- Canada

- /

- Paper and Forestry Products

- /

- TSX:ADN

Acadian Timber (TSE:ADN) Is Due To Pay A Dividend Of CA$0.29

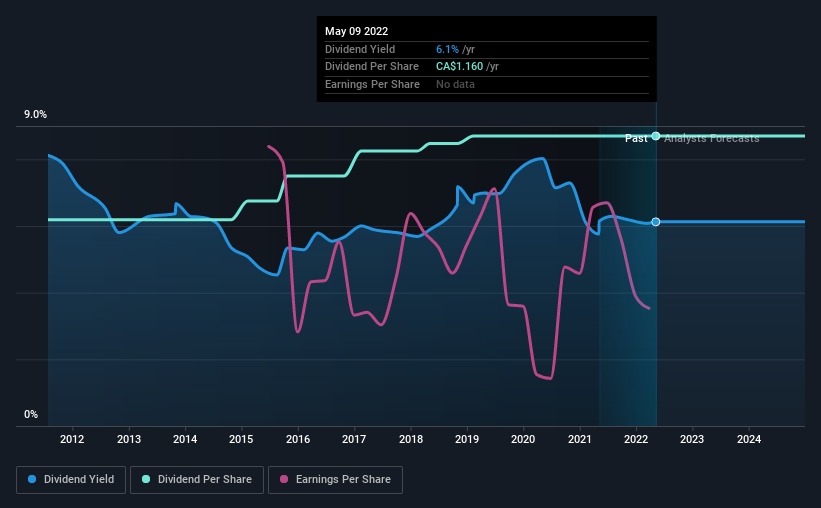

Acadian Timber Corp.'s (TSE:ADN) investors are due to receive a payment of CA$0.29 per share on 15th of July. The dividend yield will be 6.1% based on this payment which is still above the industry average.

See our latest analysis for Acadian Timber

Acadian Timber Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, the company's dividend was much higher than its earnings. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

EPS is set to fall by 3.8% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio could reach 123%, which could put the dividend in jeopardy if the company's earnings don't improve.

Acadian Timber Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2012, the first annual payment was CA$0.82, compared to the most recent full-year payment of CA$1.16. This implies that the company grew its distributions at a yearly rate of about 3.5% over that duration. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Acadian Timber May Find It Hard To Grow The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Acadian Timber hasn't seen much change in its earnings per share over the last five years. The earnings growth is anaemic, and the company is paying out 114% of its profit. As they say in finance, 'past performance is not indicative of future performance', but we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

Acadian Timber's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 3 warning signs for Acadian Timber (of which 1 doesn't sit too well with us!) you should know about. Is Acadian Timber not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ADN

Acadian Timber

Provides forest products in Eastern Canada and the Northeastern United States.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion