- Canada

- /

- Trade Distributors

- /

- TSX:RUS

Top TSX Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

In the last week, the Canadian market has remained flat, yet it has experienced a robust 21% increase over the past year with earnings forecasted to grow by 16% annually. In this environment, dividend stocks that offer consistent payouts and potential for growth can be appealing options for investors seeking stability and income.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.04% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.56% | ★★★★★★ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.01% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.88% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.55% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.62% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.46% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.90% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.99% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.31% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates retail stores providing food and everyday products to rural and urban communities in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.52 billion.

Operations: The North West Company Inc. generates revenue of CA$2.52 billion from its operations as a retailer of food and everyday products and services across various regions including northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Dividend Yield: 3%

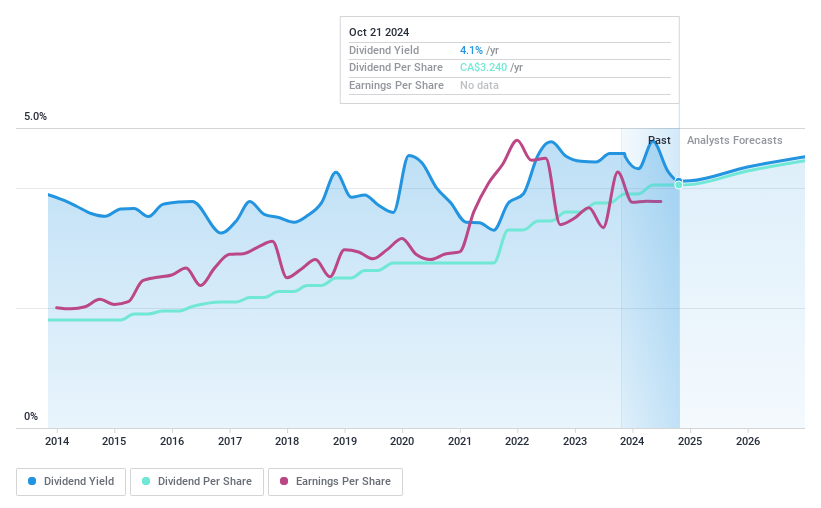

North West Company Inc. offers a stable dividend, recently increasing its quarterly payout to CAD 0.40 per share. Despite a below-market yield of 3.03%, dividends are well-covered by earnings and cash flow, with payout ratios of 56.2% and 71.9%, respectively. The company reported modest revenue growth in recent quarters, although net income slightly declined year-over-year for Q2 2024. Notably, there has been significant insider selling recently, which may warrant cautious observation.

- Get an in-depth perspective on North West's performance by reading our dividend report here.

- The valuation report we've compiled suggests that North West's current price could be quite moderate.

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company operating in Canada and the United States, with a market cap of CA$2.47 billion.

Operations: Russel Metals Inc.'s revenue is primarily derived from its Metals Service Centers at CA$2.83 billion, followed by Energy Field Stores at CA$984 million and Steel Distributors at CA$411 million.

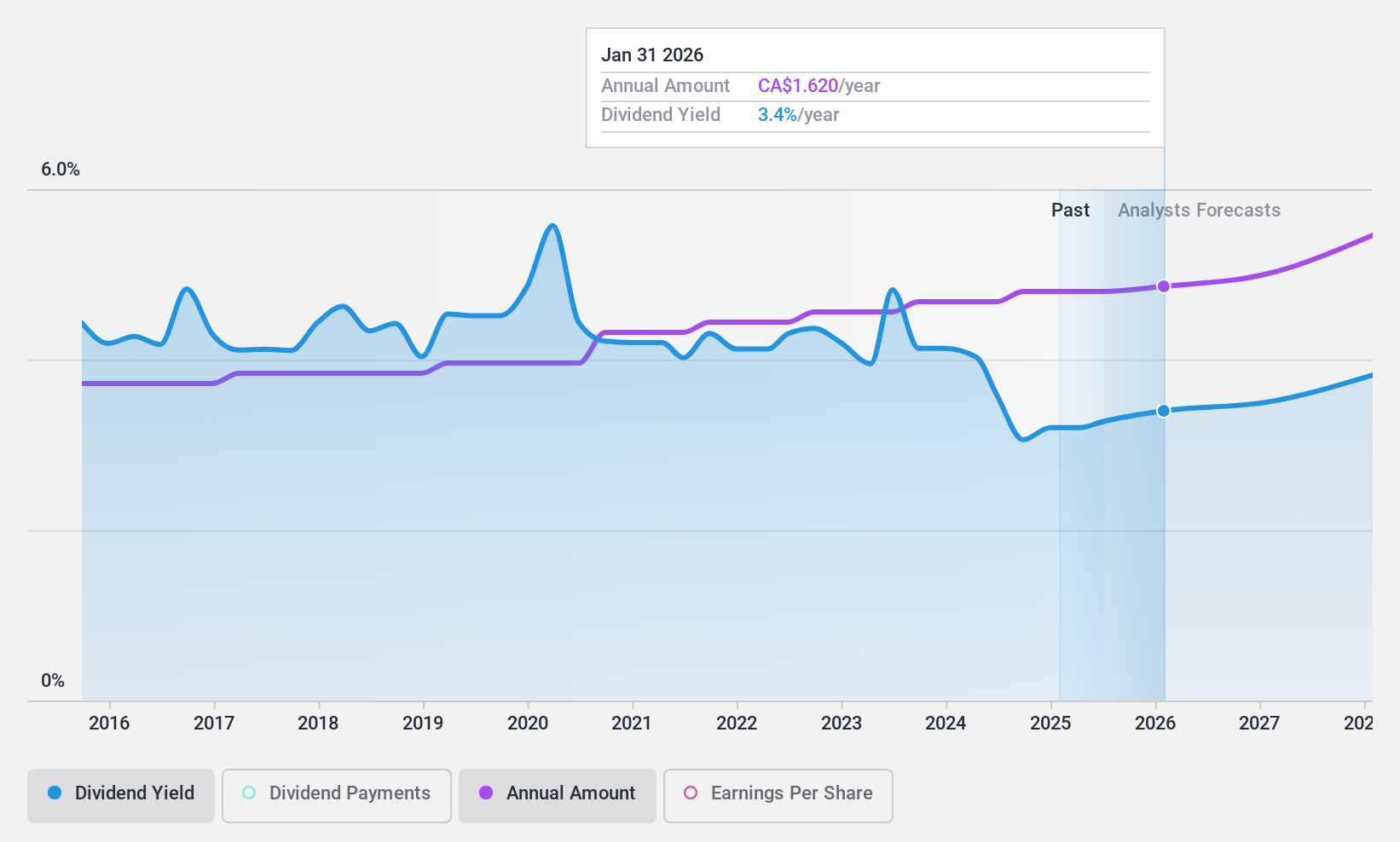

Dividend Yield: 3.9%

Russel Metals Inc. declared a CAD 0.42 per share dividend, maintaining a stable and growing payout over the past decade. Despite a decline in Q3 earnings to CAD 34.5 million from CAD 60.6 million, dividends remain well-covered by earnings and cash flows with payout ratios of 54% and 33.7%, respectively. The company redeemed its $150 million senior notes, potentially strengthening its financial position, though its dividend yield of 3.9% is below top-tier Canadian payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Russel Metals.

- Our comprehensive valuation report raises the possibility that Russel Metals is priced lower than what may be justified by its financials.

Sun Life Financial (TSX:SLF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a financial services company that offers savings, retirement, and pension products globally, with a market cap of approximately CA$48.50 billion.

Operations: Sun Life Financial Inc. generates revenue from several segments, including Asia (CA$4.11 billion), Canada (CA$17.99 billion), Asset Management (CA$6.49 billion), and the United States (CA$14.09 billion).

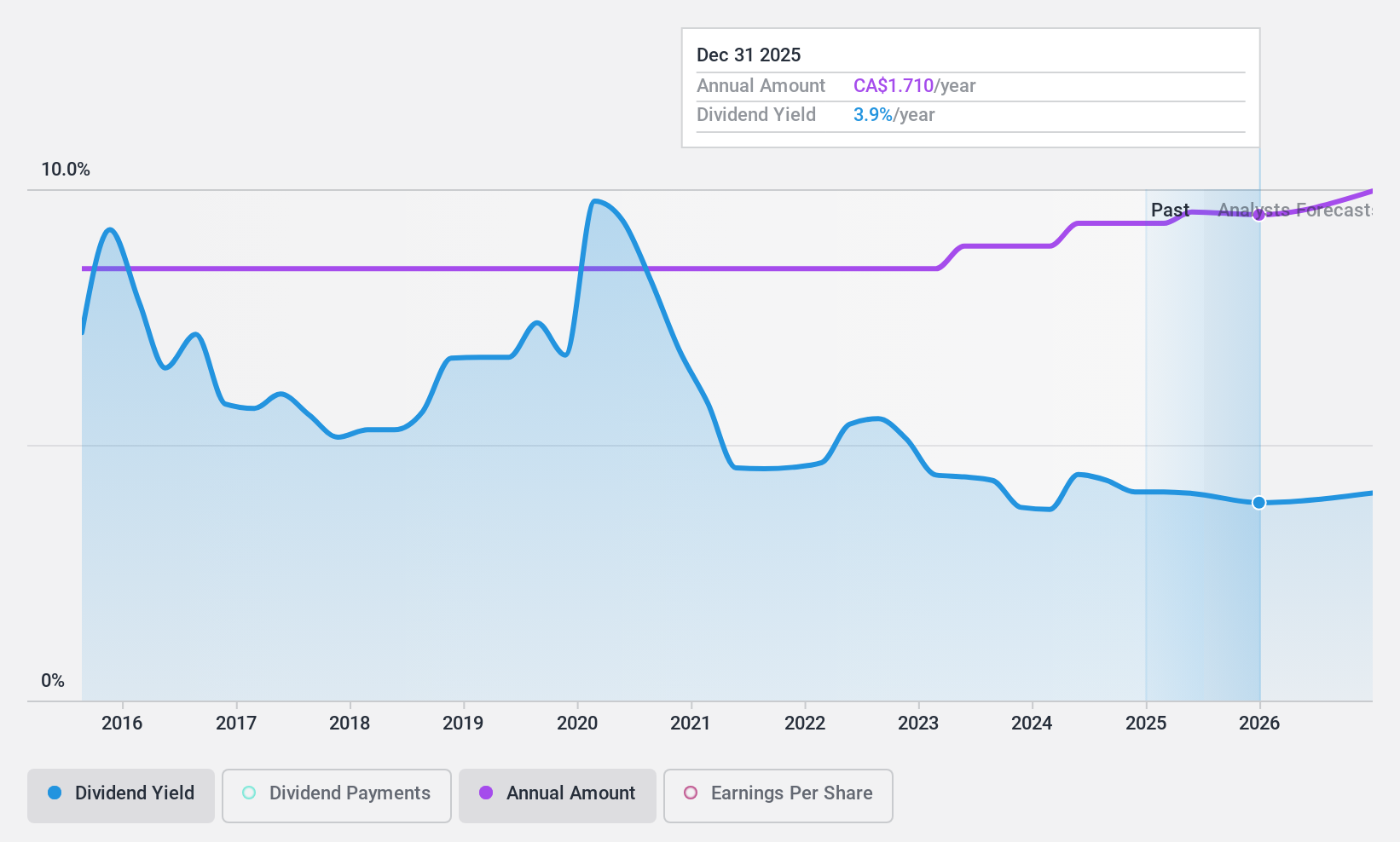

Dividend Yield: 4%

Sun Life Financial offers a stable dividend yield of 3.99%, supported by a payout ratio of 51.9% and cash payout ratio of 37.2%. Recent earnings growth, with Q3 net income rising to C$1.37 billion from C$890 million, underpins its dividend reliability and sustainability over the past decade. A recent dividend increase to C$0.84 per share reflects ongoing commitment to shareholder returns despite insider selling and lower yield compared to top-tier Canadian payers.

- Dive into the specifics of Sun Life Financial here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Sun Life Financial is trading behind its estimated value.

Taking Advantage

- Access the full spectrum of 30 Top TSX Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RUS

Russel Metals

Operates as a metal distribution and processing company in Canada and the United States.

Flawless balance sheet established dividend payer.