- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

Does Allied Gold’s (TSX:AAUC) Shift to Loss Raise Questions About Its Operational Strategy?

Reviewed by Simply Wall St

- Allied Gold Corporation recently announced its second quarter and half-year earnings, reporting sales of US$251.98 million and US$598.39 million respectively, but shifting from net income to a net loss compared to the same periods last year.

- This reversal from profitability to loss comes despite substantial year-over-year revenue growth, suggesting rising costs, lower margins, or other operational challenges in 2025.

- We'll review how the shift to a net loss, despite higher sales, could influence Allied Gold's investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Allied Gold Investment Narrative Recap

To be a shareholder in Allied Gold right now, you’d need to see the potential in its ramping production and growth-driven projects, believing these will eventually outweigh short-term losses and operational setbacks. The latest earnings news, showing a shift from net income to net loss despite higher sales, puts the near-term spotlight on margins and cost control; for now, these results sharpen focus on whether rising expenditures for expansions or timing issues could threaten targets but do not yet materially alter the largest catalyst: getting Kurmuk and Sadiola Phase 1 into profitable production. The biggest risk remains project overruns or delays, which could further strain finances if cost pressures persist. One announcement with clear relevance to the recent results is the completion of a follow-on equity offering in April 2025, which reinforced Allied Gold’s cash balances. This capital raise enhances Allied Gold’s ability to manage cost overruns and keep major projects on a growth path, framing the company’s investment case around its ability to execute these expansions and contain costs despite recent operational headwinds. In contrast, investors should be aware that higher costs and delays at major development projects may not be fully reflected yet in the headline numbers, especially if...

Read the full narrative on Allied Gold (it's free!)

Allied Gold's narrative projects $1.9 billion revenue and $616.2 million earnings by 2028. This requires 28.3% yearly revenue growth and a $711 million earnings increase from -$94.8 million.

Uncover how Allied Gold's forecasts yield a CA$29.48 fair value, a 57% upside to its current price.

Exploring Other Perspectives

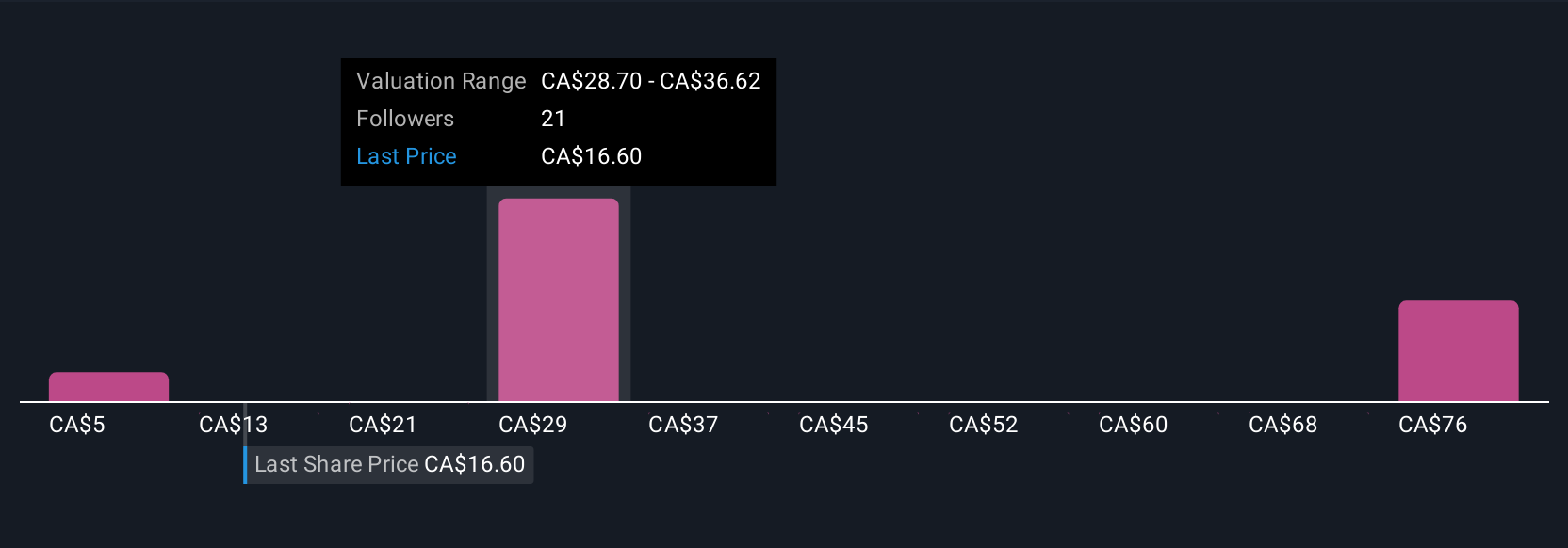

Seven unique fair value estimates from the Simply Wall St Community range from US$4.95 to US$83.98 per share. With project timelines and cost overruns posing real risks, these differences invite you to compare alternative forecasts for Allied Gold's future.

Explore 7 other fair value estimates on Allied Gold - why the stock might be worth less than half the current price!

Build Your Own Allied Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allied Gold research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allied Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allied Gold's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Community Narratives