- Canada

- /

- Metals and Mining

- /

- TSXV:CBG

Spotlight On TSX Penny Stocks: Go Metals And 2 More Hidden Opportunities

Reviewed by Simply Wall St

The Canadian market has been navigating the implications of a decisive U.S. election outcome, which has removed a layer of uncertainty and spurred a notable rally in stocks, including several record highs for the TSX this year. Amid these broader market dynamics, penny stocks remain an intriguing segment for investors seeking growth opportunities at lower price points. Although often associated with smaller or newer companies, penny stocks can still offer significant potential when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.65 | CA$285.18M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$180.11M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.435 | CA$11.75M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$316.75M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.17 | CA$5.03M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$228.59M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 961 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Go Metals (CNSX:GOCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Go Metals Corp. is an exploration stage company focused on acquiring and exploring mining properties in Canada, with a market cap of CA$1.33 million.

Operations: Currently, there are no revenue segments reported for this exploration stage company.

Market Cap: CA$1.33M

Go Metals Corp., with a market cap of CA$1.33 million, is pre-revenue and currently unprofitable, experiencing increased losses over the past five years. The company is debt-free and has short-term assets (CA$490.2K) exceeding its liabilities (CA$126.3K). However, it has a limited cash runway of two months based on recent free cash flow estimates but raised additional capital recently. Despite shareholder dilution over the past year, Go Metals' management and board are experienced with average tenures of 7.5 and 12.5 years respectively. Recent exploration at its KM98 project revealed promising titanium-vanadium occurrences which could potentially impact future developments positively.

- Dive into the specifics of Go Metals here with our thorough balance sheet health report.

- Gain insights into Go Metals' past trends and performance with our report on the company's historical track record.

Chibougamau Independent Mines (TSXV:CBG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chibougamau Independent Mines Inc. focuses on the exploration and development of natural resource properties in the Chibougamau mining district of Québec, Canada, with a market cap of CA$8.55 million.

Operations: Chibougamau Independent Mines Inc. has not reported any revenue segments.

Market Cap: CA$8.55M

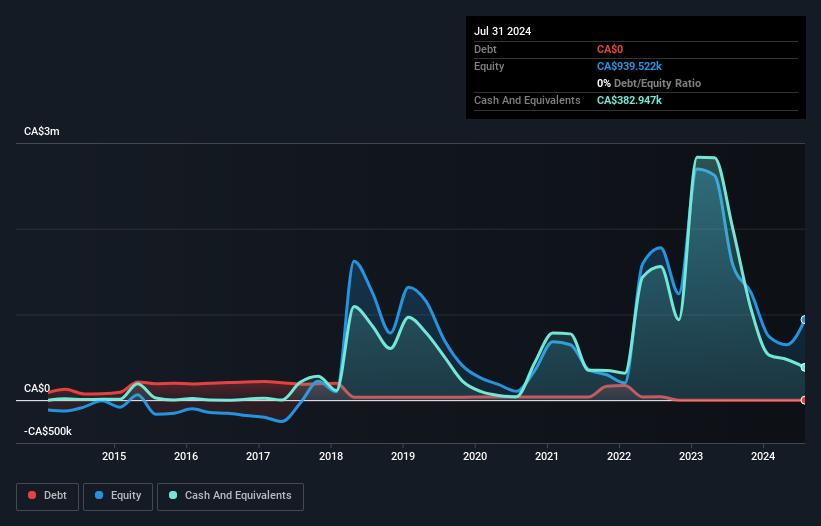

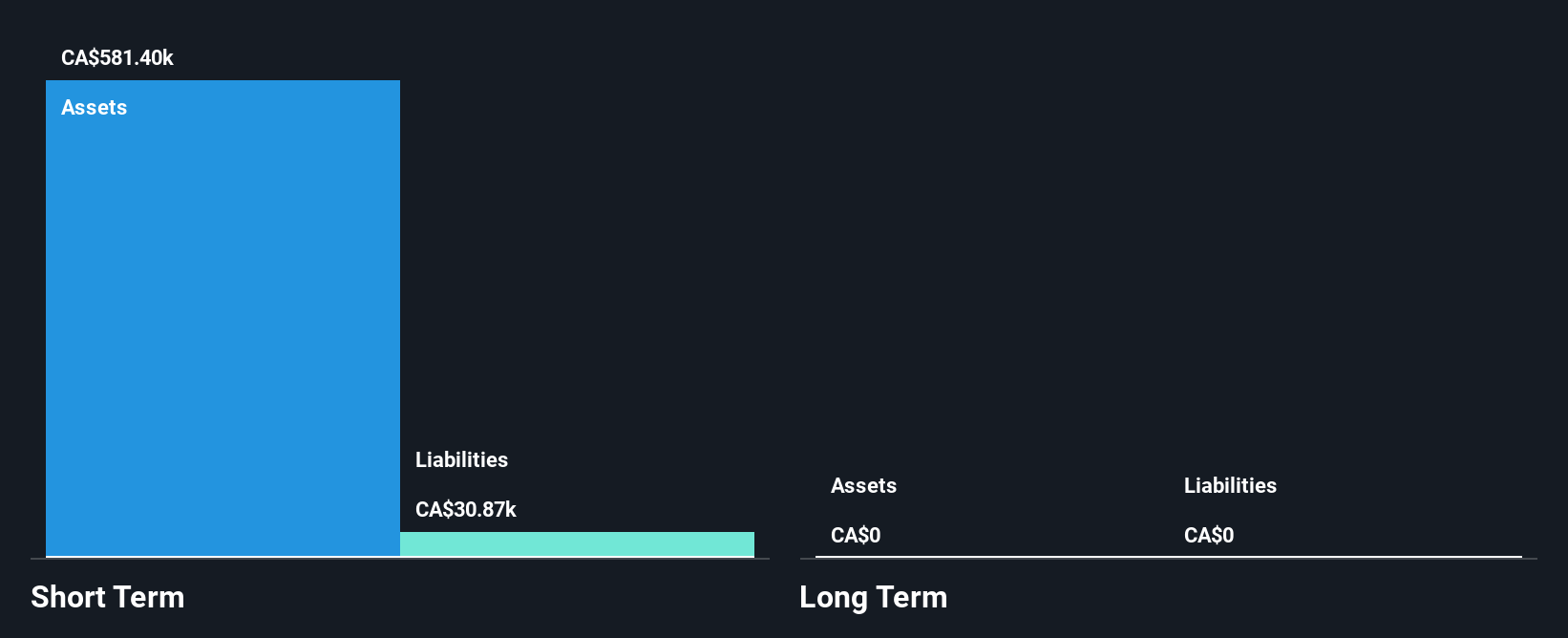

Chibougamau Independent Mines Inc., with a market cap of CA$8.55 million, reported modest sales of CA$0.06 million for the second quarter ending June 30, 2024, indicating it is pre-revenue. The company has become profitable recently but faces challenges with negative operating cash flow and low return on equity at 18.6%. However, its financial position is bolstered by more cash than debt and no long-term liabilities. Short-term assets significantly exceed liabilities, reducing immediate financial risk. The board's extensive experience averages 14.8 years in tenure, which may provide strategic stability moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Chibougamau Independent Mines.

- Explore historical data to track Chibougamau Independent Mines' performance over time in our past results report.

Strathmore Plus Uranium (TSXV:SUU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Strathmore Plus Uranium Corp. focuses on acquiring, exploring, and developing resource properties in Wyoming, United States, with a market cap of CA$10.87 million.

Operations: Strathmore Plus Uranium Corp. has not reported any revenue segments.

Market Cap: CA$10.87M

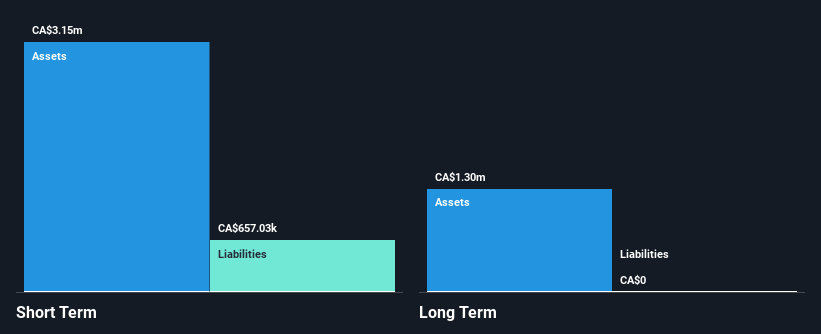

Strathmore Plus Uranium Corp., with a market cap of CA$10.87 million, is pre-revenue and focuses on uranium exploration in Wyoming. The company recently received a permit for exploratory drilling at its Beaver Rim project, aiming to confirm historical results and extend mineralization in the Gas Hills district. Financially, Strathmore has more cash than debt and no long-term liabilities, but shareholders experienced dilution over the past year. Short-term assets exceed liabilities significantly; however, the board's average tenure is only 1.1 years, suggesting limited experience which could impact strategic direction amidst high share price volatility.

- Get an in-depth perspective on Strathmore Plus Uranium's performance by reading our balance sheet health report here.

- Assess Strathmore Plus Uranium's previous results with our detailed historical performance reports.

Key Takeaways

- Get an in-depth perspective on all 961 TSX Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CBG

Chibougamau Independent Mines

Engages in the exploration and development of natural resource properties in the Chibougamau mining district of Québec, Canada.

Excellent balance sheet slight.