Dividend Hike and Earnings Surge Could Be a Game Changer For iA Financial (TSX:IAG)

Reviewed by Simply Wall St

- iA Financial Corporation Inc. announced a 10% increase in its quarterly dividend to C$0.99 per share and reported strong second quarter financial results, with net income rising to C$327 million and earnings per share showing substantial year-over-year growth.

- This combination of higher earnings and a meaningful dividend boost highlights the company's confident outlook and commitment to enhancing shareholder value.

- We'll explore how iA Financial's significant dividend increase signals management's confidence and impacts the company's broader investment story.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is iA Financial's Investment Narrative?

To feel comfortable as a shareholder of iA Financial, you need to believe in the company’s ability to sustain quality earnings, manage risk in the insurance sector, and return capital to investors through steady payouts and buybacks. The recent move, a 10% dividend increase on the back of higher Q2 net income and sharply improved earnings per share, reinforces the company's intent to reward shareholders and signals growing confidence from management. This adds momentum to what had already been a story of profit growth and disciplined capital allocation. However, it could also make continued delivery on earnings and cash flow more important, as any stumble may challenge the new, higher payout. While some short-term risk comes from ongoing M&A and industry cycles, the financial update and modest share price rise suggest the immediate risk profile and main catalysts are largely unchanged for now, with investor focus still firmly on earnings quality and consistency.

But don’t overlook how new acquisitions could reshape the risk profile for iA Financial.

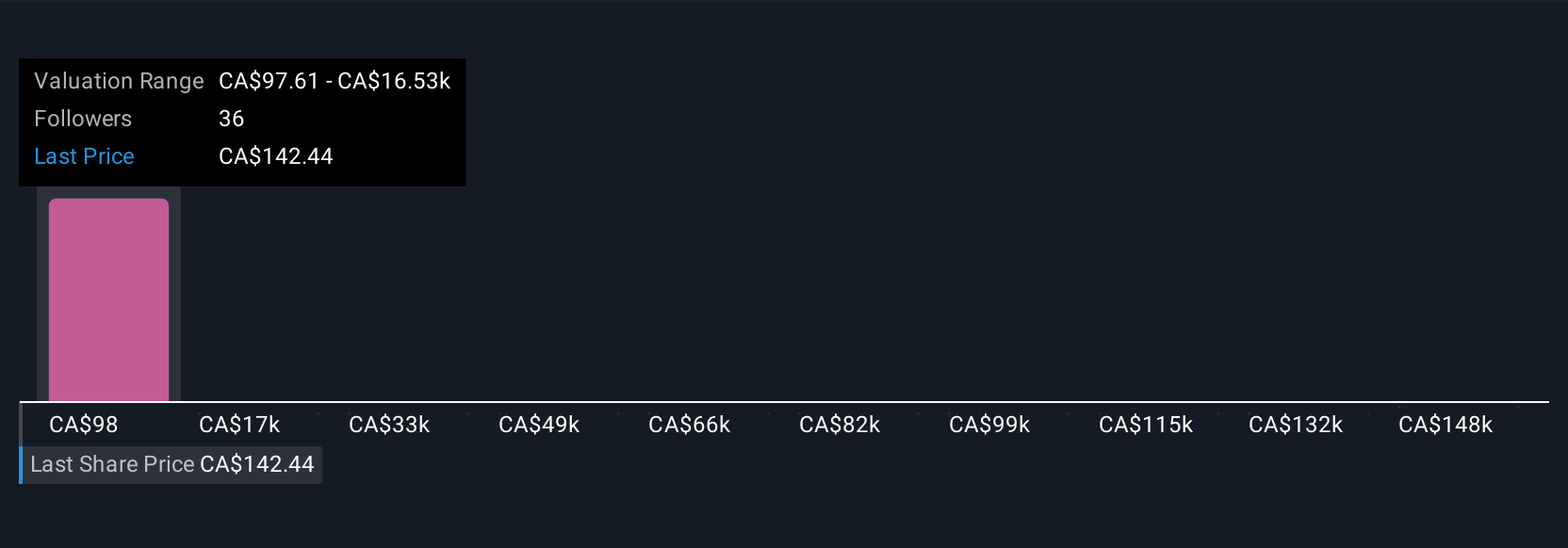

iA Financial's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on iA Financial - why the stock might be worth 31% less than the current price!

Build Your Own iA Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iA Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free iA Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iA Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives