Manulife Financial (TSX:MFC) Expands Canadian DC Plans With Real Asset Pooled Fund

Reviewed by Simply Wall St

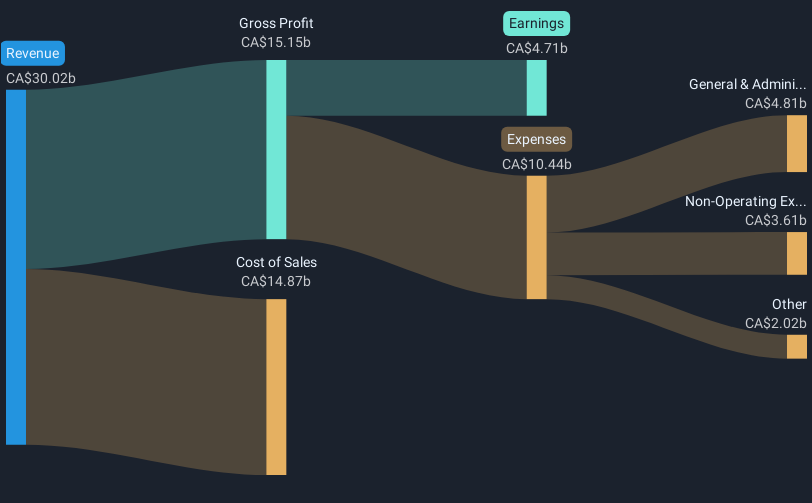

Manulife Financial (TSX:MFC) recently launched the Manulife Real Asset Pooled Fund, targeting Canadian defined contribution retirement plans—one of the first to provide diversified real asset exposure in the Canadian DC market. This product-related announcement occurs in the backdrop of a volatile market environment, with stocks dipping due to tariff concerns and a weak jobs report. Despite these broader market challenges, Manulife's price remained flat, suggesting alignment with the overall market trend rather than being significantly influenced by the new product launch. While external factors may have influenced its stability, the product initiative adds potential long-term appeal.

Find companies with promising cash flow potential yet trading below their fair value.

The launch of Manulife's Real Asset Pooled Fund for Canadian defined contribution plans marks a significant step in expanding its product offerings. This initiative could enhance long-term value, particularly if it aligns with the company's growth focus in high-growth markets like Asia and Global Wealth and Asset Management. Over the past five years, Manulife's total shareholder return was 183.19%, showcasing substantial growth. However, the company's stock underperformed compared to the Canadian Insurance industry over the past year, even as it exceeded the overall market's return.

This recent development has the potential to bolster revenue and earnings forecasts by leveraging the growing interest in diversified real asset exposure, which aligns well with Manulife's strategic focus areas. Analysts expect Manulife's revenue to grow by 20.9% annually over the next three years, driven by these strategic initiatives. Yet, the stock currently trades at CA$42.87, slightly below the consensus analyst price target of CA$47.69. If the company achieves the projected revenue growth and earnings expectations, it could align more closely with its forward price target, potentially narrowing the discount of approximately 10.8% to the analyst target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives