Sun Life Financial Inc. Just Released Its Yearly Earnings: Here's What Analysts Think

Investors in Sun Life Financial Inc. (TSE:SLF) had a good week, as its shares rose 3.7% to close at CA$66.44 following the release of its yearly results. Revenues of CA$40b were in line with forecasts, although statutory earnings per share (EPS) came in below expectations at CA$4.40, missing estimates by 2.8%. This is an important time for investors, as they can track a company's performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see analysts' latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Sun Life Financial

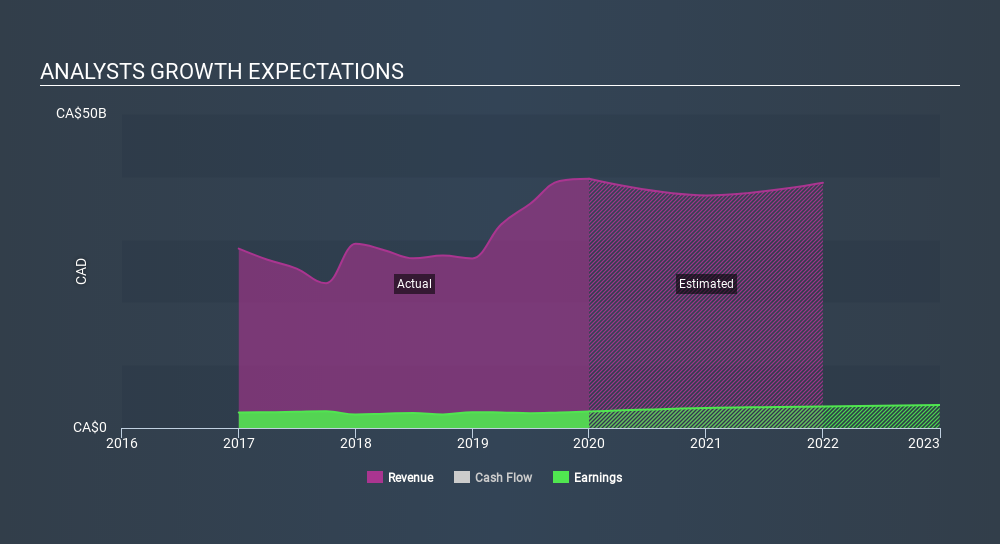

Taking into account the latest results, the eleven analysts covering Sun Life Financial provided consensus estimates of CA$37.0b revenue in 2020, which would reflect a noticeable 6.6% decline on its sales over the past 12 months. Statutory earnings per share are expected to leap 23% to CA$5.44. Yet prior to the latest earnings, analysts had been forecasting revenues of CA$36.6b and earnings per share (EPS) of CA$5.44 in 2020. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

Analysts reconfirmed their price target of CA$65.38, showing that the business is executing well and in line with expectations. The consensus price target just an average of individual analyst targets, so - considering that the price target changed, it would be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Sun Life Financial at CA$72.00 per share, while the most bearish prices it at CA$51.00. This shows there is still quite a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Further, we can compare these estimates to past performance, and see how Sun Life Financial forecasts compare to the wider market's forecast performance. These estimates imply that sales are expected to slow, with a forecast revenue decline of 6.6% a significant reduction from annual growth of 9.4% over the last five years. Compare this with our data, which suggests that other companies in the same market are, in aggregate, expected to see their revenue grow 0.1% next year. It's pretty clear that Sun Life Financial's revenues are expected to perform substantially worse than the wider market.

The Bottom Line

The most obvious conclusion from these results is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. On the plus side, there were no major changes to revenue estimates; although analyst forecasts imply revenues will perform worse than the wider market. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Sun Life Financial. Long-term earnings power is much more important than next year's profits. We have forecasts for Sun Life Financial going out to 2021, and you can see them free on our platform here.

You can also see our analysis of Sun Life Financial's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion