Exploring 3 Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

As global markets reach record highs due to favorable trade deals and robust growth in the services sector, small-cap stocks have shown notable resilience, with indices like the S&P MidCap 400 and Russell 2000 posting gains. In this buoyant environment, identifying undervalued small-cap companies with insider buying can present unique opportunities for investors seeking to capitalize on market momentum while navigating economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Daiwa House Logistics Trust | 11.4x | 6.9x | 20.81% | ★★★★★☆ |

| Lion Rock Group | 5.1x | 0.4x | 49.78% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.9x | 3.1x | 13.22% | ★★★★☆☆ |

| CVS Group | 46.0x | 1.3x | 37.02% | ★★★★☆☆ |

| Absolent Air Care Group | 34.6x | 2.3x | 45.79% | ★★★☆☆☆ |

| Saturn Oil & Gas | 3.0x | 0.5x | -153.24% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.6x | 1.8x | 13.86% | ★★★☆☆☆ |

| Chinasoft International | 25.3x | 0.8x | 8.14% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.9x | 0.7x | 9.64% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.7x | 48.01% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Basic-Fit operates a network of fitness clubs primarily in the Benelux region, France, Spain, and Germany, with a market capitalization of approximately €1.98 billion.

Operations: The company generates revenue primarily from its operations in Benelux and France, Spain & Germany, with the latter contributing a larger share. The gross profit margin has shown fluctuations, reaching 79.61% as of March 2023. Operating expenses are significant and include substantial depreciation and amortization costs alongside sales and marketing expenses.

PE: 190.4x

Basic-Fit, a smaller company in the fitness sector, recently reported half-year sales of €677.3 million, up from €584.8 million last year, but faced a net loss of €7.9 million compared to previous profits. Despite high volatility and reliance on external borrowing for funding, insider confidence is evident with recent share purchases between January and June 2025. The company's earnings are projected to grow by 65% annually, suggesting potential future growth despite current challenges in covering interest payments with earnings.

- Click to explore a detailed breakdown of our findings in Basic-Fit's valuation report.

Understand Basic-Fit's track record by examining our Past report.

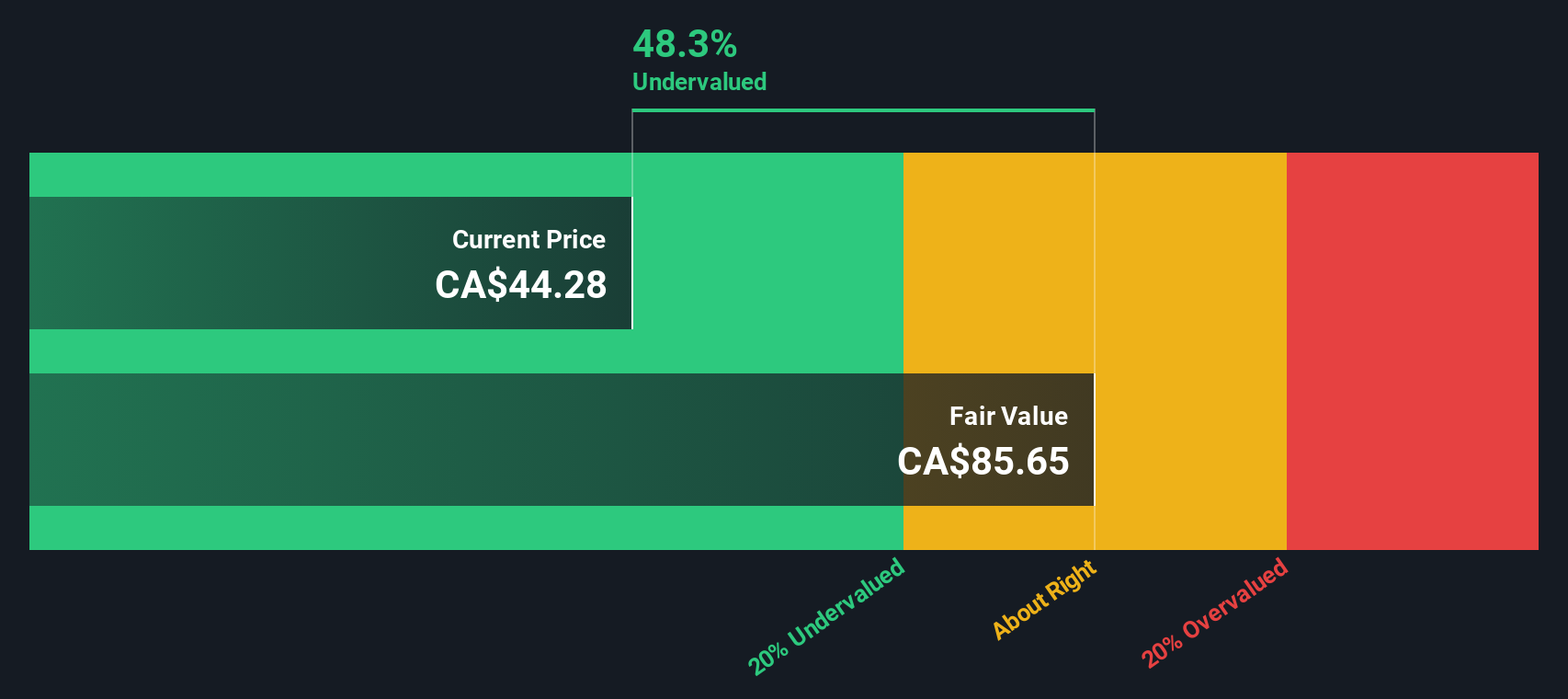

Trisura Group (TSX:TSU)

Simply Wall St Value Rating: ★★★☆☆☆

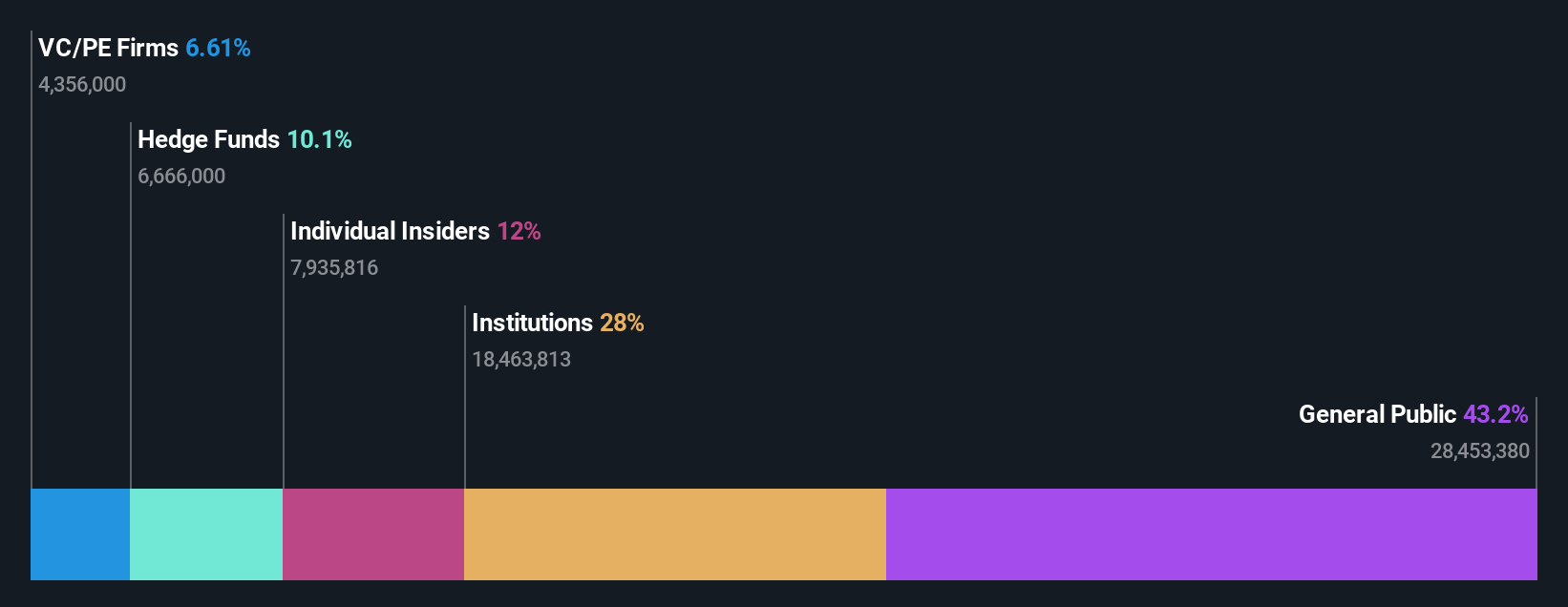

Overview: Trisura Group operates as a specialty insurance provider with a focus on niche markets, boasting a market capitalization of CA$1.84 billion.

Operations: Trisura generates revenue primarily from Trisura US Programs and Trisura Specialty, with the former contributing significantly more. The company's gross profit margin has shown fluctuations, reaching a low of 2.25% in early 2023 before rising to 5.05% by the end of 2024. Operating expenses have varied over time, with notable reductions in recent periods, such as $1.30 million at the end of 2023 and early 2024.

PE: 18.9x

Trisura Group, a small company in the insurance sector, has caught attention with its insider confidence as executives increased their shareholdings over recent months. Despite a decline in net income to C$28.99 million for Q1 2025 from C$36.43 million last year, earnings are projected to grow at 24.8% annually. The absence of share buybacks indicates a focus on other strategic initiatives. With high-quality non-cash earnings and no customer deposits, Trisura's external borrowing adds risk but also potential growth avenues.

- Navigate through the intricacies of Trisura Group with our comprehensive valuation report here.

Assess Trisura Group's past performance with our detailed historical performance reports.

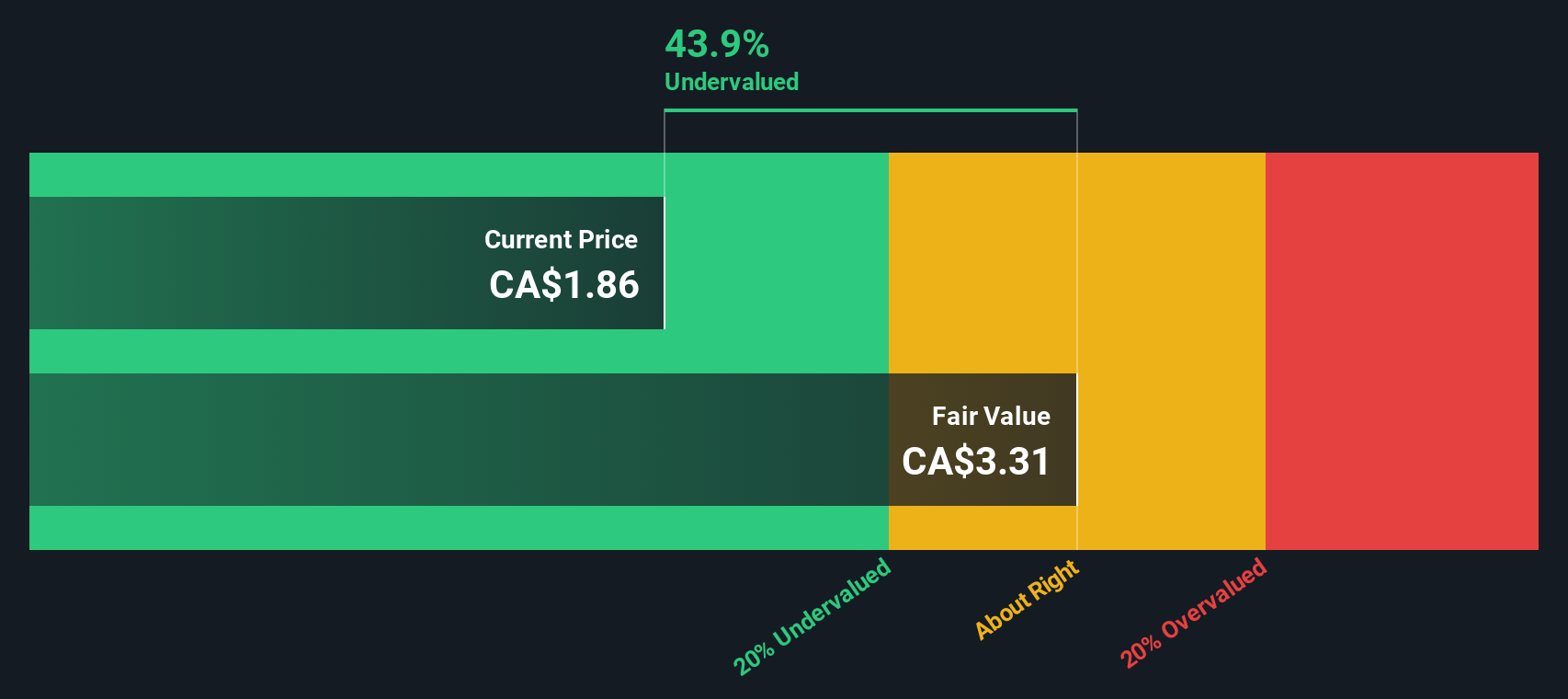

Elemental Altus Royalties (TSXV:ELE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Elemental Altus Royalties is a company focused on acquiring royalties, streams, and similar production-based interests with a market cap of approximately $0.09 billion CAD.

Operations: Elemental Altus Royalties generates revenue primarily through the acquisition of royalties, streams, and similar production-based interests. As of the latest reporting period, the company reported a gross profit margin of 99.06%. Operating expenses reached $19.57 million, with significant contributions from general and administrative expenses totaling $8.60 million.

PE: 87.5x

Elemental Altus Royalties, a smaller company in the resource sector, recently saw significant insider confidence with Tether Investments acquiring a substantial stake and participating in a CAD 15.5 million private placement. This move reflects strategic interest amid its forecasted revenue growth of 20.63% annually. Despite past shareholder dilution, the company's Q1 2025 performance showed promising results with USD 11.64 million in revenue and USD 3.45 million net income, highlighting potential for future value realization as it continues to expand its gold equivalent ounces production.

- Take a closer look at Elemental Altus Royalties' potential here in our valuation report.

Gain insights into Elemental Altus Royalties' past trends and performance with our Past report.

Where To Now?

- Reveal the 114 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trisura Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TSU

Trisura Group

A specialty insurance company, operates in the surety, warranty, corporate insurance, and program and fronting businesses in Canada and the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives