- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Is Barrick Mining’s 126% Rally in 2025 Justified After Gold Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Barrick Mining is a hidden bargain or heading for another breakout? You’re not alone, especially with so much attention on resource stocks these days.

- After climbing 11.2% in the last 30 days and 125.9% year-to-date, Barrick’s stock is catching attention for its rapid gains, which may indicate shifting growth prospects or evolving risk perceptions.

- This hot streak has coincided with industry-wide optimism driven by rising gold prices and expanded mining activity in key regions. News of new project approvals and geopolitical tensions impacting commodity markets have contributed to Barrick's recent price action.

- With a strong 5 out of 6 value score, Barrick passes most valuation yardsticks, but there is more than one way to assess a stock’s true value. Let’s review different approaches for a well-rounded perspective.

Approach 1: Barrick Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s value. This approach is often used for companies like Barrick Mining, where reliable cash flow forecasts can be made based on their current operations and growth trajectory.

Barrick Mining’s current free cash flow stands at $2.57 Billion. According to analyst estimates and extended projections, free cash flow is expected to reach $9.07 Billion by 2029, reflecting the company’s robust growth outlook. While analysts provide direct forecasts for the next five years, projections beyond that are extrapolated to give a full picture of Barrick’s long-term earning power.

Using the 2 Stage Free Cash Flow to Equity method, the latest DCF calculation produces an estimated intrinsic value of $199.49 per share. Based on today’s price, this implies the stock is trading at a 73.9% discount to its calculated fair value. This suggests significant potential upside for investors who believe in these assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Barrick Mining is undervalued by 73.9%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Barrick Mining Price vs Earnings

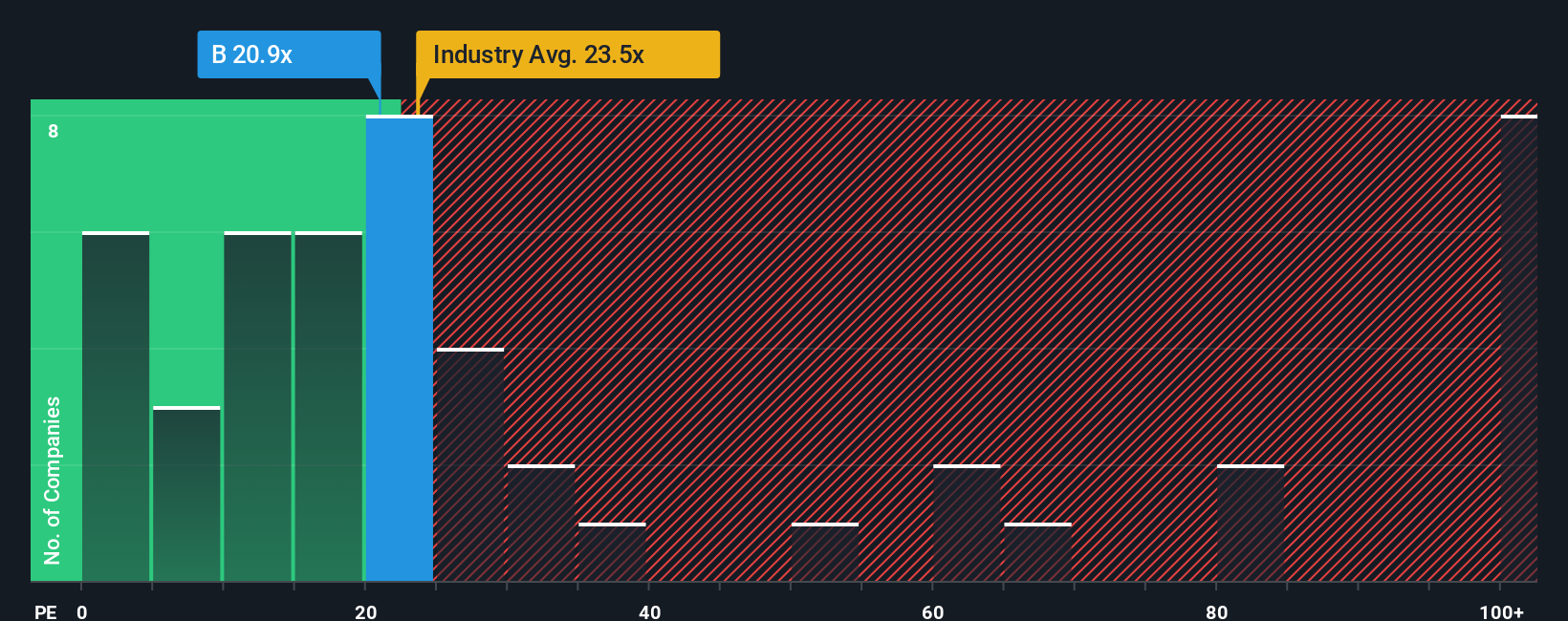

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Barrick Mining, as it helps investors assess how much they are paying per dollar of earnings. For mature miners and cyclical businesses, the PE ratio provides a direct link between share price and business profitability. This makes it especially relevant when profits are reliable and growing.

It is important to remember that growth prospects and perceived risk levels both influence what a “normal” or “fair” PE ratio should be. Companies expected to grow quickly or with less uncertainty typically trade at higher PE ratios, while more volatile or lower growth businesses generally receive a discount.

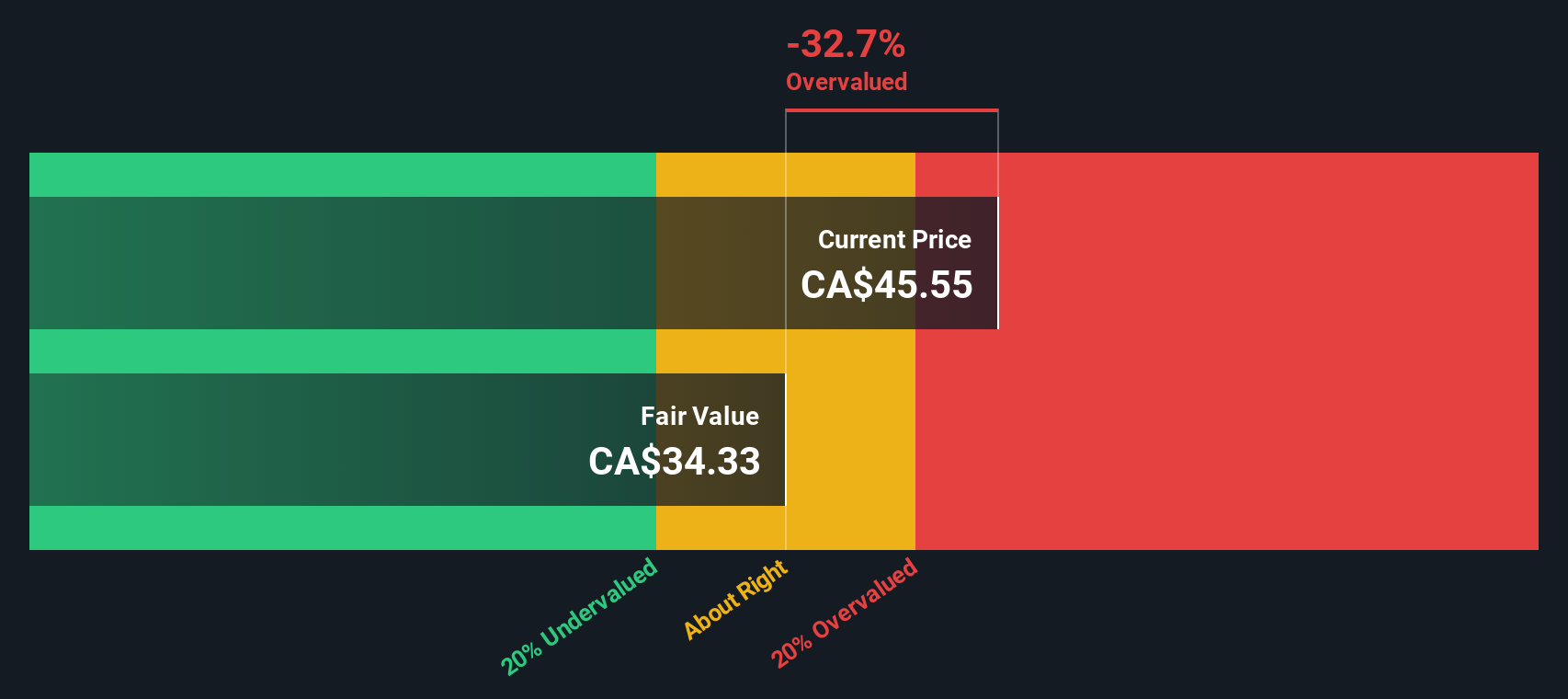

Barrick Mining is currently trading at a PE ratio of 17.4x. This is below the Metals and Mining industry average of 19.6x and well under the peer group average of 33.2x. However, Simply Wall St’s “Fair Ratio” model, which factors in Barrick’s own growth, risk, profit margins, industry, and market cap, assigns the company a fair PE multiple of 25.2x.

The Fair Ratio offers a more tailored benchmark than a simple comparison with industry averages or peers because it accounts for the specific characteristics and fundamentals that drive Barrick’s value, not just the circumstances of its competitors. By this measure, Barrick’s actual PE sits significantly below its fair multiple, suggesting the shares could offer value for investors who trust the underlying assumptions.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Barrick Mining Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

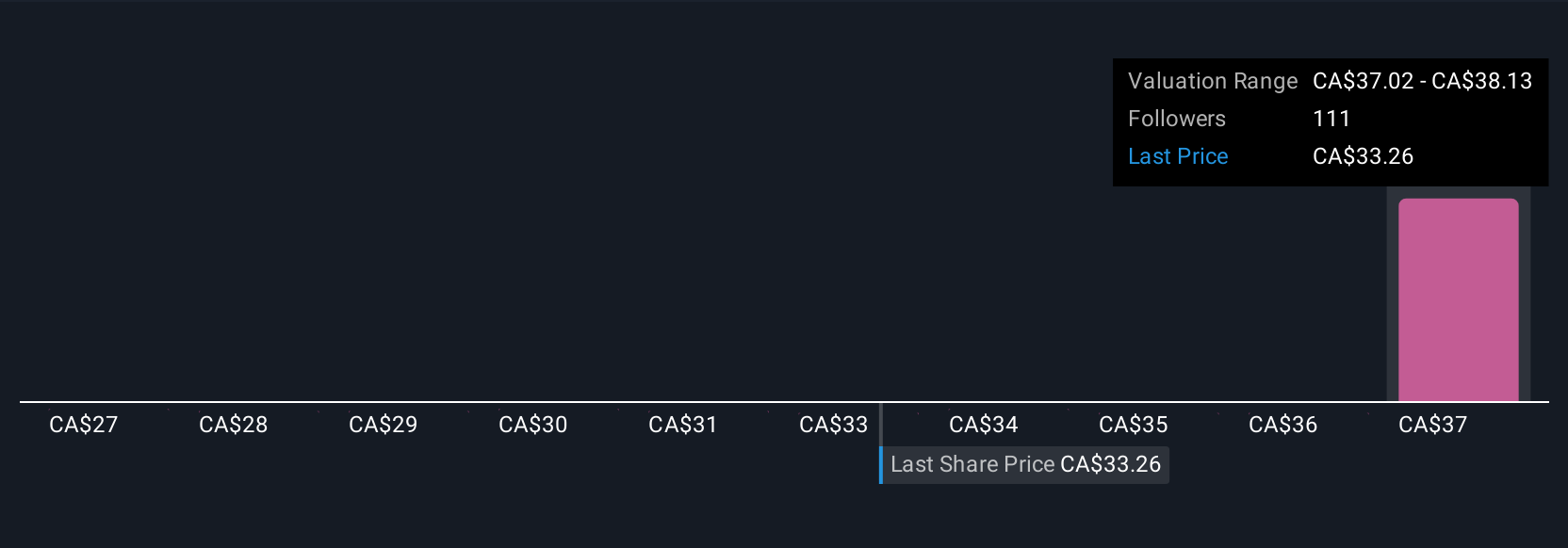

A Narrative is your story about a company. It connects your beliefs about Barrick Mining’s future (growth, margins, risks) with the numbers, resulting in your own fair value estimate. Narratives are available on Simply Wall St’s Community page, making them easy to use for millions of investors, no spreadsheets required.

This tool bridges the gap between what’s happening in the real world and financial forecasts by letting you shape key assumptions, see your calculated fair value, and compare it to the latest share price. This helps you decide if now is the right time to buy or sell.

Narratives are updated dynamically as new information comes in, such as quarterly earnings or breaking news, ensuring your perspective always reflects the latest developments. For example, some investors currently see Barrick Mining’s fair value as high as CA$60, pointing to rising gold demand amid economic uncertainty, while others remain more cautious, with fair value estimates around CA$31, emphasizing risks like political exposure and commodity price swings.

No matter your view, Narratives empower you to invest with conviction, armed with both data and your own interpretation of Barrick’s future.

Do you think there's more to the story for Barrick Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives