- Canada

- /

- Metals and Mining

- /

- TSX:ARG

Amerigo Resources (TSX:ARG): Examining Valuation Following El Teniente Mine Disruption and Debt Paydown Progress

Reviewed by Kshitija Bhandaru

Amerigo Resources (TSX:ARG) is catching attention after an accident at the El Teniente mine impacted copper production in the third quarter, which has prompted a projected shortfall for the full year. Despite these challenges, the company remains on track to clear its debt by year-end and has maintained shareholder payouts through dividends and buybacks.

See our latest analysis for Amerigo Resources.

The accident understandably shook investor confidence, yet Amerigo Resources has managed to hold up remarkably well after a bumpy spell: its share price has surged 22% in the past month alone and is up an impressive 75% year-to-date, suggesting that momentum is actually building as the company tackles challenges head-on. For patient shareholders, the total return over five years—a massive 620 percent—shows just how transformational the last half-decade has been.

If you’re in the mood to uncover more potential movers, why not see what you find with our fast growing stocks with high insider ownership?

With the stock trading well below analyst targets despite strong gains, the key question now is whether Amerigo Resources remains undervalued or if the current price fully reflects the company’s recovery prospects and future growth potential.

Price-to-Earnings of 20.1x: Is it justified?

Amerigo Resources is trading at a price-to-earnings (PE) ratio of 20.1x, which positions its valuation below peer and industry averages. This makes it look comparatively attractive given its growth trajectory and current share price of CA$2.8.

The PE ratio measures how much the market is willing to pay for each dollar of earnings. For a metals and mining stock like Amerigo Resources, a lower PE relative to competitors can signal that the market may be undervaluing the company’s earnings potential. This is particularly relevant as recent results show a turnaround in profitability and acceleration in earnings growth.

Compared to the average PE of its peer group (30.1x) and the broader Canadian metals and mining industry (23.6x), Amerigo Resources stands out as a value play at its current multiple. If the market begins to recognize its recent earnings performance and sustained profitability, there may be room for multiple expansion toward these higher levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 20.1x (UNDERVALUED)

However, unexpected operational setbacks or further commodity price volatility could quickly reverse recent gains and challenge the current valuation momentum of Amerigo Resources.

Find out about the key risks to this Amerigo Resources narrative.

Another View: Discounted Cash Flow Perspective

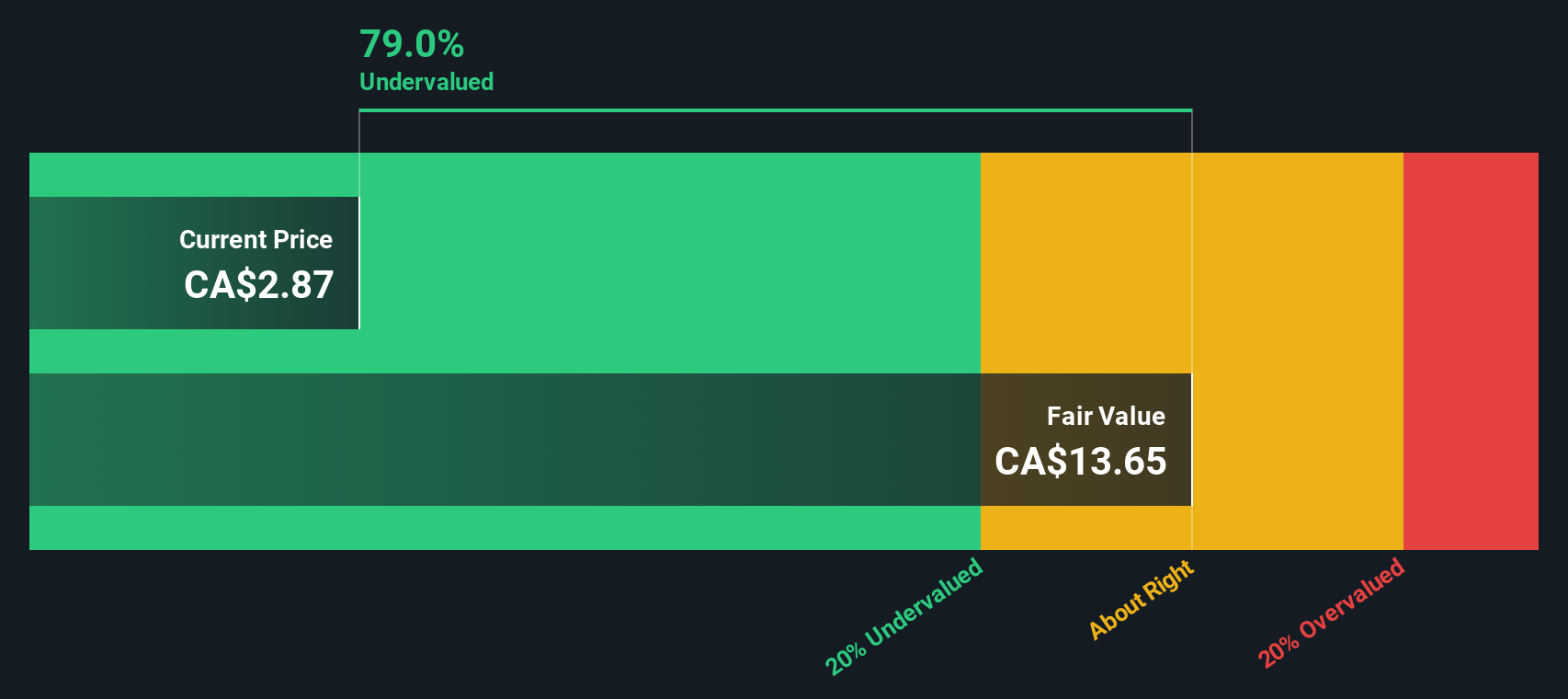

While price-to-earnings suggests Amerigo Resources is undervalued, our SWS DCF model presents an even starker picture. According to this method, the stock is trading at a steep 79.5% discount to our estimate of its fair value. This implies significant upside if the DCF assumptions hold true. However, can such a deep discount persist, or is the market identifying risks that the numbers do not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amerigo Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amerigo Resources Narrative

If you like to draw your own conclusions or want to dive deeper than our analysis, you can use our tools to build your narrative in just a few minutes. Do it your way

A great starting point for your Amerigo Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Push your investing advantage further and seize today’s market opportunities. Don’t be the last to spot what everyone is talking about tomorrow.

- Tap into rising market trends by scanning these 24 AI penny stocks, packed with companies driving innovation through artificial intelligence breakthroughs.

- Hunt for overlooked value plays among these 898 undervalued stocks based on cash flows that could deliver outsized gains as the market catches on.

- Target solid returns with these 19 dividend stocks with yields > 3%, offering reliable yields for income-focused portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., produces copper and molybdenum concentrates in Chile.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success