- Canada

- /

- Metals and Mining

- /

- TSX:ALS

Can Altius Minerals’ Share Buyback Reveal Deeper Insights Into Its Capital Priorities? (TSX:ALS)

Reviewed by Simply Wall St

- Altius Minerals Corporation (TSX:ALS) recently announced a new share repurchase program, authorized by its Board, allowing for the buyback of up to 1,864,265 shares, equivalent to 4.02% of its issued share capital, subject to Toronto Stock Exchange approval and set to expire in August 2026.

- This move signals the company’s focus on returning value to shareholders through targeted capital management and suggests confidence in its underlying fundamentals.

- We’ll explore how the launch of this share repurchase plan shapes Altius Minerals’ investment narrative and capital allocation priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Altius Minerals' Investment Narrative?

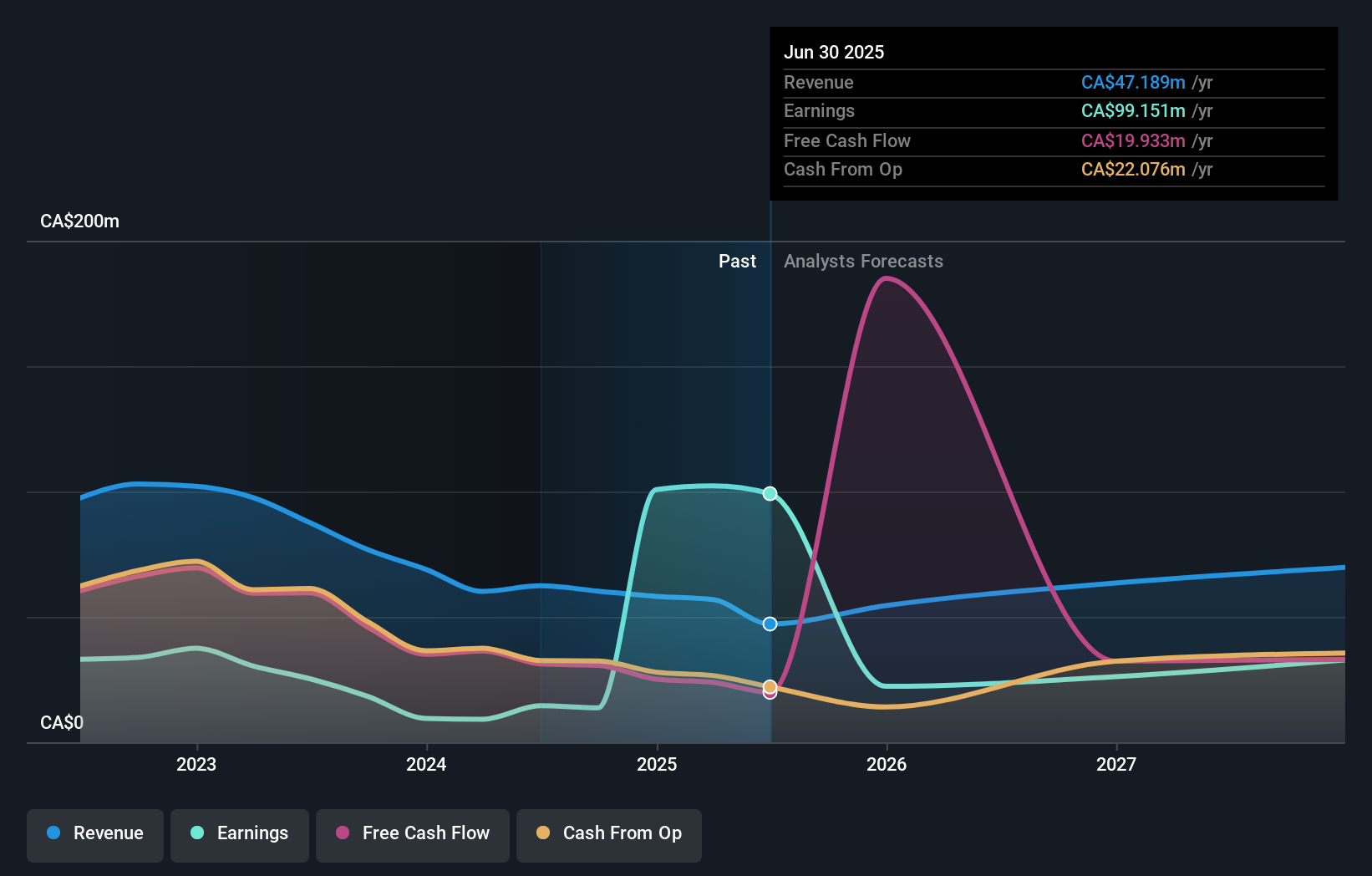

To be a shareholder in Altius Minerals right now, you need to be comfortable with both its capital management approach and the earnings volatility that has shown up in recent quarters. The newly authorized share buyback program is a clear signal that management is focused on capital returns, especially coming off an 11% dividend increase. Still, this comes amid recent drops in quarterly revenue and net income, and ongoing analyst expectations for a large decline in annual earnings ahead. While the buyback may help underpin the share price in the short term, its size relative to overall capital and past buyback activity suggests the immediate impact on key catalysts like earnings growth and cash flow is likely limited. Investors should keep an eye on the quality of future earnings, given large one-off items have influenced recent results and could affect confidence moving forward.

But digging deeper, not all risks to profit quality are in the rearview mirror. Altius Minerals' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Altius Minerals - why the stock might be worth just CA$35.71!

Build Your Own Altius Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Altius Minerals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Altius Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Altius Minerals' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALS

Altius Minerals

Engages in the mineral and renewable royalties and project generation businesses in Canada, Brazil, and the United States.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives