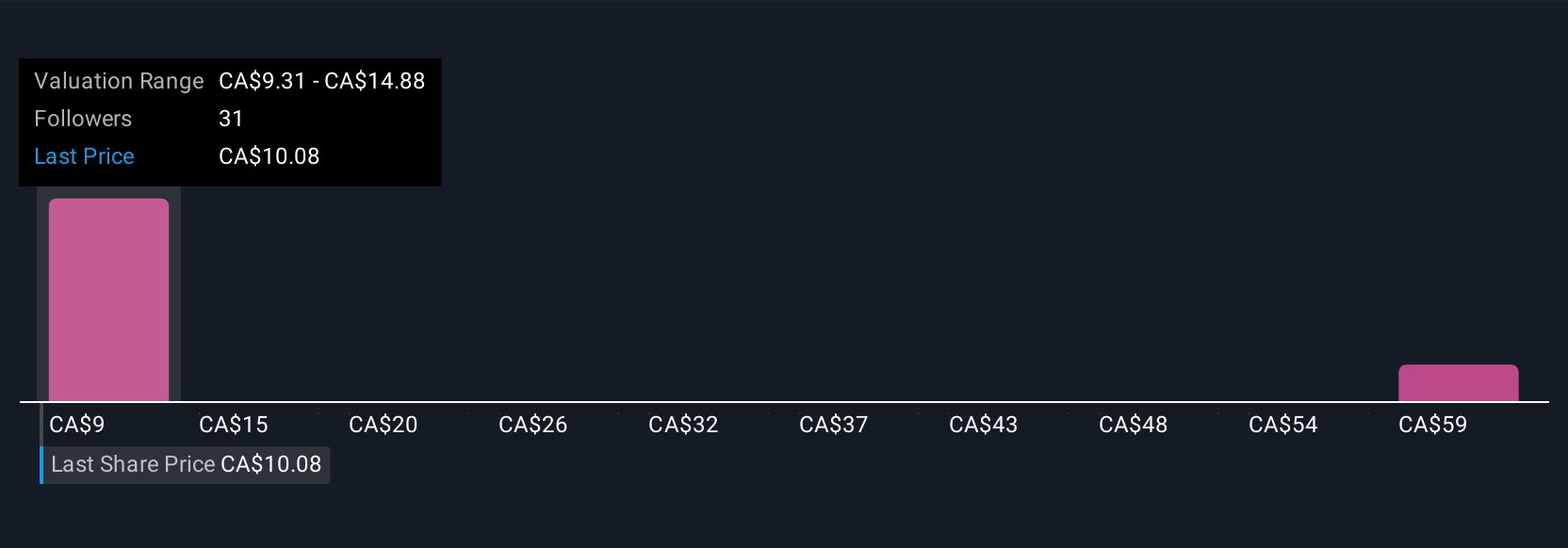

Seven members of the Simply Wall St Community estimate Aris Mining’s fair value from as low as US$9.31 up to US$65 per share. With ongoing growth projects in Colombia, the regulatory environment remains critical for unlocking value, prompting readers to consider a wide spectrum of independent viewpoints.

Explore 7 other fair value estimates on Aris Mining - why the stock might be worth over 4x more than the current price!

Build Your Own Aris Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aris Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aris Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aris Mining's overall financial health at a glance.

No Opportunity In Aris Mining?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives