- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Aris Mining (TSX:ARIS) Margin Decline Tests Bullish Growth Narratives Ahead of Forecasted Turnaround

Reviewed by Simply Wall St

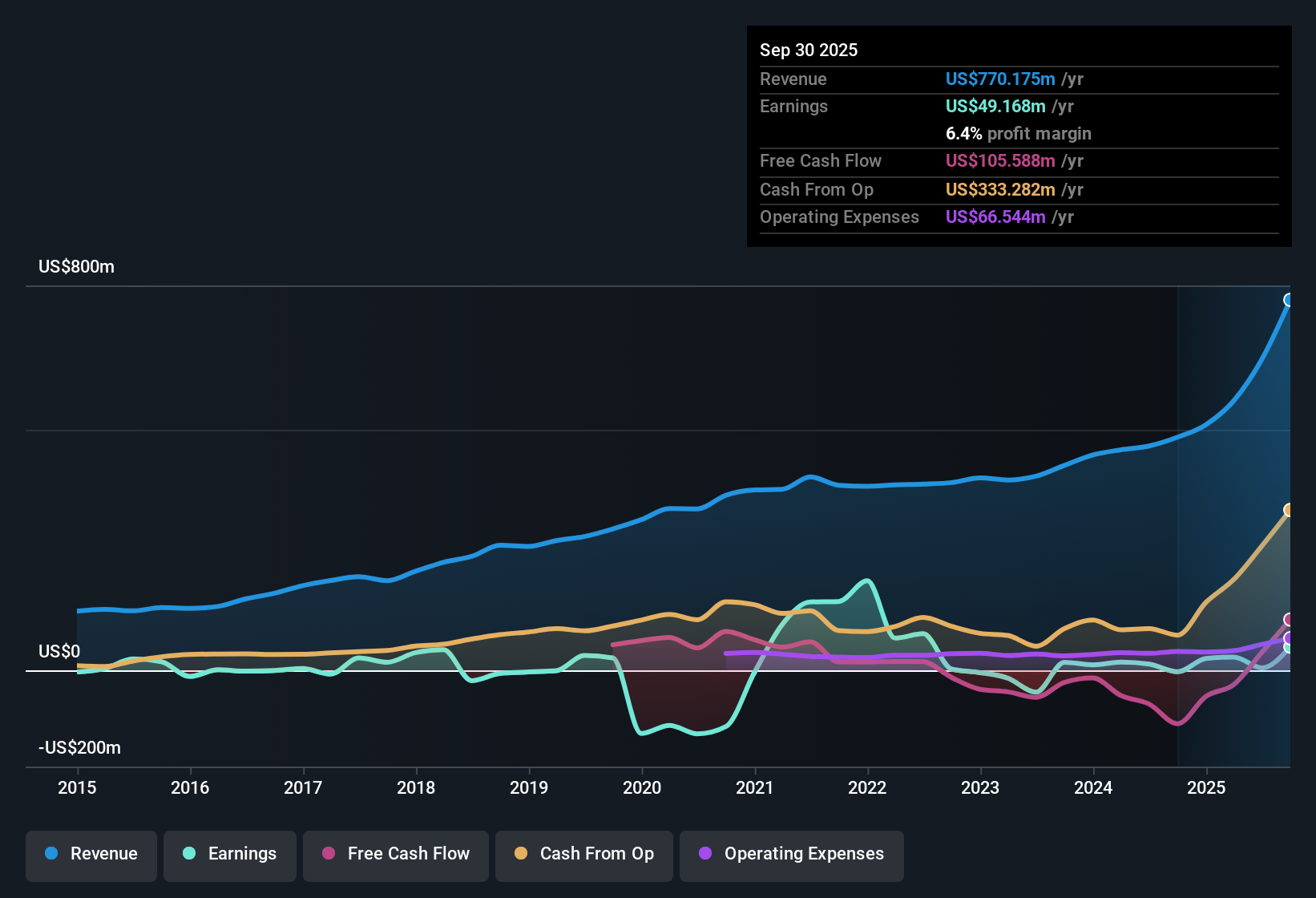

Aris Mining (TSX:ARIS) reported a net profit margin of 0.8%, down from 2.8% last year, as the company navigates the aftermath of several years of negative earnings growth. Over the past five years, average earnings growth was -22.9% per year. However, current forecasts point to a dramatic turnaround, with earnings projected to grow at 58.9% per year and revenue at 39.7% per year over the next three years. Investors now face a complex landscape as margin pressures and recent shareholder dilution are weighed against strong value metrics and ambitious growth expectations.

See our full analysis for Aris Mining.The next section measures these earnings figures against the most widely discussed narratives for Aris Mining, highlighting where consensus may shift in light of the data.

See what the community is saying about Aris Mining

Margin Expansion Targets 46.3% in Three Years

- Analysts expect profit margins to leap from today’s 0.8% to 46.3% by 2026, far outpacing not just Aris’s recent history but also sector averages, according to the latest forecasts.

- Analysts' consensus view emphasizes that this projected margin improvement is pegged to successful ramp-ups at Segovia and Marmato, leveraging expanded processing capacity and higher expected gold output.

- Consensus narrative highlights that doubling companywide production by 2026, primarily via new projects, could structurally raise operating margins as fixed costs are spread across more output.

- Rising gold prices and improved liquidity are also seen as foundational in enabling margin expansion. Much depends on operational execution and stable regulatory conditions.

- With forecasts this aggressive, investors will need to monitor the company's ability to deliver on expansion plans and keep costs under control, especially given its track record of thin profitability.

Share Dilution and Growth: Double-Edged Sword

- The number of shares outstanding is forecast to rise by 7.0% a year for the next three years, which could dampen per-share gains even if overall earnings climb.

- Analysts' consensus view flags that while expanded share count funds development and growth, rising dilution can offset EPS benefits, especially if capital missteps, delays, or cost overruns surface at Segovia or Marmato.

- With ambitious growth investments and heavy capex, executing on project timelines is critical. Higher share counts risk blunting shareholder returns if production targets slip.

- Regulatory, technical, or social hurdles, particularly in Colombia, could add further pressure. Careful tracking of dilution versus delivered growth remains vital.

Valuation Undercuts Industry and Peers

- Aris trades at 3.2x price-to-sales, a significant discount to the metals and mining industry average of 5.7x and peer average of 4.2x, suggesting embedded skepticism or opportunity for rerating.

- Analysts' consensus view sees the low valuation multiple as justified only if margin and growth execution deliver as forecast. Upcoming years remain pivotal for re-rating potential.

- If Aris can push profit margins toward the 46.3% forecast and sustain above-market revenue growth, a higher valuation could follow, especially with gold prices supporting the topline.

- Persistent margin pressure or new dilution events might entrench the discount relative to peers. This underscores how tightly the valuation story is linked to operational progress.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aris Mining on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Express your outlook and craft a unique company narrative in just a few minutes. Do it your way

A great starting point for your Aris Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Aris Mining's rapid margin expansion targets and ambitious growth plans face high execution risk, shareholder dilution, and vulnerability to operational setbacks or cost overruns.

For investors who want more reliable performance and fewer surprises, use stable growth stocks screener (2110 results) to focus on companies delivering consistent growth and strong execution across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives