- Canada

- /

- Aerospace & Defense

- /

- TSX:MAL

Undiscovered Gems in Canada to Explore This August 2025

Reviewed by Simply Wall St

As Canada grapples with a slightly elevated unemployment rate and a labor-force participation rate below pre-pandemic levels, market sentiment remains cautious yet hopeful. In this environment, identifying promising small-cap stocks that can navigate inflationary pressures and capitalize on economic shifts is crucial for investors looking to uncover potential opportunities in the Canadian market.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| TWC Enterprises | 4.26% | 13.21% | 11.52% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.21% | 62.25% | 64.39% | ★★★★★★ |

| Heliostar Metals | NA | 106.15% | 25.32% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Amerigo Resources (TSX:ARG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., focuses on producing copper and molybdenum concentrates in Chile with a market cap of CA$347.21 million.

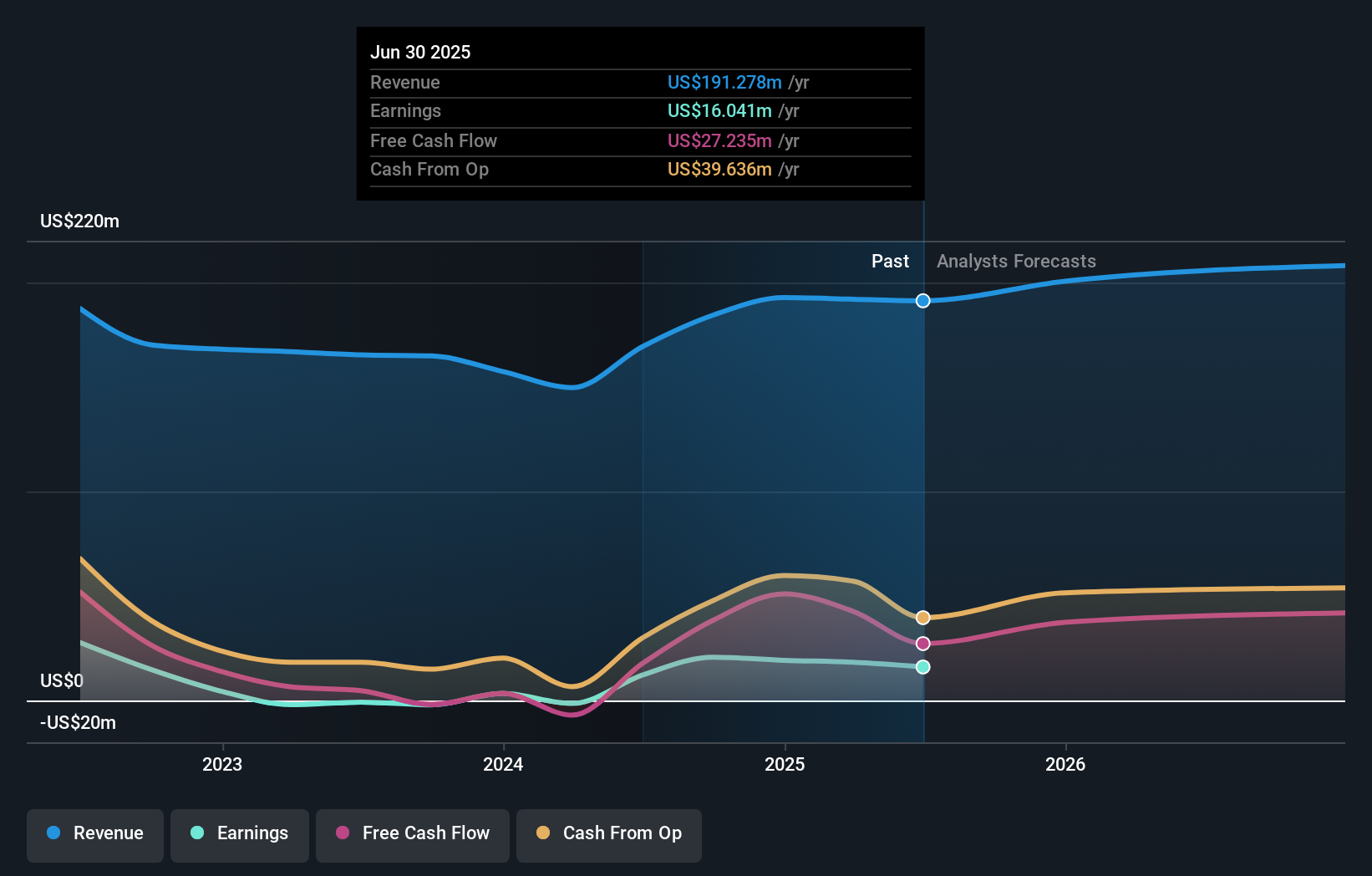

Operations: The company generates revenue primarily from the production of copper concentrates under a tolling agreement with DET, amounting to $191.28 million.

Amerigo Resources, a small player in the mining sector, recently reported Q2 2025 earnings with sales at US$50.85 million and net income of US$7.54 million, reflecting a slight dip from last year’s figures. The company has been actively repurchasing shares, buying back over 4 million shares for CAD 6.9 million this year alone. Amerigo's debt management is commendable with a debt-to-equity ratio dropping to 6.7% over five years and interest payments well-covered by EBIT at 15 times coverage. Despite insider selling recently, the firm trades significantly below its estimated fair value by about 84%.

- Navigate through the intricacies of Amerigo Resources with our comprehensive health report here.

Examine Amerigo Resources' past performance report to understand how it has performed in the past.

Magellan Aerospace (TSX:MAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Magellan Aerospace Corporation, with a market cap of CA$983.93 million, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe through its subsidiaries.

Operations: Magellan Aerospace generates revenue primarily from its aerospace segment, amounting to CA$968.02 million.

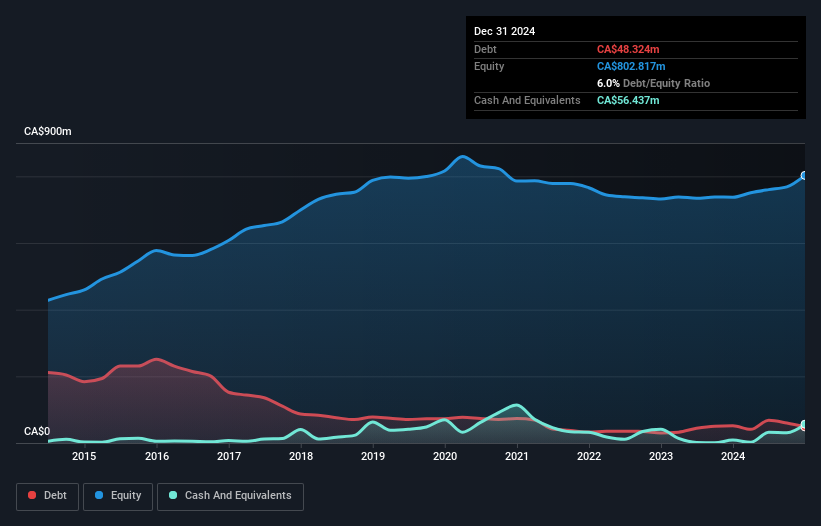

Magellan Aerospace seems to be flying under the radar with its robust performance in the aerospace sector. Over the past year, earnings soared by 242%, far outpacing industry growth of 15.3%. Trading at a good value compared to peers, Magellan's debt-to-equity ratio improved from 9% to 6.1% over five years, indicating prudent financial management. In recent news, sales for Q1 2025 reached CAD 260.9 million, up from CAD 235.24 million a year prior, while net income jumped to CAD 10.83 million from CAD 6.31 million last year, showcasing solid operational momentum and potential for future growth in this small cap space.

Orezone Gold (TSX:ORE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orezone Gold Corporation is involved in the mining, exploration, and development of gold properties with a market capitalization of CA$574.57 million.

Operations: Orezone Gold's revenue primarily comes from the acquisition, exploration, and potential development of precious metal properties, amounting to $301.55 million.

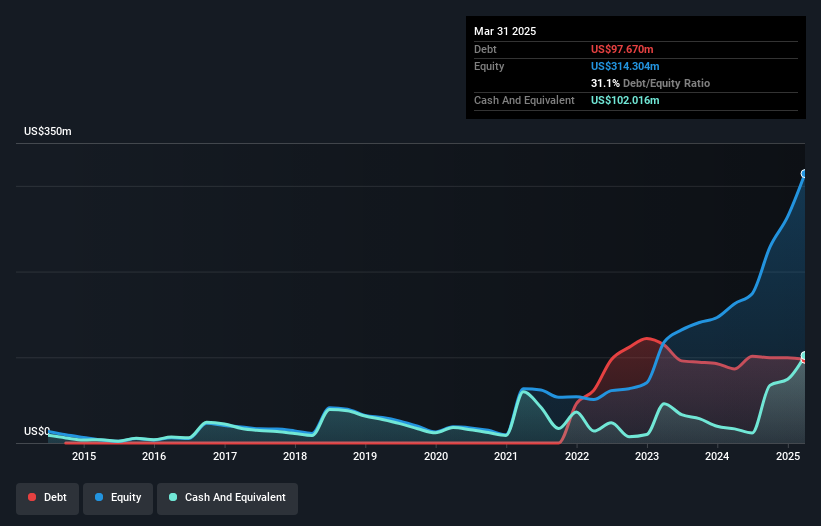

Orezone Gold is making strategic moves with its Phase 2 hard rock expansion, aiming to boost production to 220,000-250,000 ounces annually by the end of 2026. Recent developments include a follow-on equity offering of A$75 million and a diesel power plant acquisition to enhance operational efficiency. Despite challenges like increased capital expenditures and regional power issues, Orezone reported gold sales of 28,265 ounces at A$3,338 per ounce in Q2 2025. With earnings growth outpacing the industry at 85.8%, Orezone's debt-to-equity ratio has risen from 0% to 31.1% over five years while maintaining more cash than total debt.

Turning Ideas Into Actions

- Discover the full array of 44 TSX Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAL

Magellan Aerospace

Through its subsidiaries, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives