- Canada

- /

- Metals and Mining

- /

- TSXV:CDPR

Improved Revenues Required Before Cerro de Pasco Resources Inc. (CSE:CDPR) Stock's 58% Jump Looks Justified

The Cerro de Pasco Resources Inc. (CSE:CDPR) share price has done very well over the last month, posting an excellent gain of 58%. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

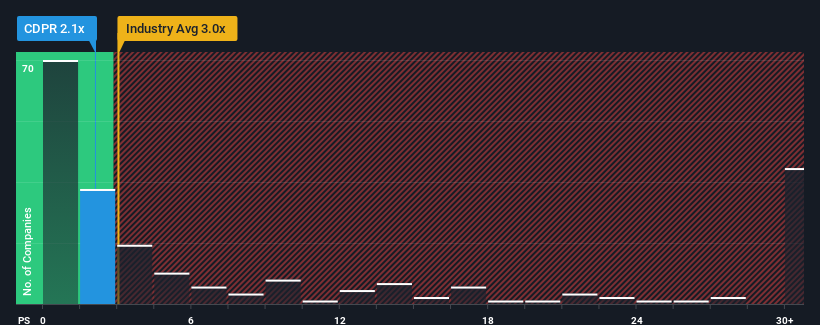

In spite of the firm bounce in price, Cerro de Pasco Resources may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.1x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 3x and even P/S higher than 17x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cerro de Pasco Resources

What Does Cerro de Pasco Resources' P/S Mean For Shareholders?

For example, consider that Cerro de Pasco Resources' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Cerro de Pasco Resources' earnings, revenue and cash flow.How Is Cerro de Pasco Resources' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Cerro de Pasco Resources' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 52%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 18% shows it's noticeably less attractive.

In light of this, it's understandable that Cerro de Pasco Resources' P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The latest share price surge wasn't enough to lift Cerro de Pasco Resources' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, Cerro de Pasco Resources maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Cerro de Pasco Resources (at least 2 which shouldn't be ignored), and understanding them should be part of your investment process.

If you're unsure about the strength of Cerro de Pasco Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CDPR

Cerro de Pasco Resources

A natural resource company, engages in the acquisition, exploration, development, and reprocessing of mineral properties in Peru.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives