- Canada

- /

- Oil and Gas

- /

- TSXV:ALV

Discover Lion Copper and Gold Among 3 TSX Penny Stock Opportunities

Reviewed by Simply Wall St

The Canadian market has shown resilience with the TSX rising over 2% even as global markets grapple with tariff uncertainties and economic pressures. In such a climate, investors might find opportunities in penny stocks, which despite their vintage name, offer potential for growth at lower price points. These smaller or newer companies can provide a mix of affordability and growth potential when paired with strong financials; we explore several that stand out for their financial strength and long-term prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.58 | CA$71.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.63 | CA$419.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.32 | CA$685.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.67 | CA$279.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$185.35M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$521.62M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.60 | CA$71.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.75M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.19 | CA$44.67M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 927 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Lion Copper and Gold (CNSX:LEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lion Copper and Gold Corp. is a mineral exploration company focused on acquiring, exploring, and developing copper projects in the United States with a market cap of CA$55.49 million.

Operations: Currently, there are no reported revenue segments for Lion Copper and Gold Corp.

Market Cap: CA$55.49M

Lion Copper and Gold Corp., with a market cap of CA$55.49 million, is currently pre-revenue and has faced challenges such as an auditor's going concern doubts and increased losses over the past five years. Despite these hurdles, the company successfully negotiated a settlement to reinstate crucial water rights for its Yerington Copper Project, which is advancing through a Pre-Feasibility Study supported by Rio Tinto's Nuton technologies. Recent executive changes bring John Banning as CEO to drive project development. The company maintains more cash than debt and has sufficient short-term assets to cover liabilities, providing some financial stability amidst volatility.

- Get an in-depth perspective on Lion Copper and Gold's performance by reading our balance sheet health report here.

- Explore historical data to track Lion Copper and Gold's performance over time in our past results report.

Surge Energy (TSX:SGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Surge Energy Inc. is involved in the exploration, development, and production of oil and gas in western Canada, with a market cap of CA$508.48 million.

Operations: The company generates revenue primarily from its Oil & Gas - Exploration & Production segment, amounting to CA$545.38 million.

Market Cap: CA$508.48M

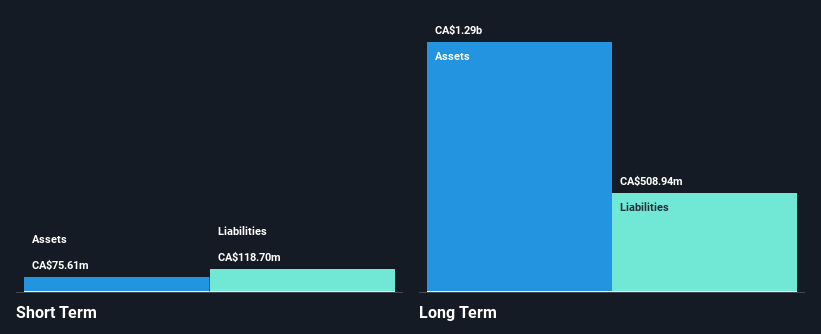

Surge Energy Inc., with a market cap of CA$508.48 million, operates in the oil and gas sector and has faced profitability challenges, reporting a net loss of CA$53.72 million for 2024 despite generating revenue of CA$541.72 million. The company's short-term assets fall short of covering its liabilities, though it maintains a satisfactory net debt to equity ratio at 28.3%. While currently unprofitable, Surge Energy has reduced its debt significantly over five years and possesses a cash runway exceeding three years due to positive free cash flow growth. Regular dividends are paid but not well covered by earnings.

- Take a closer look at Surge Energy's potential here in our financial health report.

- Understand Surge Energy's earnings outlook by examining our growth report.

Alvopetro Energy (TSXV:ALV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alvopetro Energy Ltd. is involved in the acquisition, exploration, development, and production of hydrocarbons in Brazil and Canada with a market cap of CA$185.35 million.

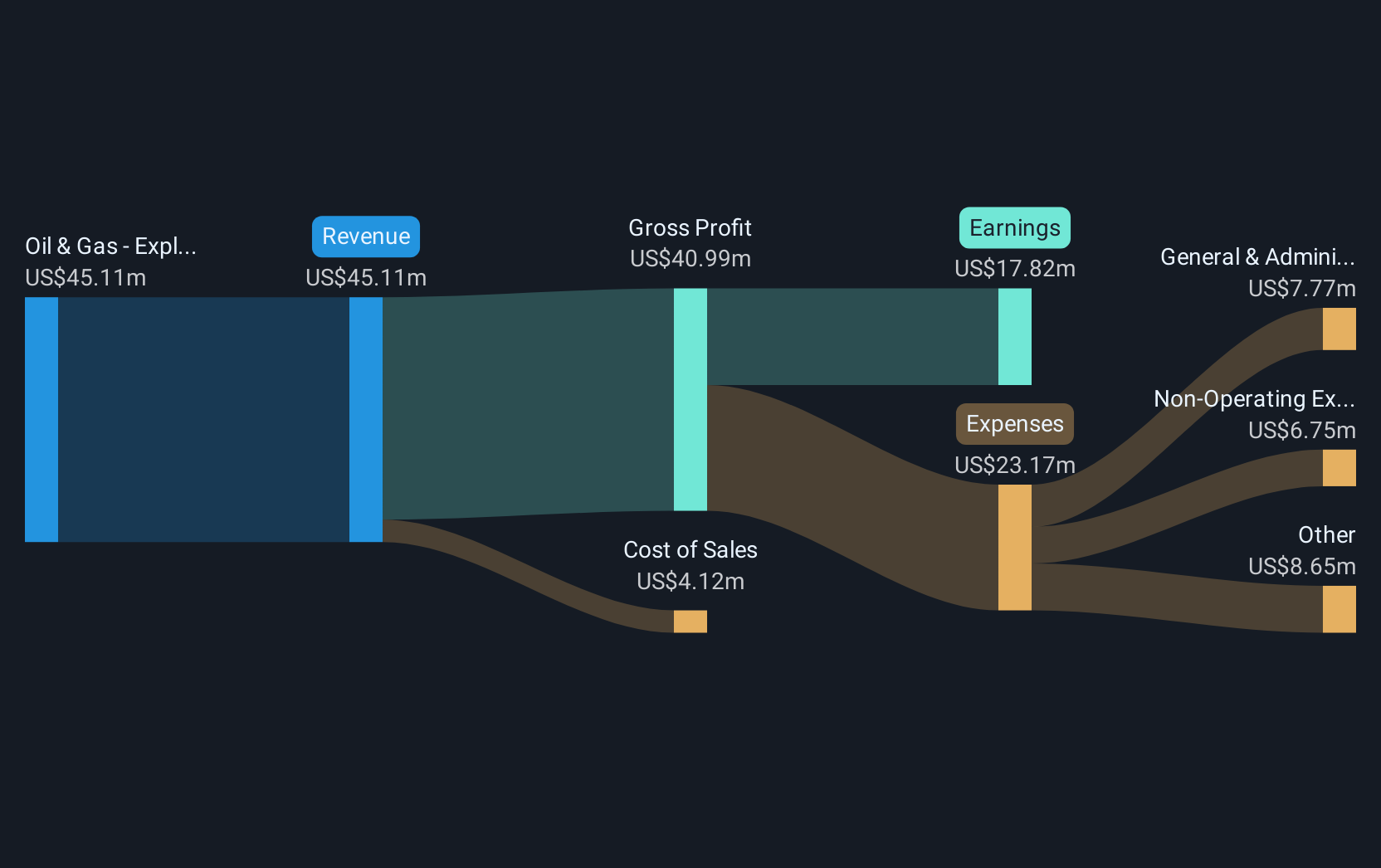

Operations: The company generates revenue from its oil and gas exploration and production activities, amounting to $44.21 million.

Market Cap: CA$185.35M

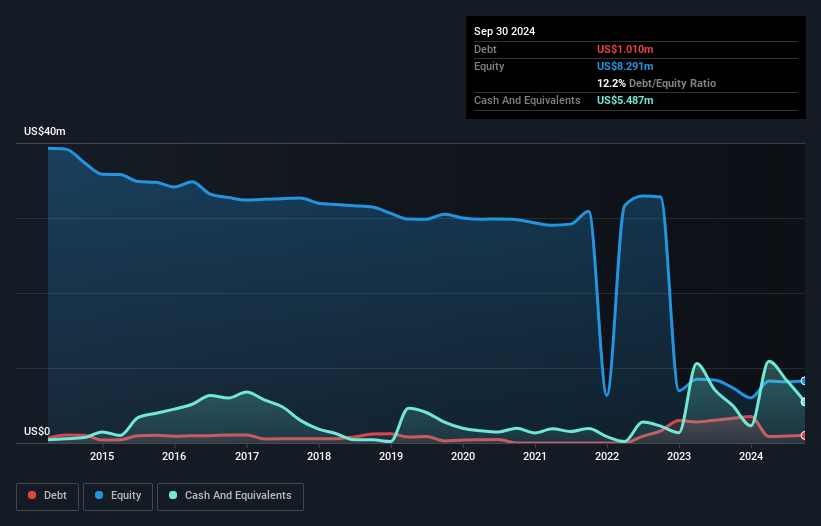

Alvopetro Energy Ltd., with a market cap of CA$185.35 million, has shown consistent revenue generation from its oil and gas operations, reporting US$45.94 million in 2024. Despite a decline in net income to US$16.3 million from the previous year, the company maintains high-quality earnings and is debt-free, with short-term assets exceeding liabilities by a comfortable margin. Recent sales growth reflects an increase in production volumes, notably improving over the last quarter of 2024 by 41%. The company has increased its quarterly dividend to US$0.10 per share, reflecting confidence in its cash flow stability amidst industry volatility.

- Jump into the full analysis health report here for a deeper understanding of Alvopetro Energy.

- Learn about Alvopetro Energy's future growth trajectory here.

Seize The Opportunity

- Gain an insight into the universe of 927 TSX Penny Stocks by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALV

Alvopetro Energy

Engages in the acquisition, exploration, development, and production of hydrocarbons in Brazil and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives