As the Canadian market navigates a landscape of steady interest rates and geopolitical uncertainties, investors are keenly observing how these factors might influence economic growth. In such conditions, penny stocks—often smaller or newer companies—continue to captivate those looking for unique investment opportunities. While the term "penny stocks" may seem outdated, their potential for growth remains significant when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.70 | CA$640.22M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.24 | CA$655.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.43 | CA$187.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.77 | CA$512.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.89 | CA$17.64M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.20 | CA$94.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.24 | CA$128.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$182.15M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.92 | CA$5.25M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 890 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Tartisan Nickel (CNSX:TN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tartisan Nickel Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada and Peru, with a market cap of CA$17.03 million.

Operations: Tartisan Nickel Corp. currently does not report any specific revenue segments.

Market Cap: CA$17.03M

Tartisan Nickel Corp., with a market cap of CA$17.03 million, is pre-revenue and focuses on the Kenbridge Nickel-Copper-Cobalt Project in Ontario. Recent developments include the completion of Phase 2 for improved access to the site, enhancing logistics and safety with year-round road access. The company is also advancing its exploration efforts through a Greenfields program and airborne geophysics to identify potential mineralization extensions. Despite having no long-term liabilities and being debt-free, Tartisan's cash runway remains short at one month, though recent capital raising may provide additional financial flexibility.

- Get an in-depth perspective on Tartisan Nickel's performance by reading our balance sheet health report here.

- Explore historical data to track Tartisan Nickel's performance over time in our past results report.

DIRTT Environmental Solutions (TSX:DRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DIRTT Environmental Solutions Ltd. is a Canadian interior construction company with a market cap of CA$151.83 million.

Operations: The company's revenue primarily comes from its Building Products segment, which generated $174.76 million.

Market Cap: CA$151.83M

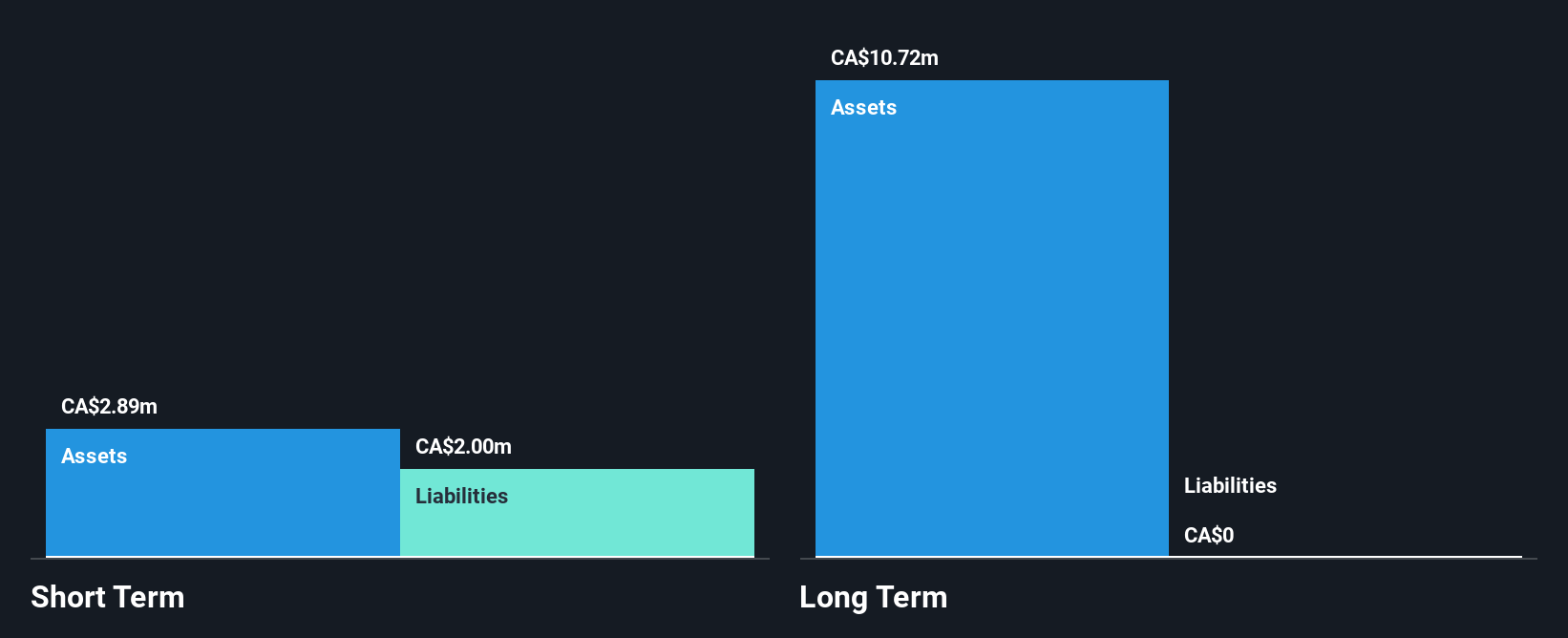

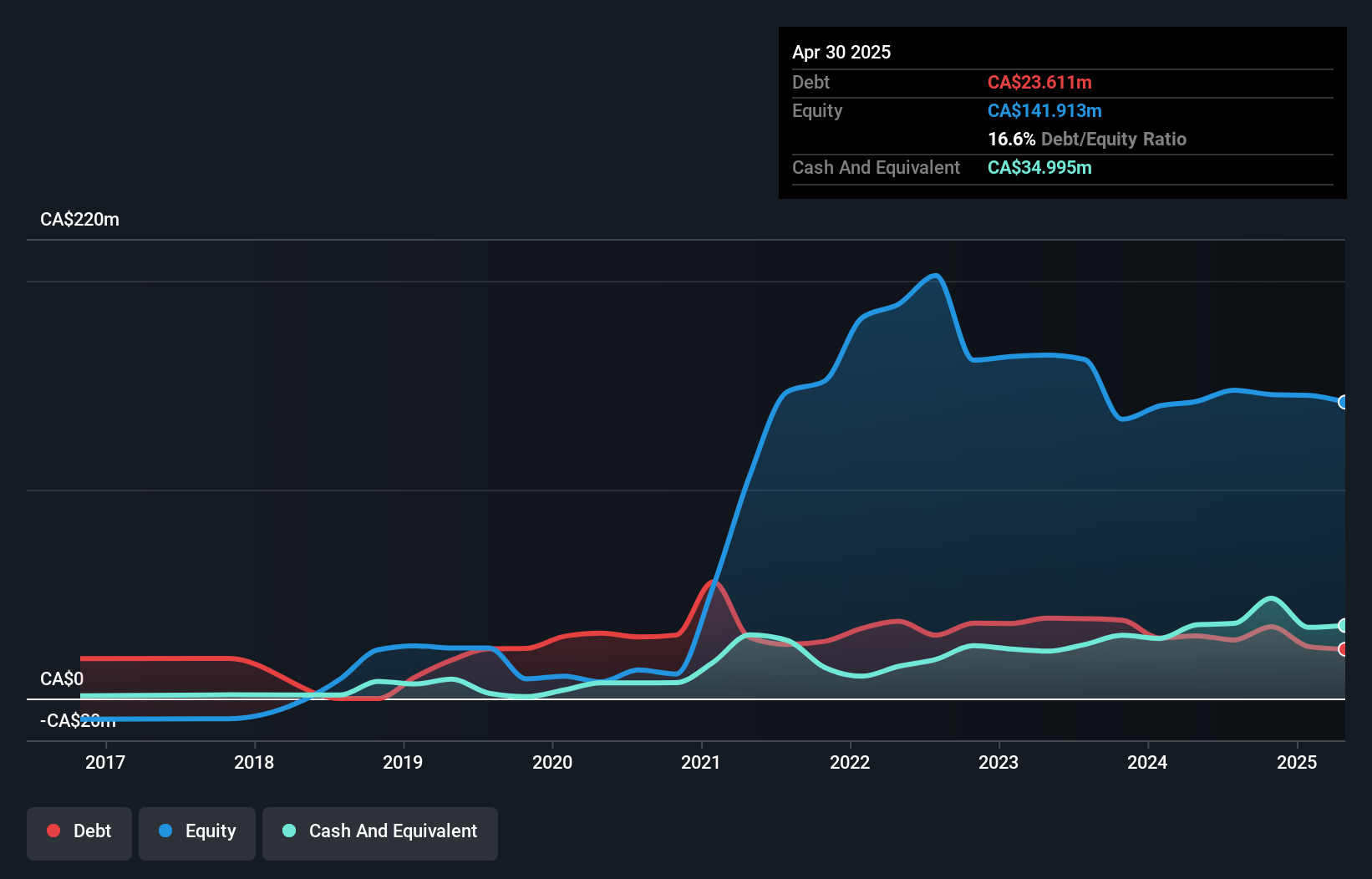

DIRTT Environmental Solutions Ltd., with a market cap of CA$151.83 million, has shown resilience in the penny stock space by maintaining revenue growth, reporting US$41.3 million for Q1 2025. Despite a recent net loss of US$0.661 million, the company has become profitable over the past five years, with earnings growing at 19.7% annually. DIRTT's cash exceeds its total debt and covers short-term liabilities effectively; however, interest coverage remains weak at 2.6x EBIT to interest payments ratio. The firm's management and board are experienced, though recent delays in SEC filings may warrant investor caution regarding regulatory compliance.

- Take a closer look at DIRTT Environmental Solutions' potential here in our financial health report.

- Review our growth performance report to gain insights into DIRTT Environmental Solutions' future.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector across Canada, the United States, and internationally with a market cap of CA$247.97 million.

Operations: The company's revenue is derived from two primary segments: E-commerce, contributing CA$27.83 million, and Bricks and Mortar, generating CA$522.42 million.

Market Cap: CA$247.97M

High Tide Inc., with a market cap of CA$247.97 million, operates in the cannabis retail sector and has expanded its Canna Cabana locations to 200 across Canada. Despite being unprofitable, it maintains a positive cash flow and sufficient runway for over three years. Recent earnings showed increased sales of CA$137.8 million for Q2 2025, but net losses widened to CA$2.9 million from the previous year. The company benefits from experienced management and board members while maintaining a strong retail presence in strategic locations with minimal competition, enhancing its potential for growth within the Canadian cannabis market.

- Click here and access our complete financial health analysis report to understand the dynamics of High Tide.

- Assess High Tide's future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock our comprehensive list of 890 TSX Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DRT

DIRTT Environmental Solutions

Operates as an interior construction company in Canada.

High growth potential and good value.

Market Insights

Community Narratives