Is It Too Late to Consider Manulife After Its Strong Multi Year Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Manulife Financial is still a smart buy after its big run, or if most of the upside is already priced in? Let us walk through what the market might be missing in the current share price.

- The stock has climbed 17.9% over the last year and is up 11.7% year to date, adding to an impressive 133.9% gain over three years and 178.8% over five years. At around CA$49.10, it is no longer flying under the radar.

- Recent headlines have focused on Manulife sharpening its focus on higher margin businesses and continuing to return capital to shareholders through dividends and buybacks. At the same time, investors have been reacting to shifts in interest rate expectations and regulatory developments in the insurance space, which can quickly change how the market values its future cash flows.

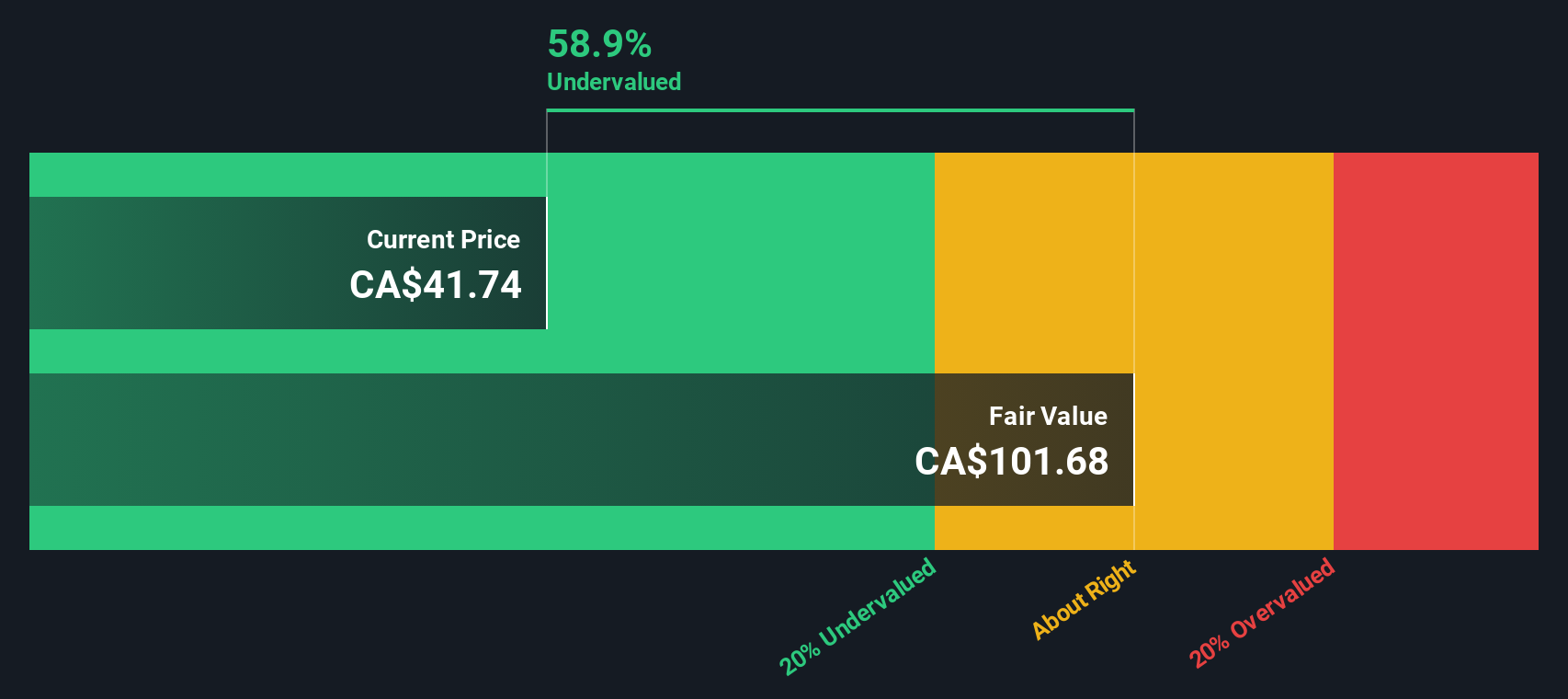

- On Simply Wall St's valuation checks, Manulife scores a 3/6 valuation score, suggesting some metrics still point to undervaluation while others look more fully priced. Next, we will break down what different valuation approaches say about the stock, and later, we will explore an even more insightful way to think about its true value beyond the usual models.

Find out why Manulife Financial's 17.9% return over the last year is lagging behind its peers.

Approach 1: Manulife Financial Excess Returns Analysis

The Excess Returns model looks at how efficiently Manulife turns shareholder capital into profits, and then values the company based on how long it can keep earning returns above its cost of equity.

For Manulife, the starting point is a Book Value of CA$28.96 per share and a Stable EPS of CA$4.70 per share, based on weighted future Return on Equity estimates from 8 analysts. With an Average Return on Equity of 16.49% versus a Cost of Equity of CA$1.74 per share, the company is generating an Excess Return of CA$2.96 per share, indicating it is creating value over and above its funding cost.

The model also uses a Stable Book Value of CA$28.50 per share, derived from future book value estimates from 6 analysts, to project how these value creating returns compound over time. Together, these inputs drive an intrinsic value estimate of roughly CA$116.32 per share.

Against a current share price near CA$49.10, this implies Manulife is about 57.8% undervalued according to the Excess Returns framework. This suggests the market is still discounting its long term profitability.

Result: UNDERVALUED

Our Excess Returns analysis suggests Manulife Financial is undervalued by 57.8%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

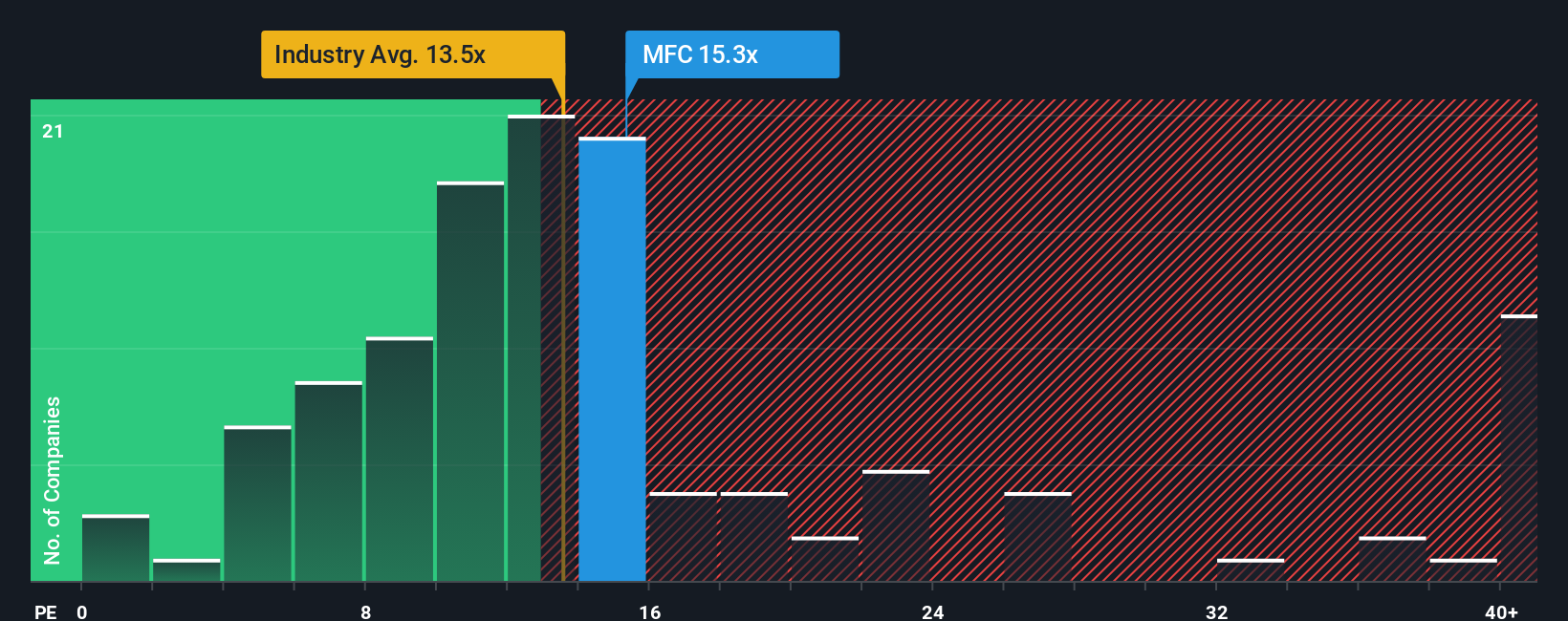

Approach 2: Manulife Financial Price vs Earnings

For a profitable, mature business like Manulife Financial, the Price to Earnings (PE) ratio is a useful way to gauge whether investors are paying a reasonable price for each dollar of earnings. In general, companies with stronger growth prospects and lower perceived risk can justify a higher PE, while slower-growing or riskier firms tend to trade on lower multiples.

Manulife currently trades on a PE of about 15.3x. That is slightly above the broader Insurance industry average of around 11.8x, and broadly in line with its peer group, which averages roughly 15.1x. On the surface, this suggests the stock is priced similarly to comparable insurers rather than at a clear discount or premium.

Simply Wall St's proprietary Fair Ratio for Manulife is 16.0x. This metric estimates the PE the company should trade on given its specific combination of earnings growth, profitability, risk profile, industry characteristics and market cap. Because it is tailored to the company rather than just comparing it to broad industry or peer averages, it provides a more nuanced anchor for valuation. With the current PE of 15.3x modestly below the 16.0x Fair Ratio, Manulife appears slightly undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1454 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Manulife Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, an easy tool on Simply Wall St's Community page that lets you turn your view of Manulife Financial into a story backed by numbers. It links what you believe about its Asia expansion, digital execution and risk profile to a concrete forecast for revenue, earnings and margins. This then produces a Fair Value you can compare to the current share price to inform your decision. Narratives are updated dynamically as new news or earnings arrive. Different investors can express very different perspectives, from a more bullish view that Manulife is worth around CA$51.94 per share based on strong long term growth, to a more cautious stance closer to CA$39.00 that focuses on regulatory, credit and legacy business risks, all within the same simple, accessible framework.

Do you think there's more to the story for Manulife Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion