Power Corporation of Canada (TSX:POW): Valuation Spotlight After S&P/TSX Preferred Share Index Inclusion

Reviewed by Simply Wall St

Power Corporation of Canada (TSX:POW) has recently seen its preferred shares added to the S&P/TSX Preferred Share Index, drawing increased attention within Canada’s investment landscape. This move could widen the company’s exposure to institutional portfolios and fund flows.

See our latest analysis for Power Corporation of Canada.

Index inclusion tends to raise a company’s profile, and lately, Power Corporation of Canada’s share price momentum has been hard to ignore. The stock’s strong 7.65% gain over the past 30 days underscores building optimism, and the one-year total shareholder return of 49% reflects both consistent performance and renewed market appetite. Longer-term investors have seen even greater rewards, with three- and five-year total returns well into triple digits. This highlights a shift in sentiment around the company’s long-term prospects.

If you’re curious what other companies are catching investors’ attention, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading above analyst price targets and recent returns well ahead of the broader market, investors may wonder if Power Corporation of Canada is still undervalued or if the market has already priced in the next stage of its growth.

Most Popular Narrative: 6.8% Overvalued

Power Corporation of Canada’s most closely watched narrative sets a fair value lower than the latest closing price, as analyst expectations lag recent market optimism. The stage is set for deeper debate as the market’s enthusiasm clashes with more measured analyst calculations.

The analysts have a consensus price target of CA$59.0 for Power Corporation of Canada based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$65.0 and the most bearish reporting a price target of just CA$49.0.

Want to know which financial targets and margin assumptions push this valuation lower than where shares trade today? Find out what narrative projections are capping the upside and which profit forecasts are shaping analyst consensus. The essential figures behind this fair value might surprise you.

Result: Fair Value of $59 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, earnings growth could stall if regulatory challenges or digital disruption affect Power Corporation’s core subsidiaries. This could put long-term margin gains at risk.

Find out about the key risks to this Power Corporation of Canada narrative.

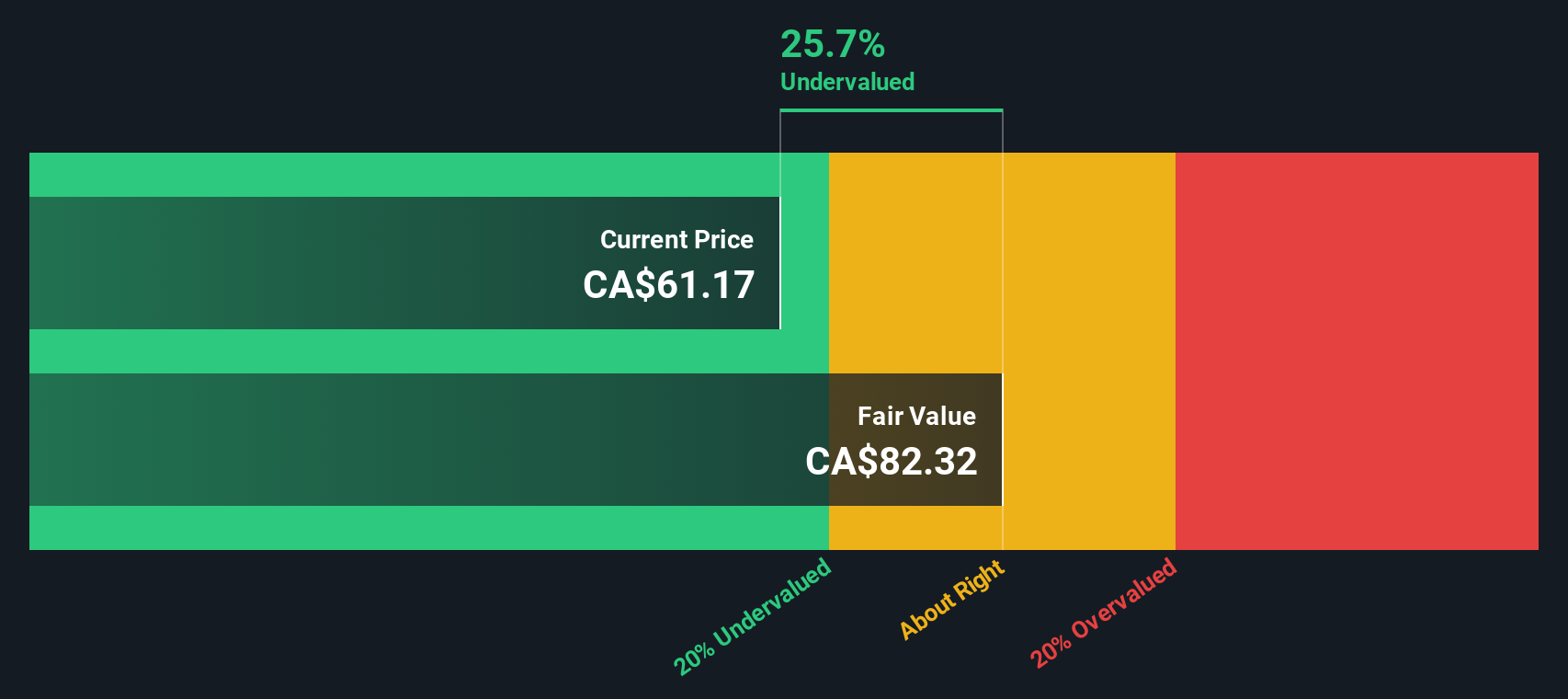

Another View: SWS DCF Model Points to Undervaluation

While analyst price targets suggest Power Corporation of Canada is slightly overvalued, our SWS DCF model calculates a fair value of CA$83.34, which is well above current levels. This highlights a sharp difference in approaches and raises the question of which outlook will prove more accurate over time.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Power Corporation of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Power Corporation of Canada Narrative

If your perspective differs or you like to dive into the details yourself, you can construct a personal valuation in just a few minutes and see the numbers for yourself. Do it your way

A great starting point for your Power Corporation of Canada research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity when you can confidently chase tomorrow’s winners? The Simply Wall Street Screener puts powerful, targeted stock ideas right at your fingertips, making it simple to spot what others might miss.

- Grab the chance for fresh income streams with these 17 dividend stocks with yields > 3%. Here, you’ll find high-yield companies delivering reliable payouts and weathering market ups and downs.

- Accelerate your search for the next innovation leader by checking out these 27 AI penny stocks. This highlights businesses at the forefront of artificial intelligence advancements and transformation.

- Pounce on compelling value plays and get ahead of the crowd by using these 876 undervalued stocks based on cash flows. This tool uncovers stocks with healthy fundamentals and attractive price points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives