Does E-L Financial (TSE:ELF) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in E-L Financial (TSE:ELF). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for E-L Financial

How Fast Is E-L Financial Growing Its Earnings Per Share?

Over the last three years, E-L Financial has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, E-L Financial's EPS shot from CA$128 to CA$315, over the last year. You don't see 146% year-on-year growth like that, very often.

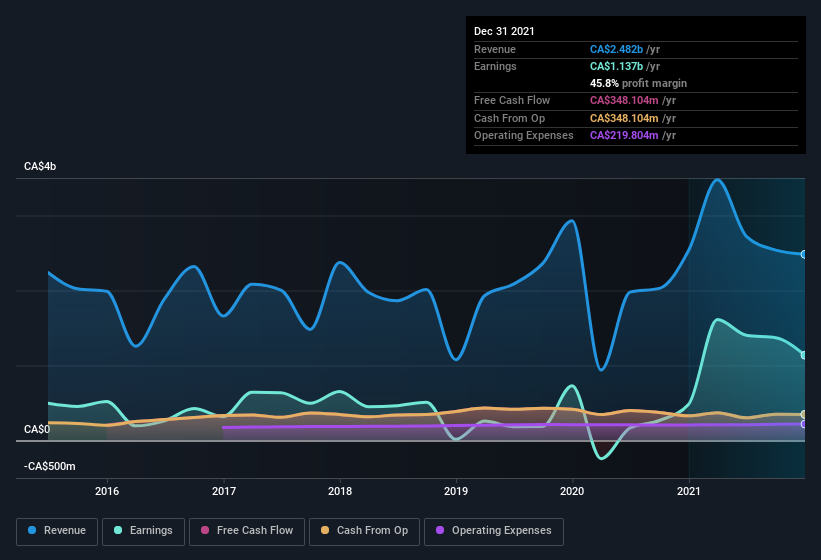

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that E-L Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. E-L Financial's EBIT margins have actually improved by 32.6 percentage points in the last year, to reach 62%, but, on the flip side, revenue was down 2.1%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are E-L Financial Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations between CA$2.5b and CA$8.0b, like E-L Financial, the median CEO pay is around CA$3.9m.

The CEO of E-L Financial only received CA$1.8m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add E-L Financial To Your Watchlist?

E-L Financial's earnings per share have taken off like a rocket aimed right at the moon. Such fast EPS growth makes me wonder if the business has hit an inflection point (and I mean the good kind.) At the same time the reasonable CEO compensation reflects well on the board of directors. While I couldn't be sure without a deeper dive, it does seem that E-L Financial has the hallmarks of a quality business; and that would make it well worth watching. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how E-L Financial shapes up to industry peers, when it comes to ROE.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if E-L Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELF

E-L Financial

Operates as an investment and insurance holding company in Canada.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives