- Canada

- /

- Metals and Mining

- /

- TSX:ARA

We're Hopeful That Aclara Resources (TSE:ARA) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Aclara Resources (TSE:ARA) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Aclara Resources

How Long Is Aclara Resources' Cash Runway?

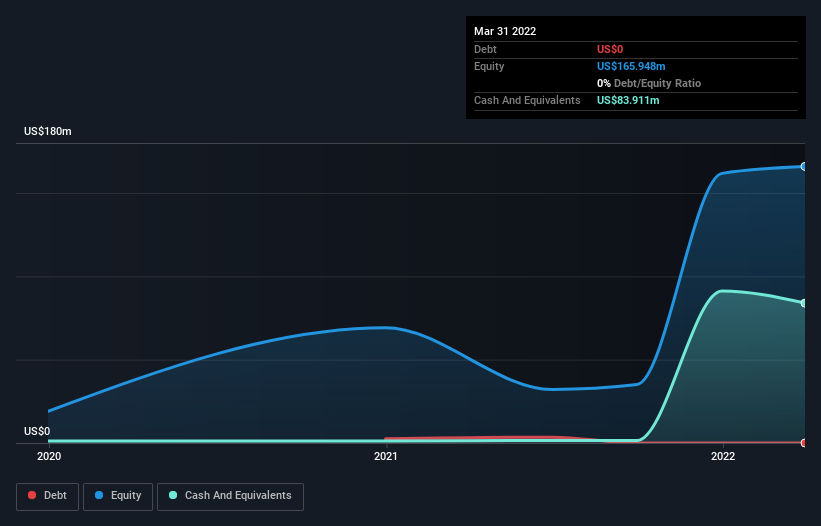

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In March 2022, Aclara Resources had US$84m in cash, and was debt-free. In the last year, its cash burn was US$20m. So it had a cash runway of about 4.2 years from March 2022. Notably, analysts forecast that Aclara Resources will break even (at a free cash flow level) in about 5 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Aclara Resources' Cash Burn Changing Over Time?

Aclara Resources didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. The skyrocketing cash burn up 149% year on year certainly tests our nerves. With spending growing that quickly, shareholders will be hoping that the money is prudently spent. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Aclara Resources Raise More Cash Easily?

Given its cash burn trajectory, Aclara Resources shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Aclara Resources' cash burn of US$20m is about 31% of its US$66m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Aclara Resources' Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Aclara Resources' cash runway was relatively promising. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Aclara Resources (2 are a bit unpleasant!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ARA

Aclara Resources

A mining company, engages in the exploration and development of rare-earth mineral resources in Chile, Brazil and Peru.

Medium-low risk and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026