- Canada

- /

- Metals and Mining

- /

- TSXV:CDPR

Benign Growth For Cerro de Pasco Resources Inc. (CSE:CDPR) Underpins Stock's 28% Plummet

Cerro de Pasco Resources Inc. (CSE:CDPR) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

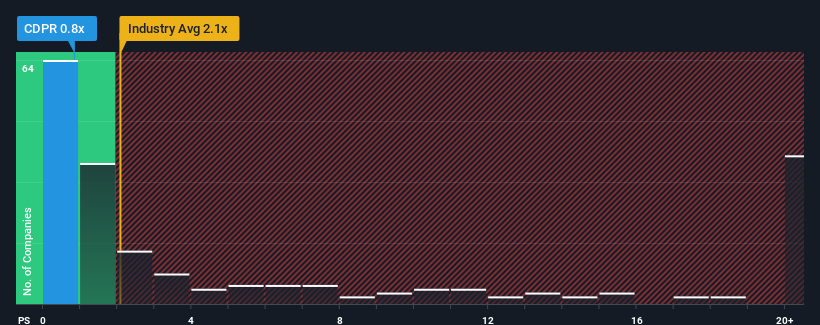

Following the heavy fall in price, Cerro de Pasco Resources' price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 2.1x and even P/S above 14x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cerro de Pasco Resources

What Does Cerro de Pasco Resources' Recent Performance Look Like?

For instance, Cerro de Pasco Resources' receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Cerro de Pasco Resources, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Cerro de Pasco Resources' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cerro de Pasco Resources' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 15% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Cerro de Pasco Resources' P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From Cerro de Pasco Resources' P/S?

Cerro de Pasco Resources' recently weak share price has pulled its P/S back below other Metals and Mining companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Cerro de Pasco Resources maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Cerro de Pasco Resources (2 are a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Cerro de Pasco Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CDPR

Cerro de Pasco Resources

A natural resource company, engages in the acquisition, exploration, development, and reprocessing of mineral properties in Peru.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives