- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Did Barrick's Loulo-Gounkoto Agreement Just Reshape Its Risk Profile and Outlook (TSX:ABX)?

Reviewed by Sasha Jovanovic

- Earlier this month, Barrick Mining Corporation announced it had reached a verbal agreement in principle with the Mali government to resolve their dispute over the Loulo-Gounkoto gold mining complex, including a 10-year license renewal, release of detained employees, return of seized gold, and dropping of arbitration proceedings.

- This resolution addresses operational uncertainty at one of Barrick's significant African assets, potentially restoring production stability and reinforcing its ability to operate across diverse jurisdictions.

- We'll explore how this agreement over the Loulo-Gounkoto mine impacts Barrick's risk profile and future earnings outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Barrick Mining Investment Narrative Recap

To be a Barrick Mining shareholder, you typically need confidence in the company’s ability to manage geopolitical risk while expanding high-quality gold and copper production across stable regions. The recent resolution with the Mali government meaningfully reduces short-term uncertainty at Loulo-Gounkoto, likely removing the most immediate operational disruption and addressing a key risk impacting future earnings visibility.

In direct connection with this development, Barrick reaffirmed its full-year 2025 production guidance, expecting gold output to track at the lower half of its 3.15 to 3.50 million ounce range. This announcement suggests the agreement with Mali can help restore predictability in output, supporting Barrick’s ongoing positioning for long-term growth driven by stable, tier-one assets.

However, investors should keep in mind, if regional or political tensions re-emerge elsewhere, operational stability could again be threatened and...

Read the full narrative on Barrick Mining (it's free!)

Barrick Mining's narrative projects $19.4 billion revenue and $5.0 billion earnings by 2028. This requires 11.9% yearly revenue growth and a $2.2 billion increase in earnings from $2.8 billion today.

Uncover how Barrick Mining's forecasts yield a CA$54.72 fair value, a 6% upside to its current price.

Exploring Other Perspectives

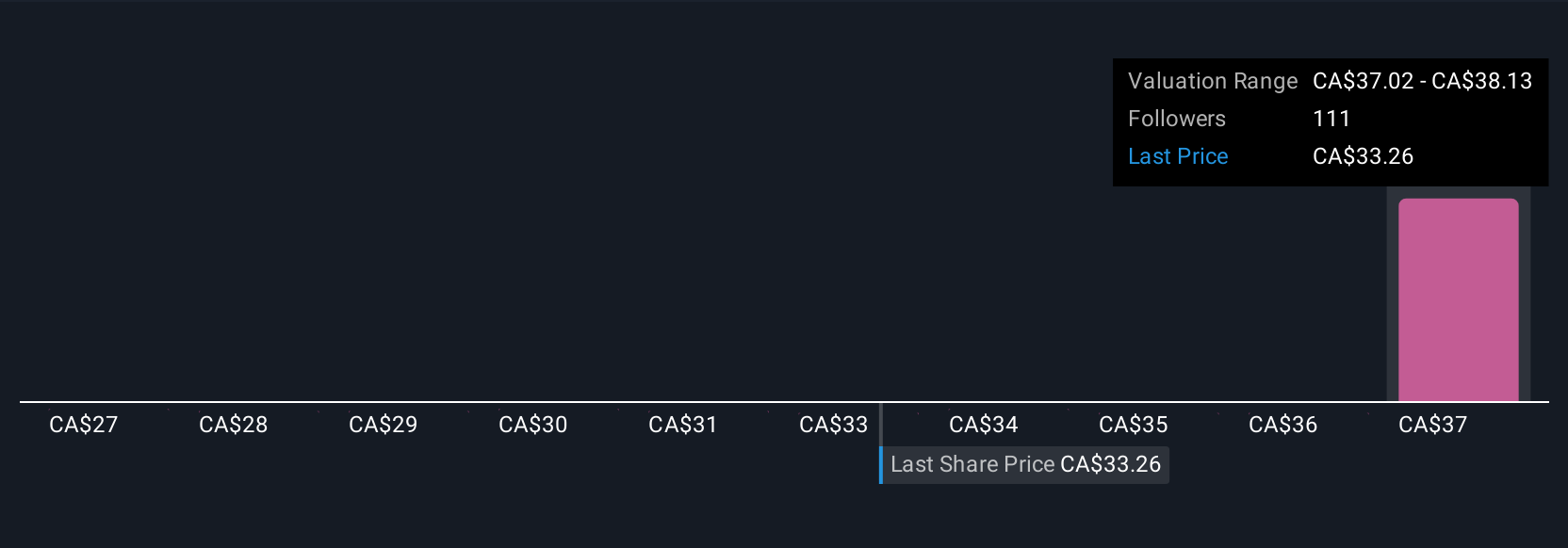

Twelve members of the Simply Wall St Community estimated Barrick's fair value from US$30.55 up to US$198.05, reflecting sharply varied outlooks. There is wide disagreement about the company’s true worth, so it is crucial to weigh these diverse views against continuing risks in politically exposed mining regions.

Explore 12 other fair value estimates on Barrick Mining - why the stock might be worth 41% less than the current price!

Build Your Own Barrick Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Barrick Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barrick Mining's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives