Should Income Investors Look At Power Corporation of Canada (TSE:POW) Before Its Ex-Dividend?

It looks like Power Corporation of Canada (TSE:POW) is about to go ex-dividend in the next 4 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Accordingly, Power Corporation of Canada investors that purchase the stock on or after the 31st of December will not receive the dividend, which will be paid on the 31st of January.

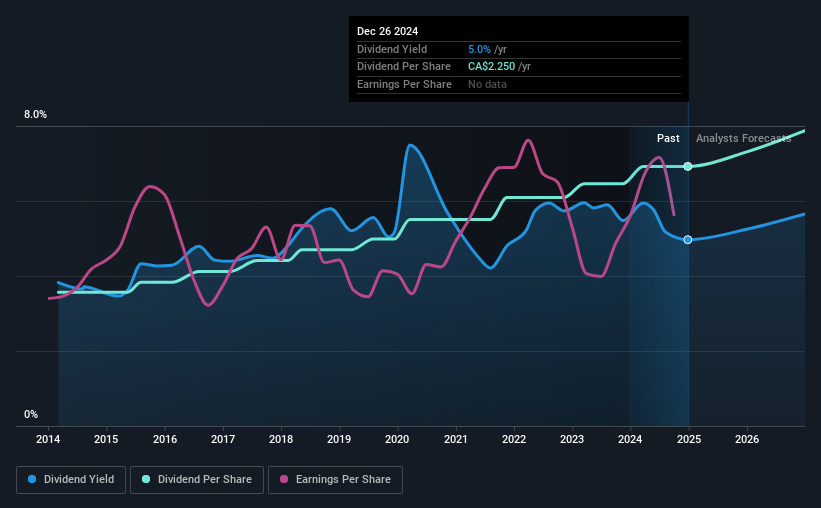

The company's next dividend payment will be CA$0.5625 per share, and in the last 12 months, the company paid a total of CA$2.25 per share. Looking at the last 12 months of distributions, Power Corporation of Canada has a trailing yield of approximately 5.0% on its current stock price of CA$45.28. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Power Corporation of Canada has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Power Corporation of Canada

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Power Corporation of Canada paid out more than half (62%) of its earnings last year, which is a regular payout ratio for most companies.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at Power Corporation of Canada, with earnings per share up 5.1% on average over the last five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Power Corporation of Canada has lifted its dividend by approximately 6.8% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

The Bottom Line

Is Power Corporation of Canada an attractive dividend stock, or better left on the shelf? Power Corporation of Canada has been generating some growth in earnings per share while paying out more than half of its earnings to shareholders in the form of dividends. We think there are likely better opportunities out there.

If you're not too concerned about Power Corporation of Canada's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. Every company has risks, and we've spotted 1 warning sign for Power Corporation of Canada you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Undervalued established dividend payer.

Market Insights

Community Narratives