Is It Smart To Buy Sun Life Financial Inc. (TSE:SLF) Before It Goes Ex-Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Sun Life Financial Inc. (TSE:SLF) is about to go ex-dividend in just 4 days. Ex-dividend means that investors that purchase the stock on or after the 28th of February will not receive this dividend, which will be paid on the 31st of March.

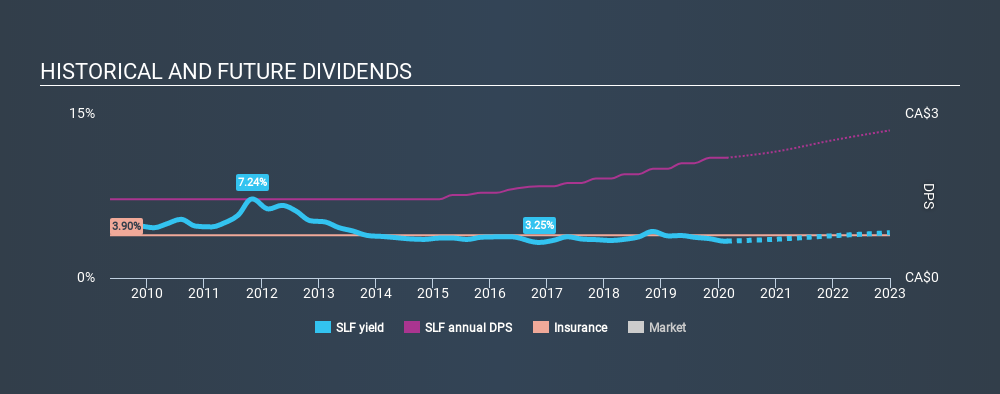

Sun Life Financial's upcoming dividend is CA$0.55 a share, following on from the last 12 months, when the company distributed a total of CA$2.20 per share to shareholders. Calculating the last year's worth of payments shows that Sun Life Financial has a trailing yield of 3.4% on the current share price of CA$65.23. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Sun Life Financial has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Sun Life Financial

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. That's why it's good to see Sun Life Financial paying out a modest 47% of its earnings.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. This is why it's a relief to see Sun Life Financial earnings per share are up 8.9% per annum over the last five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past ten years, Sun Life Financial has increased its dividend at approximately 4.3% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

The Bottom Line

Is Sun Life Financial an attractive dividend stock, or better left on the shelf? It has been growing its earnings per share somewhat in recent years, although it reinvests more than half its earnings in the business, which could suggest there are some growth projects that have not yet reached fruition. We think this is a pretty attractive combination, and would be interested in investigating Sun Life Financial more closely.

Ever wonder what the future holds for Sun Life Financial? See what the 11 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion