Stock Analysis

June 2024 Insights Into Three TSX Stocks Believed To Be Below Estimated Value

Reviewed by Simply Wall St

The Canadian market has experienced a slight decline of 2.1% over the past week, yet it maintains a robust annual growth of 9.1%, with earnings expected to grow by 15% annually. In this context, identifying stocks that are trading below their estimated value can offer potential opportunities for investors looking for growth in a generally positive market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Calian Group (TSX:CGY) | CA$56.41 | CA$110.60 | 49% |

| Calibre Mining (TSX:CXB) | CA$1.89 | CA$3.17 | 40.4% |

| Trisura Group (TSX:TSU) | CA$41.89 | CA$80.18 | 47.8% |

| Kinaxis (TSX:KXS) | CA$150.62 | CA$250.13 | 39.8% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Endeavour Mining (TSX:EDV) | CA$28.81 | CA$54.09 | 46.7% |

| Green Thumb Industries (CNSX:GTII) | CA$15.97 | CA$27.18 | 41.2% |

| Jamieson Wellness (TSX:JWEL) | CA$27.93 | CA$46.71 | 40.2% |

| Kits Eyecare (TSX:KITS) | CA$8.33 | CA$14.23 | 41.5% |

| Capstone Copper (TSX:CS) | CA$9.31 | CA$16.46 | 43.4% |

Let's uncover some gems from our specialized screener

Calian Group (TSX:CGY)

Overview: Calian Group Ltd. operates in providing business services and solutions both in Canada and internationally, with a market capitalization of approximately CA$668.93 million.

Operations: Calian Group's revenue is generated from four primary segments: IT and Cyber Solutions (CA$212.56 million), Health (CA$204.46 million), Learning (CA$106.24 million), and Advanced Technologies (CA$199.69 million).

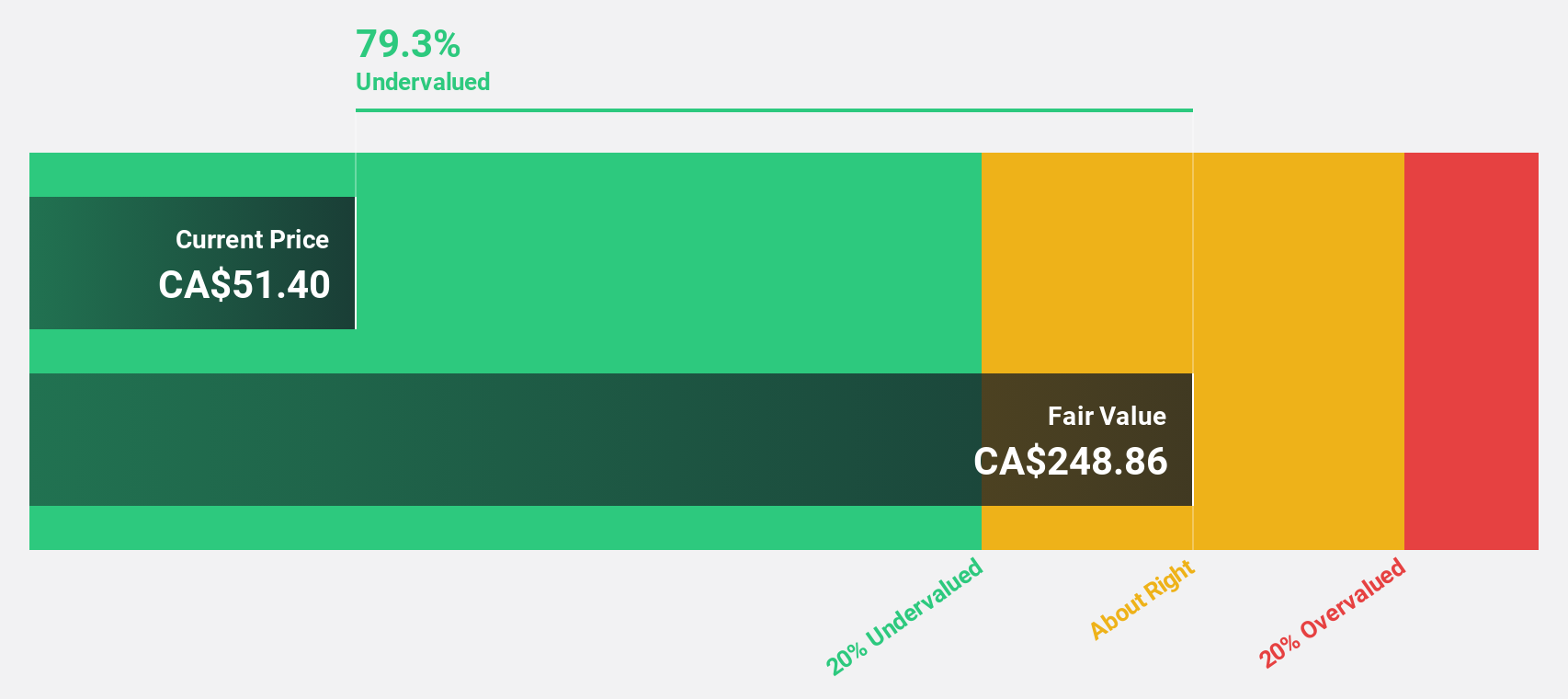

Estimated Discount To Fair Value: 49%

Calian Group Ltd. is considered undervalued based on discounted cash flow analysis, trading at CA$56.41 against an estimated fair value of CA$110.6, reflecting a significant discount. Recent financials show robust growth with second-quarter sales up to CA$201.27 million and net income rising to CA$4.93 million from the previous year's figures, supporting a positive outlook on earnings growth forecasted at 30.71% annually over the next three years. Despite slower revenue growth projections of 8.6% annually compared to more aggressive market averages, Calian's consistent dividend payments and strategic contracts in defense and technology sectors underscore its stable financial position and potential for appreciation.

- In light of our recent growth report, it seems possible that Calian Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Calian Group's balance sheet health report.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, along with its subsidiaries, is a gold mining company operating in West Africa with a market capitalization of approximately CA$7.05 billion.

Operations: The company generates its revenue primarily from four mines: Ity Mine at $653.70 million, Mana Mine at $292.70 million, Houndé Mine at $611.30 million, and Sabodala Massawa Mine at $548.40 million.

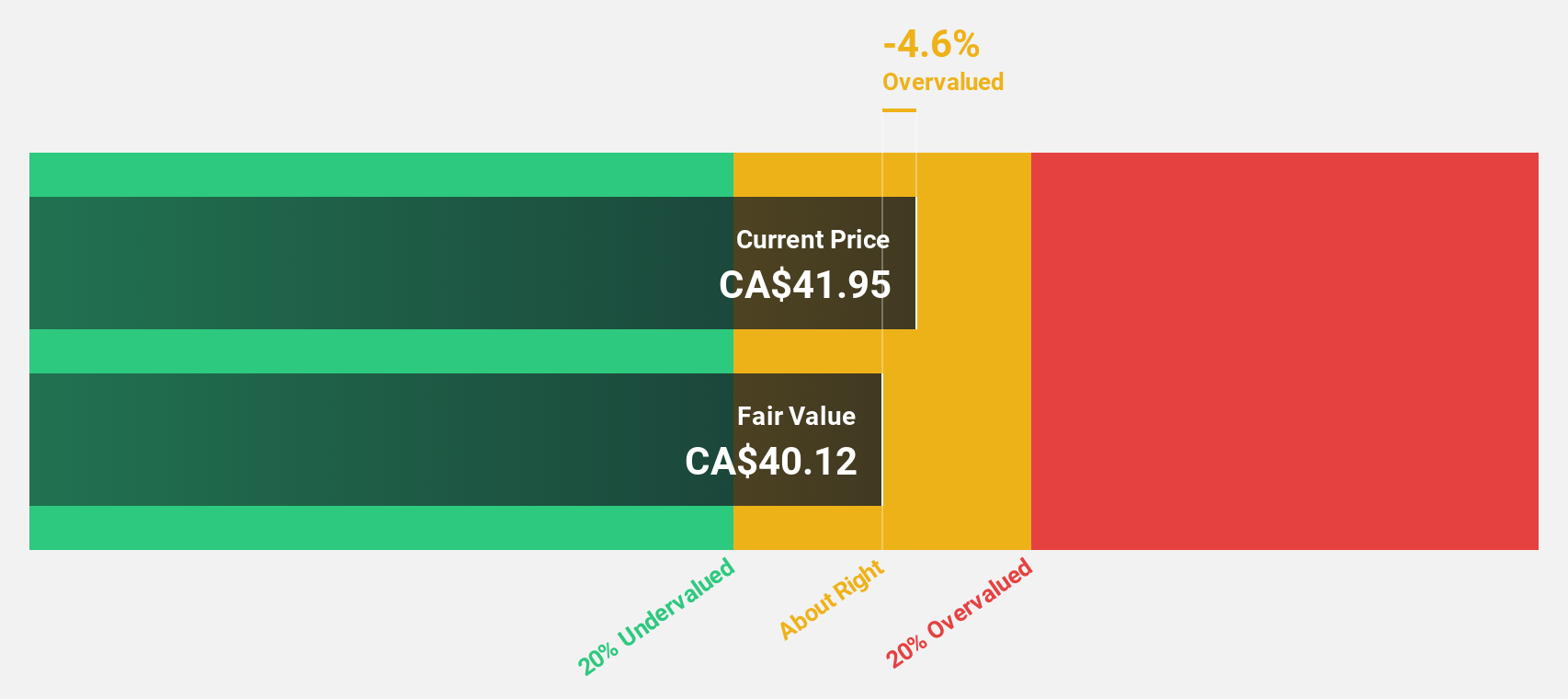

Estimated Discount To Fair Value: 46.7%

Endeavour Mining, priced at CA$28.81, is significantly undervalued against a fair value of CA$54.09 based on discounted cash flow analysis. Despite trading 46.7% below its estimated value and having strong relative market positioning, concerns arise from substantial insider selling in the past quarter and dividends that are poorly covered by earnings or cash flows. Additionally, while revenue growth is projected to outpace the Canadian market average at 8.7% annually, profitability is only expected within the next three years with earnings forecasted to grow by 45.09% per year.

- Insights from our recent growth report point to a promising forecast for Endeavour Mining's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Endeavour Mining.

Trisura Group (TSX:TSU)

Overview: Trisura Group Ltd. is a specialty insurance provider with operations in surety, risk solutions, corporate insurance, and reinsurance across Canada, the United States, and internationally, boasting a market capitalization of approximately CA$1.99 billion.

Operations: The company generates revenue from its operations in the U.S. and Canada, with CA$2.04 billion and CA$900.81 million respectively from these regions.

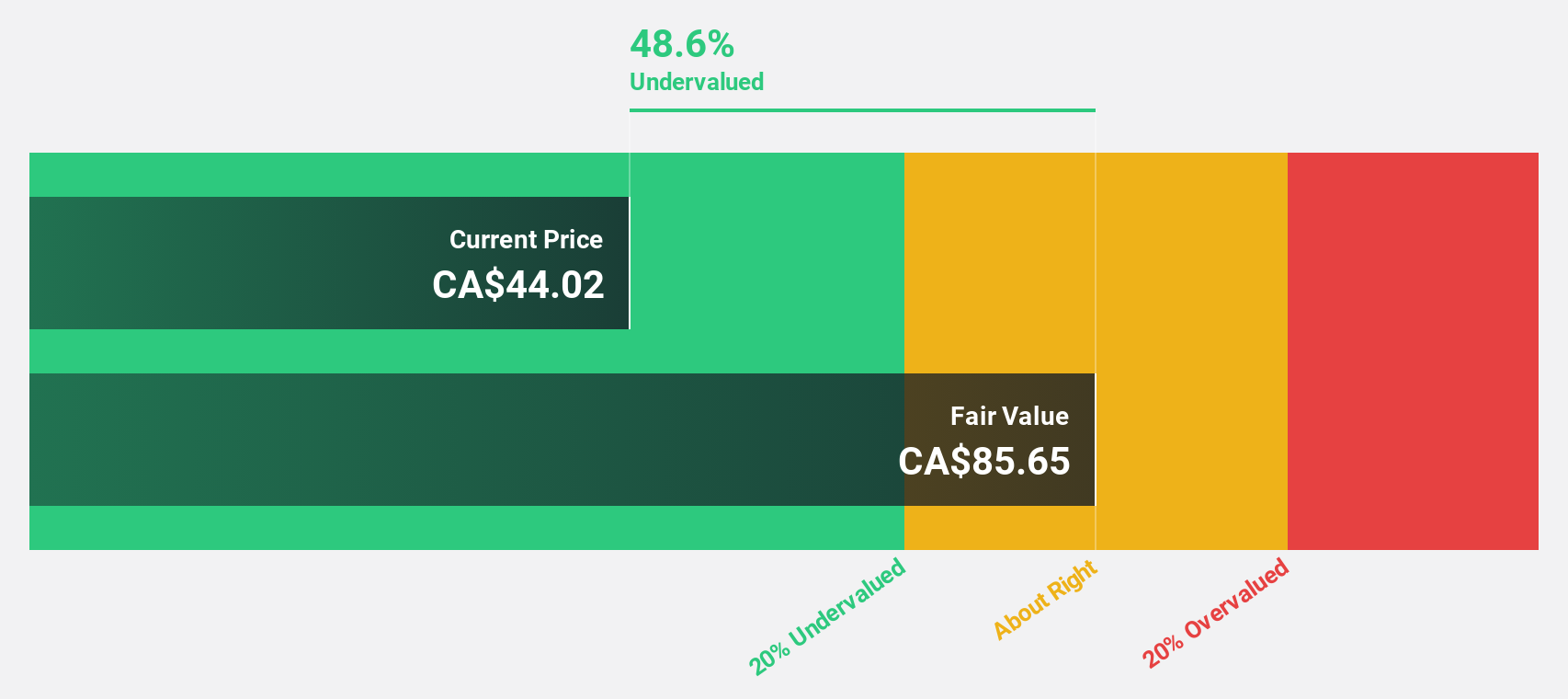

Estimated Discount To Fair Value: 47.8%

Trisura Group Ltd., valued at CA$41.89, is considered undervalued by 47.8%, with a fair value of CA$80.18 based on discounted cash flow analysis. The company's earnings have surged by 385% over the past year and are expected to grow at 31.6% annually, outpacing the Canadian market forecast of 14.7%. However, concerns include significant insider selling recently and shareholder dilution within the last year, despite robust forecasts for revenue growth at 11.8% annually compared to the market's 7.3%.

- According our earnings growth report, there's an indication that Trisura Group might be ready to expand.

- Click here to discover the nuances of Trisura Group with our detailed financial health report.

Make It Happen

- Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 21 more companies for you to explore.Click here to unveil our expertly curated list of 24 Undervalued TSX Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Trisura Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TSU

Trisura Group

A specialty insurance company, operates in the surety, risk solutions, corporate insurance, and reinsurance businesses in Canada, the United States, and internationally.

Solid track record with excellent balance sheet.