Will Sun Life (TSX:SLF) Find New Growth Drivers Amid Asia Expansion and U.S. Challenges?

Reviewed by Sasha Jovanovic

- Earlier this week, Sun Life Financial appointed Anshuman Das as its new bancassurance chief for Asia, bringing 15 years of experience in insurance and consumer banking to lead the firm's bancassurance strategy from Singapore.

- While this new leadership role highlights Sun Life's commitment to its Asian expansion, the company’s recent quarterly results also point to operational headwinds in its core U.S. and asset management businesses despite ongoing share buybacks.

- We'll explore how the appointment in Asia and mixed quarterly results may shape Sun Life Financial's future growth outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Sun Life Financial Investment Narrative Recap

To be a Sun Life Financial shareholder today, you need to trust in the company’s ability to turn long-term Asian growth and digital investments into sustained gains, while navigating challenges in U.S. and asset management segments. The appointment of a new bancassurance chief for Asia signals management’s focus, but this move does not materially shift the near-term outlook or offset the current risks of continued outflows at MFS and profitability struggles in U.S. business lines.

Of Sun Life's many recent announcements, the appointment of Tom Murphy as President of Sun Life Asset Management is particularly relevant, given ongoing headwinds at MFS Investment Management. Combined with new leadership in both Asia and U.S. divisions, the company appears intent on addressing operational challenges and supporting its core growth catalyst, the expansion of fee-based earnings in Asia and asset management, to offset margin pressures.

Yet, in contrast to the promising Asian expansion, sustained net outflows at MFS remain a critical issue investors should be aware of...

Read the full narrative on Sun Life Financial (it's free!)

Sun Life Financial's narrative projects CA$49.3 billion in revenue and CA$4.5 billion in earnings by 2028. This requires 13.0% yearly revenue growth and a CA$1.3 billion earnings increase from the current CA$3.2 billion.

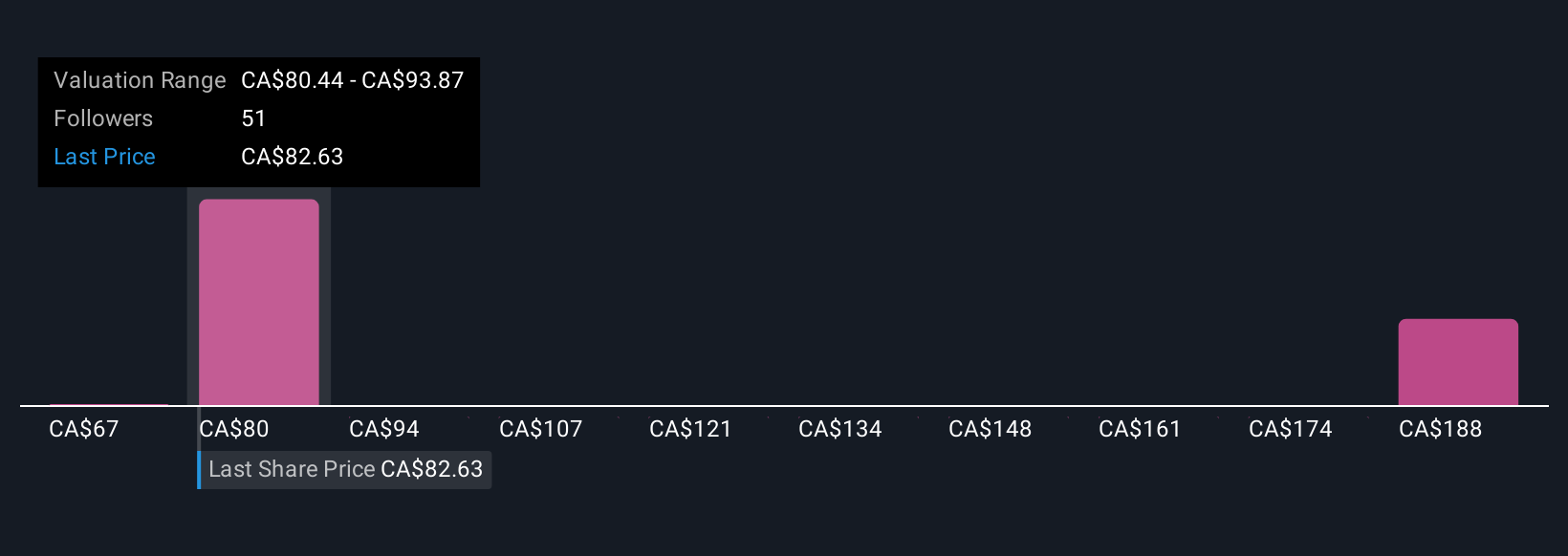

Uncover how Sun Life Financial's forecasts yield a CA$90.14 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from CA$90.14 to CA$214.54, offering broad perspectives on Sun Life's share price. Persistent asset management outflows highlight why opinions about future performance can differ so widely, so be sure to explore several viewpoints.

Explore 3 other fair value estimates on Sun Life Financial - why the stock might be worth just CA$90.14!

Build Your Own Sun Life Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Life Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sun Life Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Life Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives