- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

Allied Gold Corporation (TSE:AAUC) Soars 35% But It's A Story Of Risk Vs Reward

Allied Gold Corporation (TSE:AAUC) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 39% in the last year.

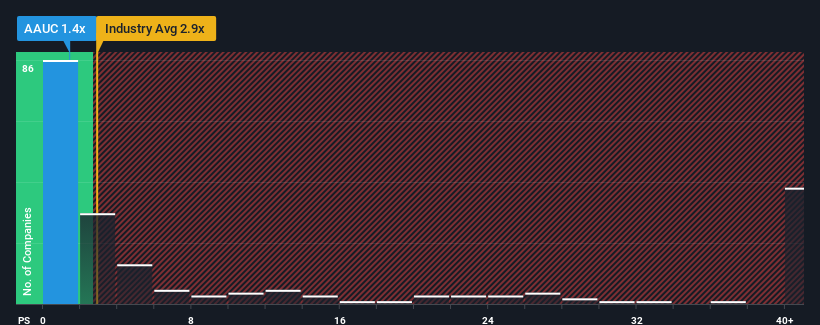

Although its price has surged higher, Allied Gold's price-to-sales (or "P/S") ratio of 1.4x might still make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 2.9x and even P/S above 24x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Allied Gold

What Does Allied Gold's P/S Mean For Shareholders?

Allied Gold could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Allied Gold will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Allied Gold would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 51% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 28% per annum over the next three years. With the industry only predicted to deliver 15% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Allied Gold's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Allied Gold's P/S?

Despite Allied Gold's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Allied Gold currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Allied Gold that you need to take into consideration.

If you're unsure about the strength of Allied Gold's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Community Narratives