Replenish Nutrients Holding Corp. (CSE:ERTH) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Replenish Nutrients Holding Corp. (CSE:ERTH) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

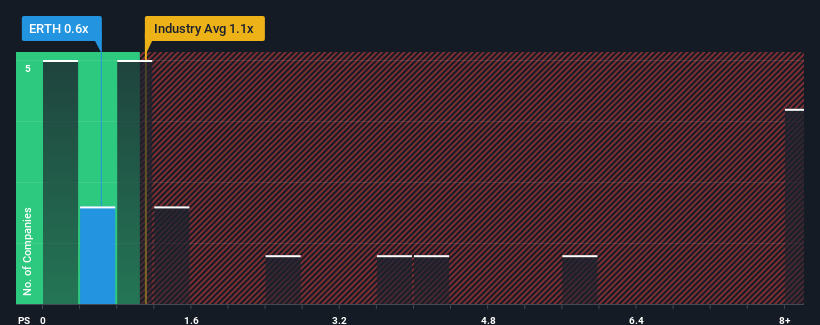

Even after such a large drop in price, there still wouldn't be many who think Replenish Nutrients Holding's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Canada's Chemicals industry is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Replenish Nutrients Holding

How Has Replenish Nutrients Holding Performed Recently?

As an illustration, revenue has deteriorated at Replenish Nutrients Holding over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Replenish Nutrients Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Replenish Nutrients Holding?

The only time you'd be comfortable seeing a P/S like Replenish Nutrients Holding's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Comparing that to the industry, which is predicted to shrink 6.5% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, we find it intriguing that Replenish Nutrients Holding's P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Replenish Nutrients Holding's P/S

With its share price dropping off a cliff, the P/S for Replenish Nutrients Holding looks to be in line with the rest of the Chemicals industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As mentioned previously, Replenish Nutrients Holding currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

It is also worth noting that we have found 4 warning signs for Replenish Nutrients Holding (2 are significant!) that you need to take into consideration.

If you're unsure about the strength of Replenish Nutrients Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:ERTH

Replenish Nutrients Holding

Manufactures and sells regenerative fertilizer solutions to support a farm system in Canada.

Slight risk and overvalued.

Market Insights

Community Narratives